Here’s How Many Ethereum (ETH) Holders Are in Profit Amid September Drop

Blockchain intelligence platform IntoTheBlock has revealed a new metric showing that 61% of ETH holders are sitting in profits.

This record comes when Ether (ETH) and other altcoins are experiencing significant price downtrends. Over the past 24 hours alone, the second-largest cryptocurrency has tanked by over 4%, bringing its trading price to around $2,300.

61% of ETH Holders in Profit

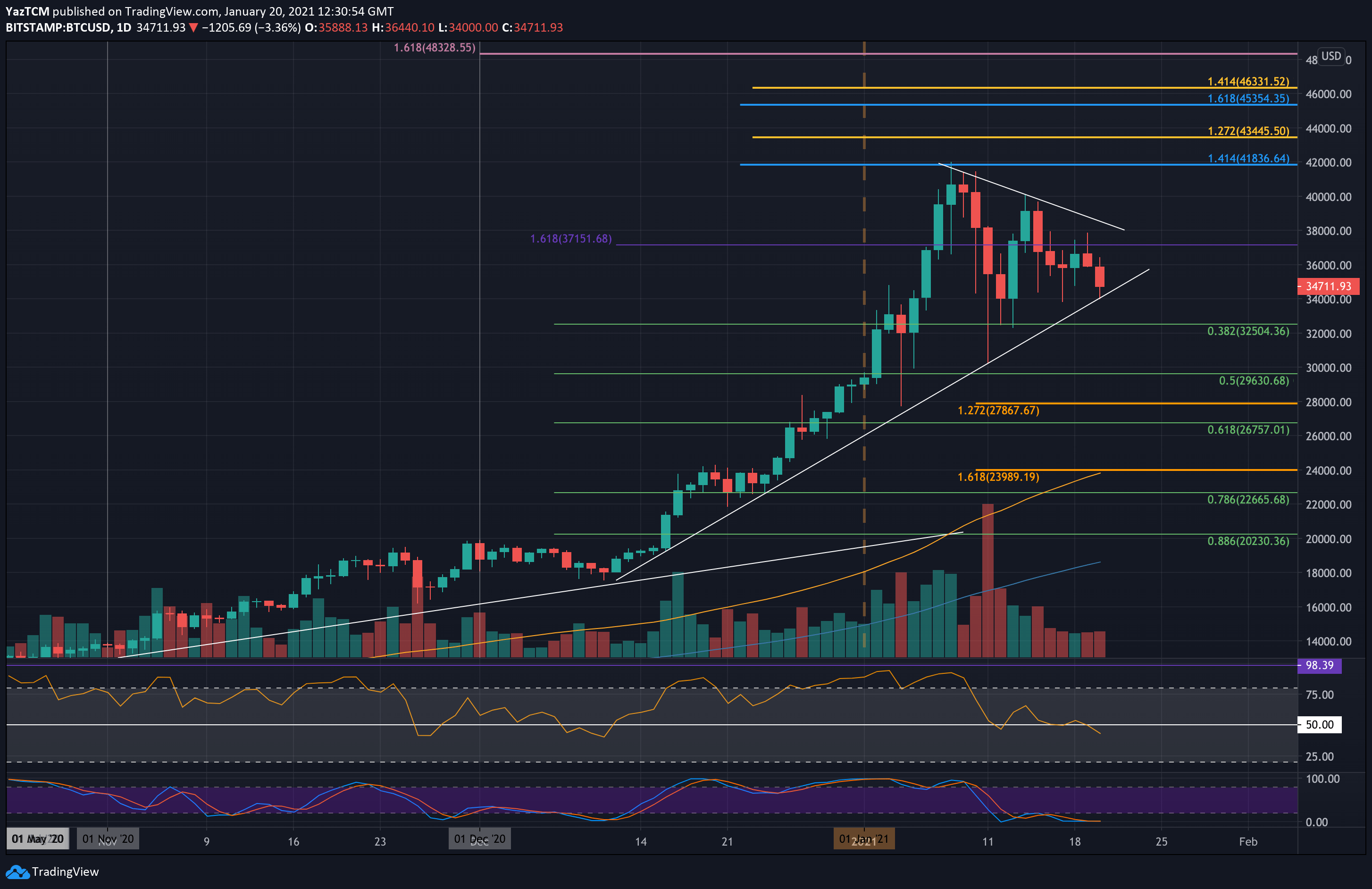

IntoTheBlock’s data showed the second-largest crypto asset’s Historical In/Out of the Money since 2016.

The metric shows that ETH holders in profit dropped to as low as 3% after the 2017 cycle. Such depth is often accompanied by a significant price decrease as various investors grapple to sell their ETH holdings to see any gains.

Fast forward to the 2019-2020 cycle, ETH wallets in profits dropped below 10% when the bearish trends enveloped the market. With the 2021 bull run, where ETH reached its peak value of $4,870, those in the money soared to record levels at the time.

The chart also shows that ETH wallet addresses in profit sank to 46% during a recent market downturn earlier this year. With the percentage of profitable ETH holders currently at 61%, investors are less likely to be pressured to sell their Ether assets, benefitting the market’s overall performance.

A Bearish September

This month has seen ETH’s worst performance since February, as the asset dropped below $2,300 once again earlier today.

In a recent report, Bitwise’s CEO Matt Hougan highlighted three potential drivers behind the crypto market downtrend every September. Among his reasons, he explained that risk assets like Bitcoin and other cryptocurrencies often perform woefully in September. The Bitwise executive added that investors typically expect the crypto market to underperform during the month, sparking the market performance.

Despite the current downtrend, Hougan expressed conviction that Uptober (October) will bring the bulls, taking prices of assets like ETH to impressive heights.

What’s more worrying for Ethereum bulls is the ETH/BTC trading pair, which dumped to a 3.5-year low. This means that ETH has been losing a lot of ground compared to the largest digital asset.

The post Here’s How Many Ethereum (ETH) Holders Are in Profit Amid September Drop appeared first on CryptoPotato.