Here’s Why the Bitcoin Price is Down Over 3% as Bitcoin Minetrix Continues to Grow

The Bitcoin (BTC) price has seen significant downward pressure this week, and has dropped 3% in the last day alone.

Investors have been rushing to sell off Bitcoin following the launch of spot BTC ETFs in the US – creating a broader “sell the news” movement.

Meanwhile, with over $8.8 million raised, the new presale project Bitcoin Minetrix (BTCMTX) continues to impress ahead of its crypto market debut.

Bitcoin Price Slumps Below $42k Despite ETF Hype

Bitcoin is now trading below $42,000, with institutional buying having little impact on the coin’s value.

BTC is now 15% below the high of January 11, which came immediately after the SEC gave the green light to spot Bitcoin ETFs.

Looking at the technicals, price is currently testing a solid support zone at $41,000, which has held firm since early December.

More worryingly for Bitcoin holders, price has broken below the 50-day exponential moving average (EMA) on the daily time frame.

This coincides with a further drop in the Crypto Fear & Greed Index, which now sits at just 51 – indicating investors are “Neutral” on Bitcoin’s prospects.

Should Bitcoin break support at $41,000, the next port of call could be as low as $38,100, coinciding with the wicks from mid-November.

Overall, it’s been a tough two weeks for Bitcoin investors, which has come as a massive surprise given the excitement around spot ETFs finally being launched.

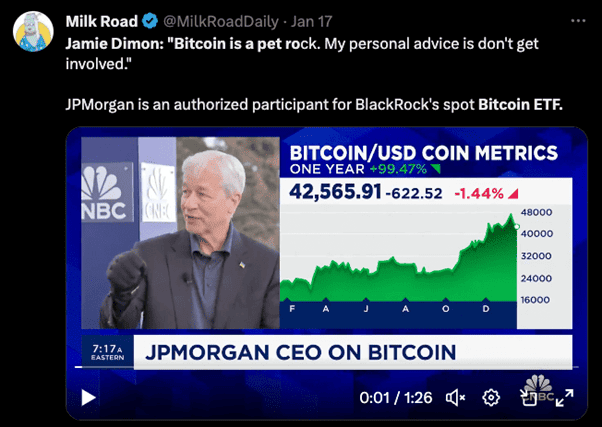

Jamie Dimon’s Comments & GBTC Selling Add Further Pressure

Other factors are also weighing on Bitcoin beyond the technicals.

This week, Jamie Dimon of JPMorgan advised against investing in crypto despite his firm serving as an authorized participant for a Bitcoin ETF.

His anti-Bitcoin rhetoric is nothing new, yet Dimon’s quotes have likely dampened overall market sentiment.

Meanwhile, Grayscale’s Bitcoin Trust has sold over 27,000 BTC following the ETF launches.

Again, this selling activity has been viewed as a bearish signal from the broader market.

However, ETFs like BlackRock’s have rapidly grown their Bitcoin reserves in response.

Ultimately, the selling pressure from GBTC and Dimon’s comments have contributed to Bitcoin’s inability to capitalize further on the ETF excitement.

Whether Bitcoin can bounce back next week remains to be seen, as the technicals remain bearish, yet many pundits and analysts are convinced this is just a temporary blip for the coin.

Bitcoin Minetrix Attracts Attention with Innovative Mining Model & Staking Protocol

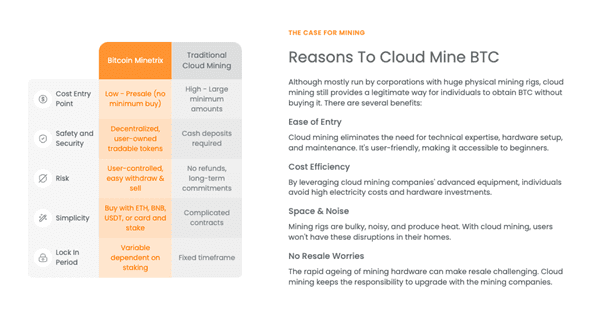

In the meantime, a new presale crypto called Bitcoin Minetrix (BTCMTX) has been gaining attention for its unique approach to BTC mining.

The project has raised millions so far in its presale as investors begin to pay attention to its Stake-to-Mine model.

This model allows users to stake their BTCMTX tokens to earn mining credits, which are burned to access cloud mining power.

Through this process, there’s no need for technical expertise, and everyday investors can participate without requiring expensive equipment.

Other features include a high-yield staking protocol for BTCMTX and a dedicated mobile app for miners.

Underpinning all of these features is a thorough smart contract audit from Coinsult, which found no issues.

As an early-stage venture, Bitcoin Minetrix is being discussed as a potential revolutionary force in the mining space.

Crypto mining is traditionally reserved for those with technical knowledge and access to significant financial resources.

However, Bitcoin Minetrix seeks to change all that and make the process more accessible ahead of the 2024 BTC halving event.

For this reason, many believe Bitcoin Minetrix’s native BTCMTX token could be in line for substantial growth once listed on exchanges.

YouTuber No Bs Crypto even suggested it could “100x” if the exchange launch is successful.

Although returns like this aren’t guaranteed, it showcases the crypto community’s growing bullishness towards Bitcoin Minetrix.

Visit Bitcoin Minetrix Presale

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post Here’s Why the Bitcoin Price is Down Over 3% as Bitcoin Minetrix Continues to Grow appeared first on CryptoPotato.