Here’s the Bad News for Bitcoin: Capitulation Is Not Here Yet (Analysis)

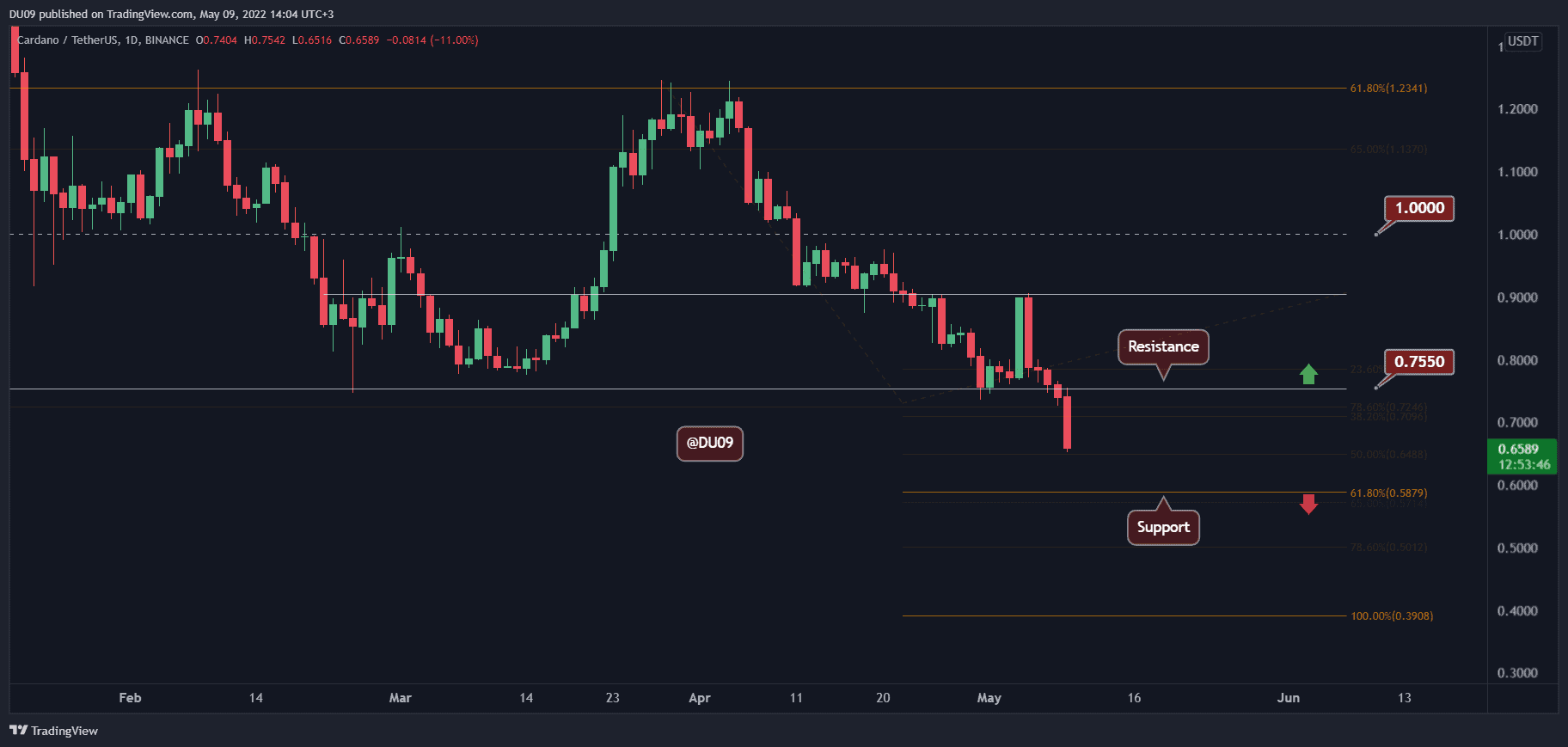

Despite Bitcoin’s massive drawdown over the weekend, one analyst believes that the bottom isn’t in yet. Chartoday – an educational resource for technical analysis – claims that most “bearish targets” have still not been touched.

- According to a post logged on the on-chain analytics site CryptoQuant, the Spent Output Profit Ratio (SOPR), is not yet showing signs of bottoming.

- SOPR measures whether moved coins are being sold at either a profit or a loss. A value over 1 means they are being sold at a profit, and vice versa.

- The metric has only recently descended below 1. However, this event has historically coincided with further consolidations and price pullbacks in past bear markets.

-

“Bitcoin’s next move is probably to keep going down until we see way more coins being sold at a loss,” reads the post. “That’s what capitulation implies in the end.”

- The entire crypto market has now collapsed to lows unseen since December of 2020. Bitcoin’s relative strength index (RSI) – an indicator of an asset’s momentum and whether it is overbought or oversold – also touched an all-time low.

- CryptoQuant CEO Ki-Young Ju further elaborated on market conditions over Twitter. He clarified that the average blockchain wallet is now at a loss.

- In late May, Ju stated that Bitcoin was approaching its “cyclic bottom,” using a measure of UTXO age bands.

-

“UTXOs over 6 months old take 62% of the realized cap,” he said. “In the 2020 March great sell-off, this indicator reached 62% as well.”