Here’s Why Bitcoin’s Rally Is Far From Over as BTC Crosses $91K

Bitcoin experienced a short-term pullback at the end of the business week, slipping below $87,000 briefly after registering its latest all-time high of nearly $94,000 on Wednesday.

However, the worst could be over as the asset has recovered most of the losses and currently sits above $91,000. At the same time, on-chain factors have emerged to suggest that its rally still has a lot of legs and could eventually challenge the coveted $100,000 level.

BTC on Exchanges Decline

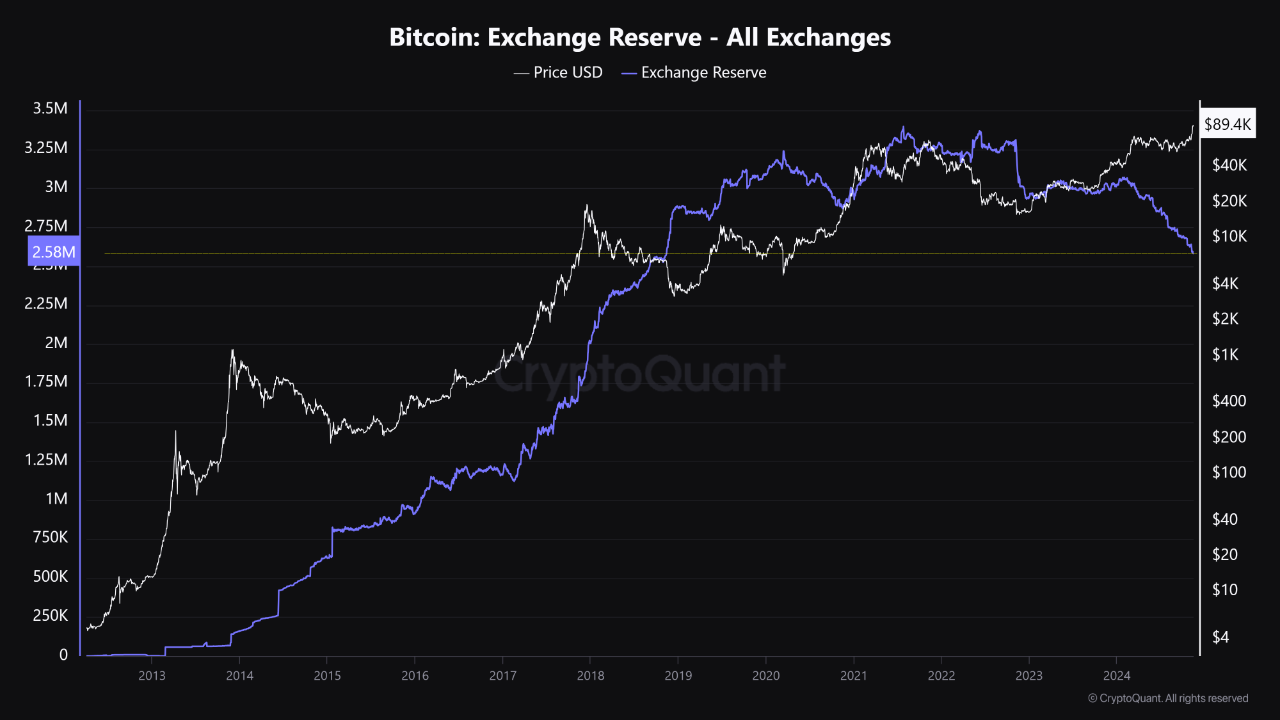

One of the metrics used to determine the immediate sell pressure for a certain cryptocurrency is its availability to be sold in a hurry, which is evident from the reserves on exchanges. Essentially, the lower the amount sitting on trading platforms, the less immediate selling pressure there is for the underlying asset.

In this scenario, investors are withdrawing their funds, typically to cold storage devices, in preparation for the continuation of the ongoing trend.

CryptoQuant data shows that the BTC reserves on exchanges have continued to decline recently, especially since Donald Trump won the 24 US presidential elections last week. In fact, the bitcoin reserves are down to a six-year low of under 2.6 million.

“This movement reduces the supply available for immediate sale, creating buying pressure in a tight supply environment. As a result, the market may see a trend towards Bitcoin’s appreciation, especially if demand remains stable or grows.” – reads their analysis.

The report further indicated that these withdrawals from exchanges solidify investors’ perspective that bitcoin serves as a “store of value in a global economic context of uncertainty and high inflation.”

The removal of BTC from trading platforms could result in a “more volatile but more resilient” BTC market, with less selling pressure and a “growing dominance of long-term holders, which could open up space for new price peaks.”

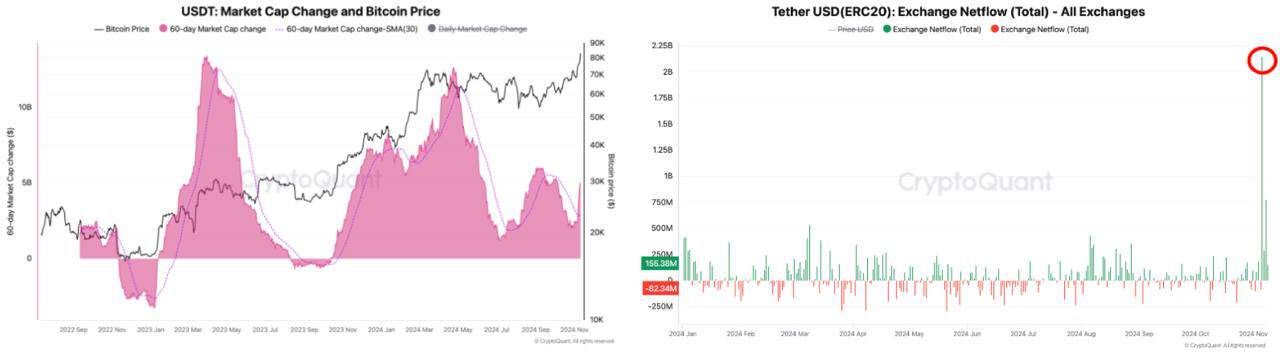

Stablecoins on the Rise

Market liquidity has improved in recent weeks, again, especially after Trump’s victory, is another factor that could suggest more price gains for the crypto market. After all, stablecoins facilitate an easy and simple way for investors to enter the market and allocate funds to bitcoin and altcoins.

CryptoQuant’s dashboard shows that more than $3 billion in USDT alone has entered crypto exchanges since the elections, which is the highest in three years. The chart below demonstrates how the larger number of stablecoins in existence and on trading platforms coincides with BTC price rallies.

The post Here’s Why Bitcoin’s Rally Is Far From Over as BTC Crosses $91K appeared first on CryptoPotato.