High Ether Yields Drive $50M to DeFi Protocol Pendle Finance

BowTiedBull

President

BowTied Jungle

The pseudonymous investor BowtiedBull explores the BowtiedJungle, where citizens swap advice on investing, job-seeking, …

BowTiedBull

President

BowTied Jungle

The pseudonymous investor BowtiedBull explores the BowtiedJungle, where citizens swap advice on investing, job-seeking, …

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

BowTiedBull

President

BowTied Jungle

The pseudonymous investor BowtiedBull explores the BowtiedJungle, where citizens swap advice on investing, job-seeking, …

BowTiedBull

President

BowTied Jungle

The pseudonymous investor BowtiedBull explores the BowtiedJungle, where citizens swap advice on investing, job-seeking, …

Yield management protocol Pendle Finance has attracted over $50 million amid renewed interest from traders looking to passively capture market returns.

The total locked value (TVL) of assets on the platform has risen over 300% since the start of this year, DeFiLlama data shows. $26 million of which has been captured on the Ethereum network, $21 million on the Arbitrum network and just under $1 million on Avalanche.

Staked ether (stETH) dominates the holdings, taking up 27% of all capital on Pendle, followed by GMX protocol’s glp tokens at 18% and by dai (DAI) stablecoins at 16%.

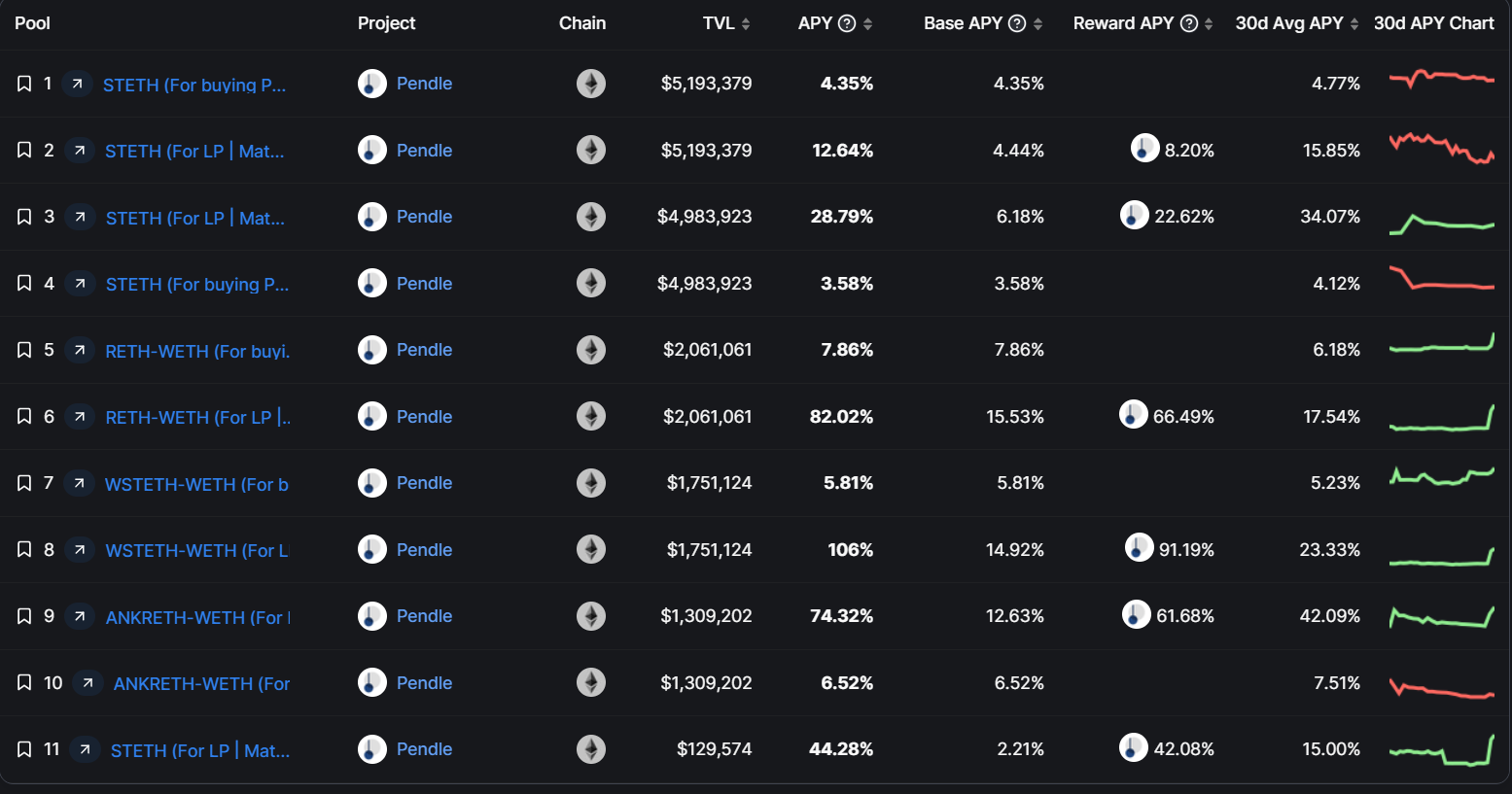

Some strategies are offering as much as 82% annualized on ether and ether derivative tokens. These have a maturity period that ends in late 2023 or early 2024.

Pendle is also letting investors purchase ether at a 5.88% discount as of Thursday. This ether can be claimed on December 26, 2024, where the discount will be made up for by capturing future expected yields on the principle amount.

Ether yields on Pendle. (DeFiLlama)

More sophisticated strategies that utilize ether derivatives offered by other projects, such as Frax, are offering as much as 441% in yields over a 624-day period.

Pendle uses a dual-token model that breaks up and represents any investment into a decentralized finance (DeFi) protocol, such as Compound or Aave, into two parts: one, the initial principle put up by an investor, and two, the future yield expected to be earned on that position in the form of token rewards.

This is done by wrapping yield-bearing tokens into a standardized yield token, that token is then wrapped into a principal token (PT) and yield token (PT) which can be traded on the open market.

“Nearly every pool in DeFi gives you a yield-bearing position in return for staking or depositing tokens,” states Pendle in its technical documents. “1 PT gives you the right to redeem 1 unit of the underlying asset upon maturity. 1 YT gives you the right to receive yield on 1 unit of the underlying asset from now until maturity, claimable in real-time.”

This allows Pendle to offer several products to users – such as the ability to lock in expected fixed yields, buy yields in the hopes of higher returns in the future, or switch between multiple strategies to continually gain from yields offered by various protocols.

Pendle’s native governance tokens, PENDLE, trade at 50 cents at press time on Thursday. These accrue value over time, documents show, and can ultimately benefit from the growth and adoption of the underlying platform.

Edited by Oliver Knight.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.