Here’s Why Bitcoin (BTC) May Hit Another ATH This Year: Analysts

TL;DR

- Bitcoin’s price has dropped over 8% in the past two weeks to around $65,200, but analysts expect a rebound to $72,000-$74,000 and potentially above $100,000 by late 2024.

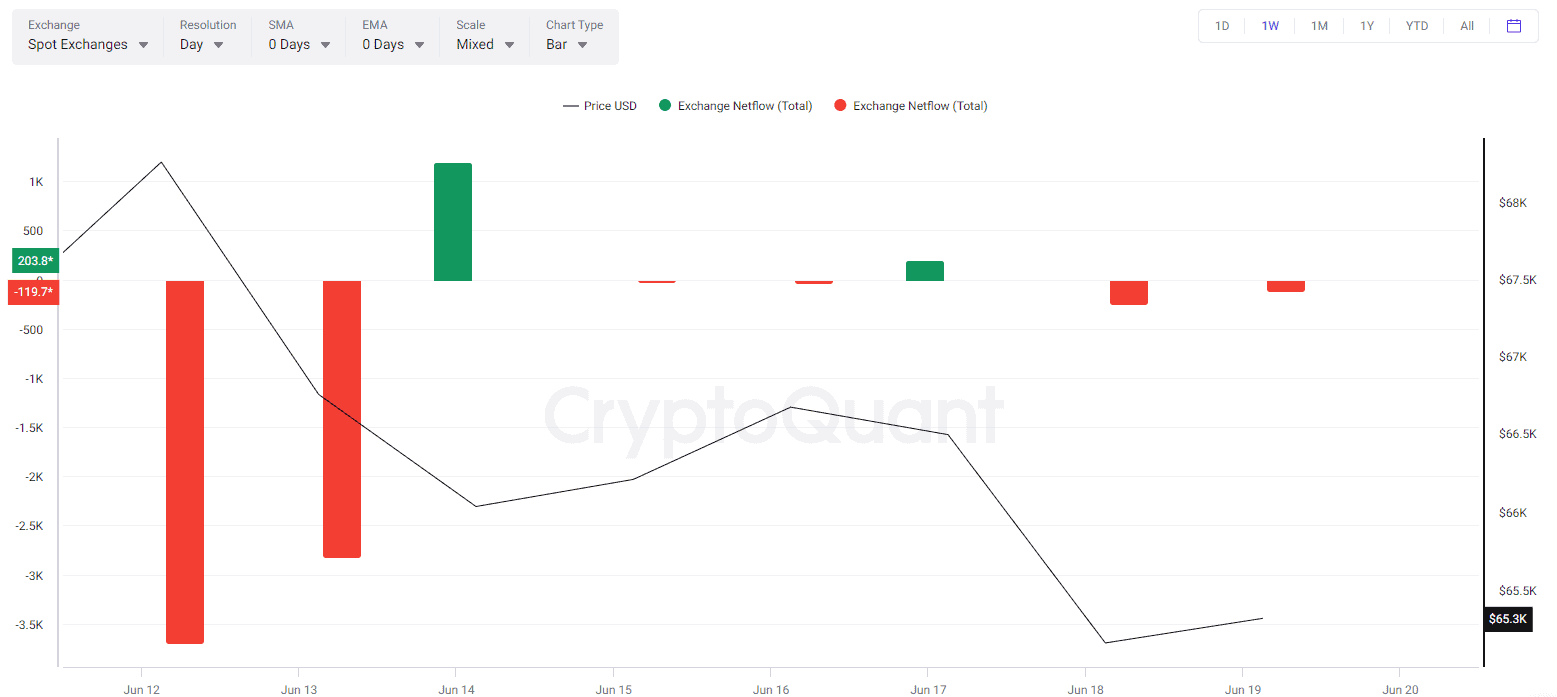

- High BTC open interest and negative exchange netflow suggest increased volatility and a potential bull run.

BTC’s Next Possible Move

The leading cryptocurrency in terms of market capitalization has underperformed as of late, with its price dipping by over 8% in the past two weeks. Currently, it trades at around $65,200 (per CoinGecko’s data), a 12% decline from the all-time high registered in mid-March this year.

Nonetheless, prominent industry participants and analysts expect a rebound in the near future. One example is Crypto Rover (an X user with almost 800,000 followers), who thinks BTC has “bottomed” and is now poised to spike to $72,000-$74,000.

Recall that the asset’s price tumbled to as low as $64,000 on June 18 but recovered some of the losses the following day.

Titan of Crypto chipped in, too, envisioning a potential rally above the $100,000 milestone before the end of 2024. The analyst based their forecast on the BTC halving, which took place in April this year.

#Bitcoin It’s about time.

After the halving #BTC takes a few months before pulverizing its previous ATH.

This time is no different.

Patience my friends. pic.twitter.com/cx26164J0D

— Titan of Crypto (@Washigorira) June 18, 2024

The halving occurs every four years and slashes in half the daily issuance of new assets. Historically, it has been followed by a massive BTC price rally and a resurgence of the entire cryptocurrency market.

For his part, Ali Martinez argued that BTC might yet reach its cycle top, assuming it mirrors its performance in past bull runs. The analyst believes the price might peak around December 2024 or by October 2025.

Taking a Closer Look at Some Major Indicators

Important on-chain metrics such as BTC open interest and exchange netflow signal increased volatility in the future and a possible bull run. Bitcoin open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not been settled yet.

The metric’s rise generally indicates that fresh capital is flowing into the ecosystem, suggesting that traders are either opening new positions or adding to their existing ones. However, it can also signal the opening of new short positions, which could result in a price decline due to the increased selling pressure.

BTC open interest hit an all-time high at the start of June. Despite the retreat in the following days, the indicator is still not so far from its peak level (according to CryptoQuant’s data).

For its part, BTC exchange netflow has been predominantly negative in the last week, suggesting a shift from centralized platforms toward self-custody methods. This is considered bullish since it reduces the immediate selling pressure.

The post Here’s Why Bitcoin (BTC) May Hit Another ATH This Year: Analysts appeared first on CryptoPotato.