Hex Trust Issues First Native Stablecoin on Layer-1 Blockchain Flare

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

USDX stakers will receive a real world yield and cUSDX in return.

-

The stablecoin is backed at a 1:1 ratio against the dollar or equivalently valued assets.

00:59

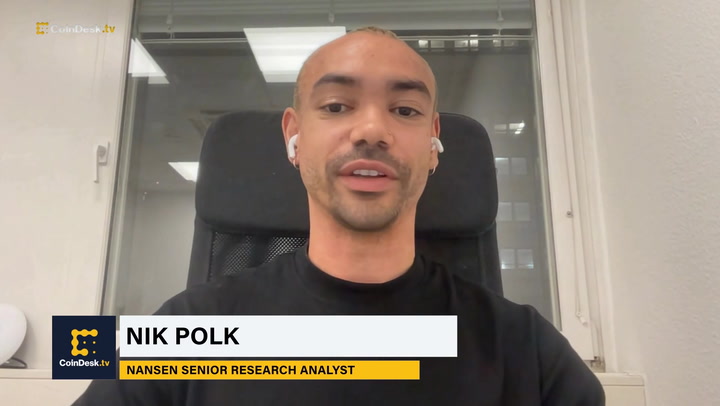

Why Proof-of-Stake Works Like a ‘Pawn Shop’: 5 Questions With Nansen’s Nik Polk

10:14

Staking Is ‘Definitely a Positive’ for the Spot Ether ETF Narrative, Analyst Says

06:50

Tax Expert Breaks Down the Crypto Tax Basics for Beginners

13:53

German Finance Heavyweights Develop Fully-Insured Crypto Staking Offering

Hong Kong-based crypto custodian Hex Trust Group has issued USDX, a new stablecoin on layer-1 blockchain Flare, according to a press release.

USDX becomes the first native stablecoin on Flare as the blockchain gears up for a boost in decentralized finance (DeFi) activity. It will be available to use across lending protocols and exchanges and will also feature staking mechanism to a dedicated T-Pool, which is created by decentralized credit marketplace Clearpool.

Those staking USDX will receive cUSDX in return, which can be used as collateral across DeFi protocols on Flare.

Backing for the stablecoin is maintained at a 1:1 ratio against the U.S. dollar or equivalently valued assets, the press release added.

“The collaboration between USDX and Clearpool on Flare delivers a 1:1 backed stable asset with immediate access to real world yield,” Flare’s co-founder Hugo Philion said. “This will be particularly useful for FAsset agents, putting their stable collateral to work even while it’s locked in the system.”

Hex Trust’s CEO Alessio Quaglini added that the launch of USDX will “reduce cryptocurrency market volatility” and “streamline transactions.”

Flare raised $35 million in a private round in February from the likes of Kenetic and Aves Lair. The blockchain currently has $8 million in total value locked (TVL), according to DefiLlama.

Edited by Stephen Alpher.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/www.coindesk.com/resizer/fczAGHsWLFXiMV23oZZmkW19Ots=/arc-photo-coindesk/arc2-prod/public/D4HEG34XFVFVJHPXEEJAEFZ3SI.jpg)

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.