Following a remarkable climb in 2023, Cardano (ADA) has experienced a downward trajectory for the past few weeks, deviating from the prevailing bullish market sentiment. As a result, ADA has registered a monthly loss of nearly 20%, leading to a reduction in its yearly gains to just over 61%.

Priced at $0.522, experts suggest that ADA might go through a consolidation phase before initiating a meaningful rally.

ADA’s Trajectory Mapped

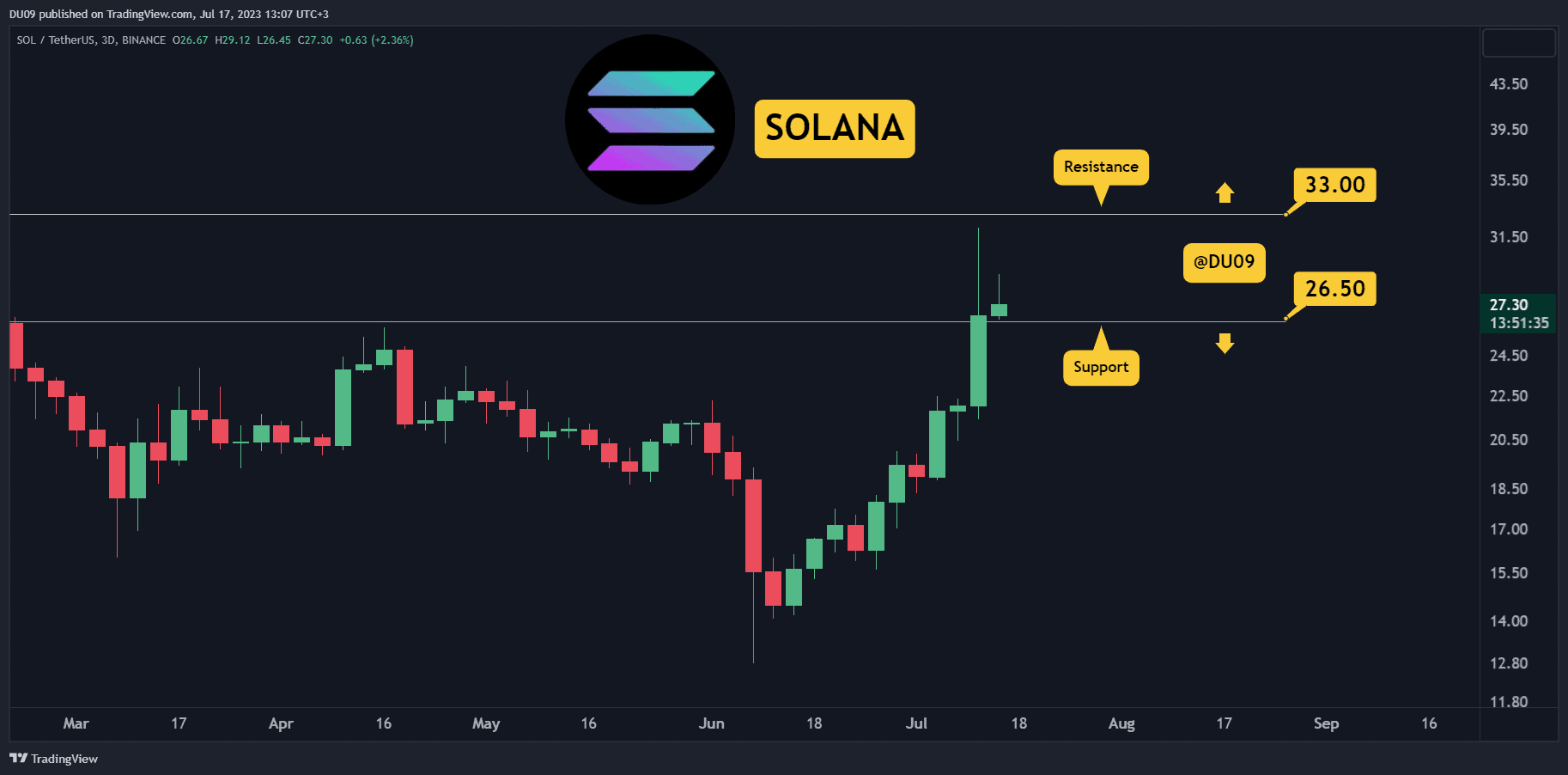

Crypto analyst Ali Martinez’s recent prediction on ADA suggests that the current price action closely mirrors the pattern observed between 2018 and 2020.

According to Martinez, if this trend persists, there is a possibility that the eighth-largest crypto asset by market cap could undergo a period of consolidation around its present levels until April. This consolidation phase, as per his analysis, could potentially serve as a crucial setup for the resumption of a bullish trend.

His tweet regarding the same read,

“So far, Cardano price action is echoing its 2018-2020 pattern! If this trend continues, we might see ADA consolidating around its current levels until April, setting the stage for a potential resumption of the bull run.”

In contrast to Martinez’s forecast of a concrete bullish trend four months later, Captain Faibik, a Twitter user, recently presented a chart illustrating a “bullish pennant formation” for ADA. According to this analysis, the crypto asset is anticipated to potentially surge to $0.80 by the end of this month.

Revival in DeFi, NFT Activity

At the beginning of 2024, Cardano observed 3,064 staking pools, contributing to a staked quantity of 22.76 billion ADA, constituting 64.94% of the overall supply.

The spur in activity can be witnessed across several Cardano-based projects as well. Data suggest that the majority of growth appears to have taken place in the recent week, notably involving the lending protocol Indigo and on-chain exchange Minswap.

Meanwhile, the total value locked (TVL) in Cardano currently stands at $357.2 million, while its 24-hour trading volume was recorded at $7.78 million, according to data compiled by DeFiLlama.

Additionally, Cardano NFT sales volume increased to almost $9 million, registering a 60% increase.

The post Here’s When Cardano (ADA) Price Will Break Out of Consolidation and Turn Bullish: Analysis appeared first on CryptoPotato.