Here’s How Miners Are Betting on Bitcoin’s Price Surge: CryptoQuant

Bitcoin (BTC) has struggled below the $70,000 price for over four months. Even the much-lauded “Uptober” failed to bring it above it for quite a while, until yesterday.

However, a CryptoQuant analyst projects that the current metric on the Miners’ Position Index (MPI) will significantly aid Bitcoin’s price gain to incredible heights between this year’s ending and next year.

How Miners Are Fueling the Next Price Gain

Bitcoin miners verify new transactions, add them to the network, and create new bitcoins by solving cryptographic problems. Entities interested in operating a mining node must set up the equipment required for the job.

Historically, Bitcoin miners tend to sell portions of their BTC stash to cover operational costs before the Bitcoin halving occurs. This quadrennial event downsizes the number of BTC produced in each block by half. The most recent halving on April 20th saw the block reward drop from 6.25 BTC to 3.125 BTC.

The CryptoQuant analyst explained that miners often accumulate and hold BTC instead of selling it whenever the price stalls after the halving event. Recent reports show that prominent miners like Marathon Digital are accumulating as much BTC as possible. The current MPI metric indicates that miners are still holding their coins.

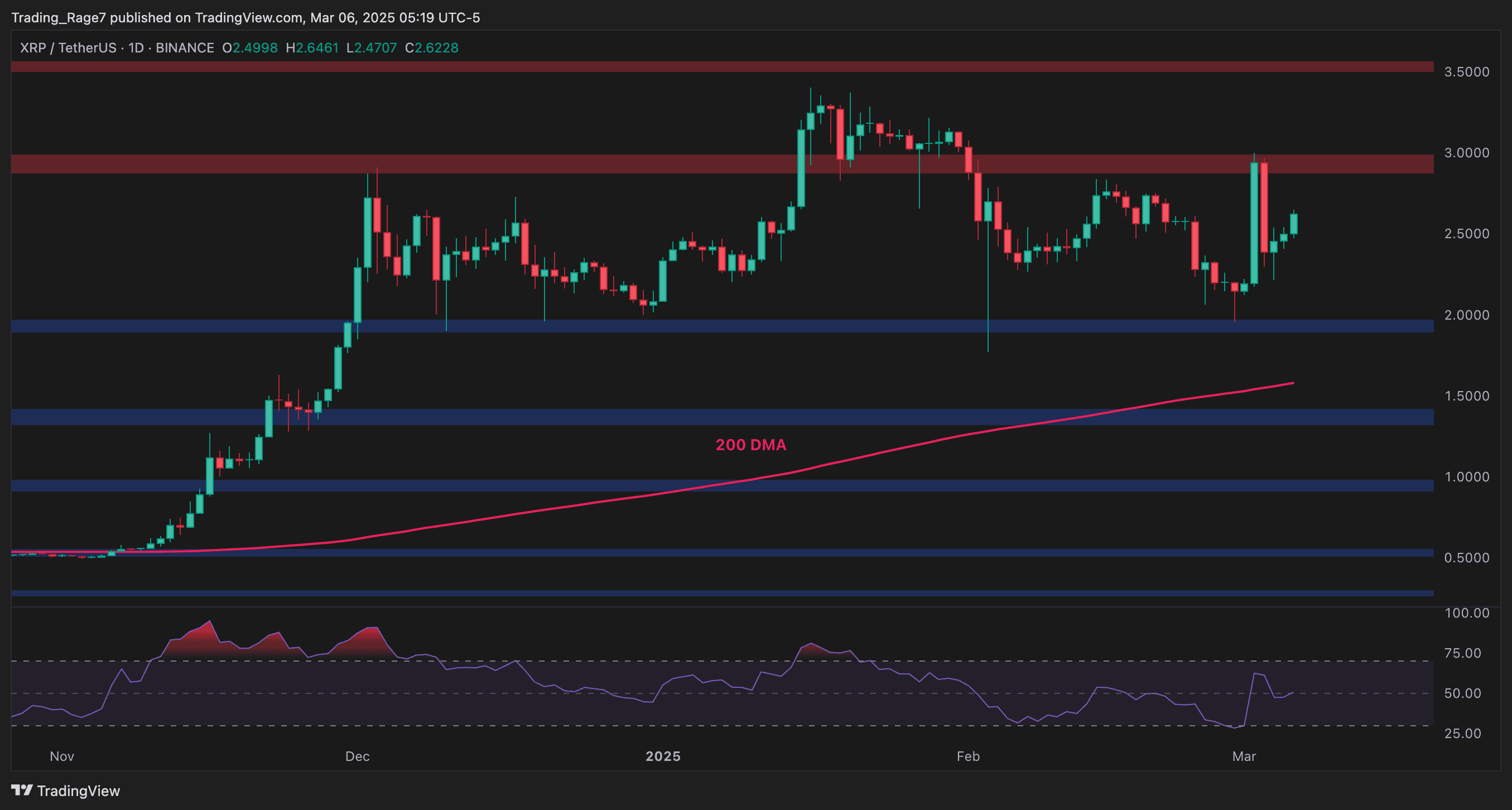

-

Source: CryptoQuant

Explaining the chart, the analyst stated:

“Historically, when the MPI rebounded from a low, Bitcoin’s price tended to experience significant increases. Therefore, the current situation could also be interpreted as a prelude to a Bitcoin price rally.”

Referencing another on-chain indicator, the analyst explained that block rewards are also increasing due to a surge in on-chain transactions. Ideally, an uptrend in on-chain trades is often accompanied by a price surge for the network’s underlying asset.

BTC Shoots Above $68K

Even though the CryptoQuant analyst expects a new all-time high for bitcoin, it remains uncertain when the leading crypto asset will attain such a price increase.

At the time of writing, BTC exchanged hands with $68,800, representing a mild 1.58% increase over the past 24 hours.

The post Here’s How Miners Are Betting on Bitcoin’s Price Surge: CryptoQuant appeared first on CryptoPotato.