High Fees vs. “High Fees”: How I Learned To Stop Worrying And Love The Mempool

The recent surge in Bitcoin’s on-chain fees has reignited a familiar discussion within our community, bringing to the surface diverse perspectives on the implications and root causes of this trend. A faction within the community views these heightened fees as a strategic solution to Bitcoin’s security budget concerns. In contrast, others see them as a formidable barrier, potentially stymieing Bitcoin’s global adoption. This issue is especially pertinent for newcomers in Western markets and communities in the global south, where the proportionally higher transaction costs can be especially burdensome.

The marked increase in fees, denominated in BTC, is primarily driven by the rising popularity of ordinal inscriptions, BRC-20 tokens, and similar contrivances on the Bitcoin network. Ordinal inscriptions, which involve embedding data into the witness portion of a transaction, have become increasingly popular for creating digital collectibles and unique assets on the Bitcoin blockchain. While this practice is somewhat novel, it demands additional block space, thereby heightening the overall demand and, consequently, escalating transaction fees.

Moreover, the advent and growing popularity of BRC-20 tokens – a standard akin to Ethereum’s ERC-20, but for the Bitcoin network – has further contributed to network congestion. These tokens, often created for speculation and distribution of memecoins, require complex and often sizable transactions. The aggregate effect of these transactions intensifies the network load, further amplifying the issue of surging fees in BTC terms.

The Fundamental Shift in Network Utilization

It is essential to recognize that these techniques, and others likely to emerge, signify a paradigm shift in the utilization of the Bitcoin network. The resulting elevation in transaction fees, when measured in BTC, mirrors these evolving use cases and underscores the necessity for continual advancements in network scalability and efficiency. Others have discussed some responses to these issues, and I will not comment on specific responses other than the two below.

Re-litigating the Blocksize War

It’s important to acknowledge the topic of blocksize, albeit cautiously. The idea of re-opening the blocksize war, often suggested by some non-bitcoin factions, is not only counterproductive but also disregards the nuanced understanding required to address the current fee environment. The network’s security and efficiency do not necessitate a blocksize increase, especially not in response to the transitory strains caused by specific uses like JPEGs or BRC-20s.

The Mining Sector’s Perspective

As for the mining sector, the burgeoning interest in Bitcoin has led to novel approaches in mining pool operations, as seen with Ocean and Braidpool. These entities enable miners to create their own transaction templates and actively manage network congestion, with Ocean notably filtering out what it considers spam transactions. This evolution in mining strategies represents a balance between profit motives and the responsibility of maintaining an efficient network.

Understanding The Dual Nature of “High Fees”

High Fees in Real Terms vs. BTC Terms

https://x.com/davidfbailey/status/1737761749116358865

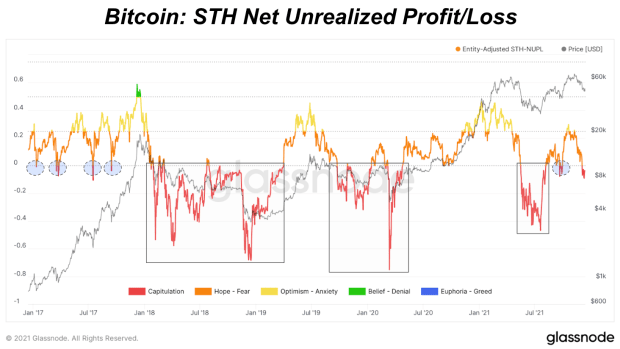

When dissecting the nature of high fees in Bitcoin, it’s imperative to differentiate between fees in real terms (USD) and those in BTC terms. The increase in fees in real terms is a reflection of Bitcoin’s maturation and its growing significance in the global economy, a testament to its success. Conversely, high fees in BTC terms highlight a temporary bottleneck in the network, underscoring the need for technological and community-driven innovations to bolster the network’s efficiency and scalability.

Common Themes of High Fees

- A Self-Regulating Economy: Bitcoin’s fee market epitomizes a self-regulating economy. Users valuing prompt and guaranteed transactions willingly pay more, bolstering the network’s security and evolution. This self-regulation is pivotal to Bitcoin’s resilience, adapting organically to market dynamics.

- Efficient Use of Block Space: The high fees encourage judicious use of block space, fostering innovative applications of the Bitcoin network. Developments in second-layer solutions like Lightning, Fedimint, and Liquid are particularly noteworthy, as they promise faster transactions at reduced costs, albeit with certain trade-offs.

Celebrating High Layer-1 Fees in Real Terms

As Bitcoin forges ahead in its journey to global currency status, the inevitability of high Layer-1 fees, in real terms, is not a cause for alarm but a milestone to be celebrated. The era where transactions at even 1 sat/vB become costly marks a significant chapter in Bitcoin’s success and global influence. Resisting this trend is not just futile, but runs counter to the very ethos of Bitcoin’s growth and stability.

- Reflecting Bitcoin’s Value and Demand: The correlation between high transaction fees in real terms and Bitcoin’s increasing value and demand is unmistakable. As Bitcoin cements itself as a viable investment and transactional asset, the willingness to incur higher fees reflects its perceived utility and worth. This is a bullish signal for Bitcoin’s sustainability and long-term success.

- From Block Rewards to Transaction Fees: The shift from miner revenue based on block rewards to transaction fees is an essential evolution of Bitcoin’s economic model. As we edge closer to the Bitcoin supply cap, high transaction fees in real terms become crucial for compensating miners, ensuring the network’s security and longevity.

- Signifying Asset Maturation: High transaction fees in real terms also signify Bitcoin’s maturation as an asset class. Similar to traditional financial systems, the presence of transaction fees in the Bitcoin network underscores its evolution from a niche technological experiment to a globally recognized financial asset.

- Reflecting Deflationary Nature: Unlike fiat currencies, Bitcoin’s deflationary design is expected to increase its value over time. High fees in real terms validate this deflationary nature; as Bitcoin becomes more valuable, the cost to transact in Bitcoin naturally rises. This phenomenon is both expected and indicative of a successful deflationary model.

Challenges Posed by High Fees in BTC Terms

While the narrative of high Layer-1 fees in real terms underscores Bitcoin’s burgeoning role and value, the high fees in BTC terms present unique challenges that warrant careful consideration. This distinction is vital for comprehending both the current state and the future scalability of the network.

- Barrier to Widespread Adoption: Exorbitant fees in BTC terms pose a significant obstacle, especially for those in developing regions or engaging in smaller transactions. The universal appeal of Bitcoin as a global currency is intrinsically linked to its accessibility and affordability. If high BTC-denominated fees persist, they risk undermining Bitcoin’s promise as a tool of financial inclusion and empowerment.

- Network Congestion and User Experience: Rising fees in BTC terms often signal network congestion, leading to prolonged transaction times and a diminished user experience. For Bitcoin to thrive as a practical, day-to-day transactional medium, it must offer consistent reliability and efficiency. Current high fees in BTC terms point to a bottleneck in transaction processing, which can deter both prospective and existing users.

- Centralization Concerns: While all high fees tend to encourage centralization, those in BTC terms have a pronounced impact, potentially shifting transaction processing towards larger entities capable of affording such fees. This shift challenges Bitcoin’s decentralized ethos, with potential implications for its security, integrity, and overall trustworthiness.

The Myth of the “Security Budget Issue” and the “Mining Death Spiral”

A common misconception within Bitcoin discussions is the fear of a ‘security budget issue’ or a ‘mining death spiral.’ These concerns often stem from misunderstandings about the halvings and the decreasing block subsidy, leading to apprehensions about inadequate miner incentives.

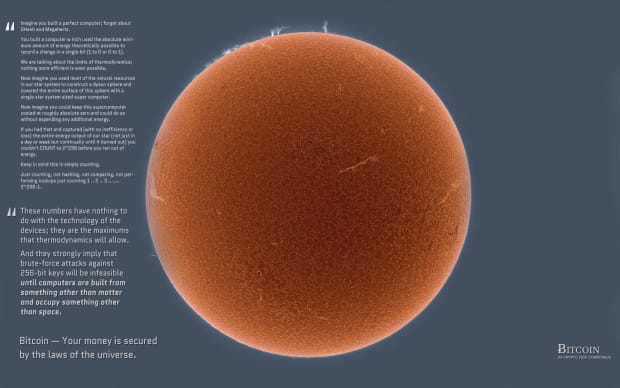

However, such fears fail to account for the crucial factor of purchasing power. Consider this: if Bitcoin’s value reaches $550k, even a constant block fee of around 25M sats would surpass the current 6.25 BTC block subsidy’s purchasing power at today’s $40k/BTC. What matters most is not the quantity of Bitcoin awarded, but the purchasing power it represents. As long as this continues to increase, miner remuneration remains sustainable and secure.

The focus should not be on increasing fees in Bitcoin terms or considering alternatives like tail-emission, but rather on ensuring that the purchasing power derived from transaction fees continues to grow. This is the cornerstone of Bitcoin’s economic model, emphasizing the importance of a unitary currency system.

Layer-2 Technologies and Fee Dynamics

The emergence and integration of Layer-2 technologies represent a critical evolution in Bitcoin’s ecosystem. While these technologies might reduce fees in BTC terms, they are essential for the network’s scalability and future viability. Efficient Layer-2 solutions can potentially compress transactions more effectively than currently possible on Layer-1.

High fees in BTC terms signal the need for more extensive and innovative Layer-2 solutions, to ensure the scalability and efficiency of the network. It’s clear that the Bitcoin blockchain, in its current state, cannot handle a significant fraction of global daily transaction volume – nor should it aim to. The real solution lies in a combination of improved Layer-2 innovations, renegotiating conventions, and possibly revising consensus mechanisms.

Conclusion

In summing up the discourse on Bitcoin’s transaction fees, it becomes evident that the dual perspectives of high fees – in real terms versus BTC terms – are emblematic of a currency in the throes of evolution and maturation. *There is no need for increasing fees in Bitcoin terms, or anything like tail-emission, so long as the purchasing power continues to increase.* Which, you’ll note, is the entire point of a depreciating or unitary currency.

High fees in real terms should be seen not as a deterrent but as a hallmark of Bitcoin’s increasing value and mainstream adoption. This trend, though challenging, is a testament to the growing acceptance of Bitcoin as a significant financial asset on the global stage. It highlights Bitcoin’s journey from a novel digital experiment to a robust, decentralized financial system.

Conversely, the challenges posed by high fees in BTC terms underscore a critical juncture in Bitcoin’s development. They emphasize the need for innovative solutions to enhance network efficiency and scalability, ensuring Bitcoin remains accessible and viable for a diverse, global user base, and an escape hatch on the ever encroaching fiat. As the Bitcoin community navigates these complexities, the focus must remain on advancing technologies and strategies that uphold the core principles of decentralization, security, and inclusivity.

In navigating the future, the Bitcoin ecosystem must balance its growing value with the pragmatic approach to its technical and economic challenges. The evolution of Layer-2 technologies, along with community-driven initiatives, will be pivotal in addressing these challenges. As Bitcoin continues to evolve, it stands not only as a testament to the ingenuity of its design but also as a beacon for the potential of decentralized digital currencies to revolutionize the financial landscape.

The author would like to acknowledge @theemikehobart, @cryptoquick, @GrassfedBitcoin, and @barackomaba, who contributed thoughts and comments during the drafting of this article.

This is a guest post by Colin Crossman. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.