Hinman Emails Reveal 2018 Speech on Ether Drew Input From Multiple SEC Officials

A U.S. Securities and Exchange Commission official wanted to say that the agency did “not … see a need to regulate Ether” as it was offered in 2018, read an email released Tuesday.

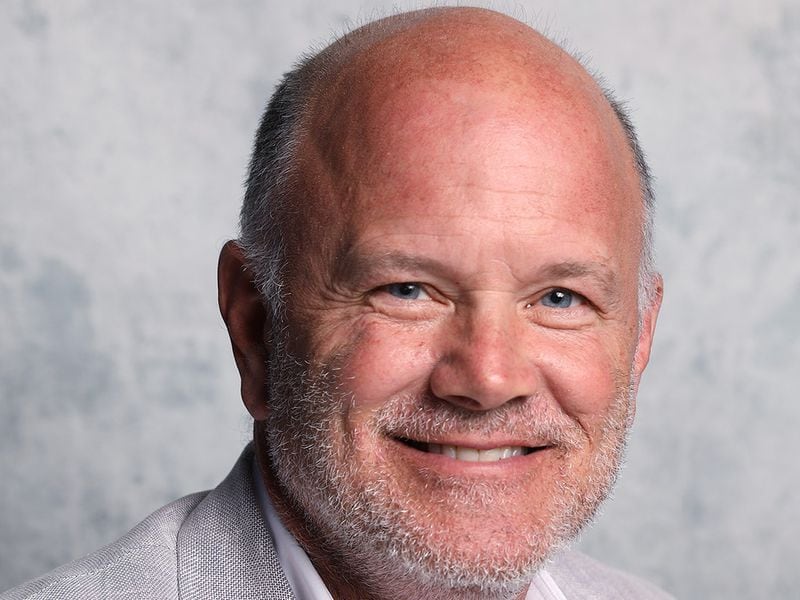

A number of emails tied to the one-time Director of Corporation Finance William Hinman’s 2018 speech saying Ether did not look like a security were published Tuesday by Ripple in its ongoing defense against an SEC lawsuit alleging the company illegally sold XRP tokens as an unregistered security for over seven years. The emails were published alongside an updated motion for summary judgment.

XRP’s price spiked after the emails were initially released.

The emails show SEC officials deliberating about how clear the speech actually was in expressing a view that ether (ETH) was not a security.

“As written, the language remains vague as to whether ETH is a security. If you want to make an affirmative statement that it is not a security, the language could be stronger (i.e., just say it). If you don’t want to take an affirmative stance, we suggest using language similar to what you used for Bitcoin re. the disclosure regime to make it more consistent,” wrote former SEC Director of Trading and Markets Brett Redfearn on June 12, 2018.

Redfearn left comments in a proposed draft of the speech further emphasizing that point, saying parts of it “appear likely to create more confusion about the status of ETH.”

Valerie Szczepanik, the current head of the SEC’s FinHub group, wrote in an earlier email dated May 25, 2018 that she believed “the less detail the better,” referring to what appears to be one of the earliest drafts of the speech.

“This is introducing a concept, that will probably generate much discussion, and so leaving room for that discussion is good I think,” she wrote.

This earlier version of the speech did not mention ether at all, though it did reference bitcoin.

A June 12 email from Laura Jarsulic, an attorney with the SEC’s Office of General Counsel, referenced the landmark Supreme Court case commonly used as a test for determining whether something is a security even today – SEC v. W. J. Howey Co. In that case, the SEC sued Howey on allegations that his selling trees in orange groves promising a future return violated securities law.

Jarsulic suggested an edit clarifying that the Supreme Court ruled that purchasers who bought trees but did not buy investment contracts did not purchase securities.

“The Court found that only the purchase of land and service contract was the purchase of a security (those who bought land only had not purchased a security),” another suggestion read.

Further down, Jarsulic wrote in a suggestion that there could be situations where a token is indeed a security – for example, if a company issues tokens instead of shares.

Several of the officials’ emails suggested tying the speech closer to the Howey Test. The emails also indicated that SEC officials met with Ethereum founder Vitalik Buterin, apparently to discuss the Ethereum Foundation’s role.

Other officials cc’d in the emails include former SEC Enforcement Directors Stephanie Avakian and Steven Peikin, former Division of Investment Management Director Dalia Blass, former Chief Counsel and Acting Director of the Division of Trading and Markets Heather Seidel and a host of others.

In 2020, the SEC sued Ripple on allegations that the firm sold unregistered securities. Ripple has historically maintained a distance from XRP, the token that powers some of its products and the XRP Ledger network. But any progress in the case has an impact on XRP prices.

On Tuesday, after publishing the emails, Ripple Chief Legal Officer Stu Alderoty tweeted that “We now can all see Hinman ignored multiple warnings that his speech contained made-up analysis with no basis in law, was divorced from the Howey factors, exposed regulatory gaps, and would create not just confusion, but ‘greater confusion’ in the market.”

The SEC declined to comment on the matter.

Update (June 13, 14:07 UTC): Adds detail about officials indicating they met with Ethereum founder Vitalik Buterin.

Update (June 13, 14:18 UTC): Adds that the SEC declined to comment on the emails in last paragraph.

Edited by Sandali Handagama.