Hedera’s HBAR Doubles, Then Falls 25%, as BlackRock Links Diminish

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

BlackRock was not directly involved with the launch of a tokenized money market fund on Hedera.

-

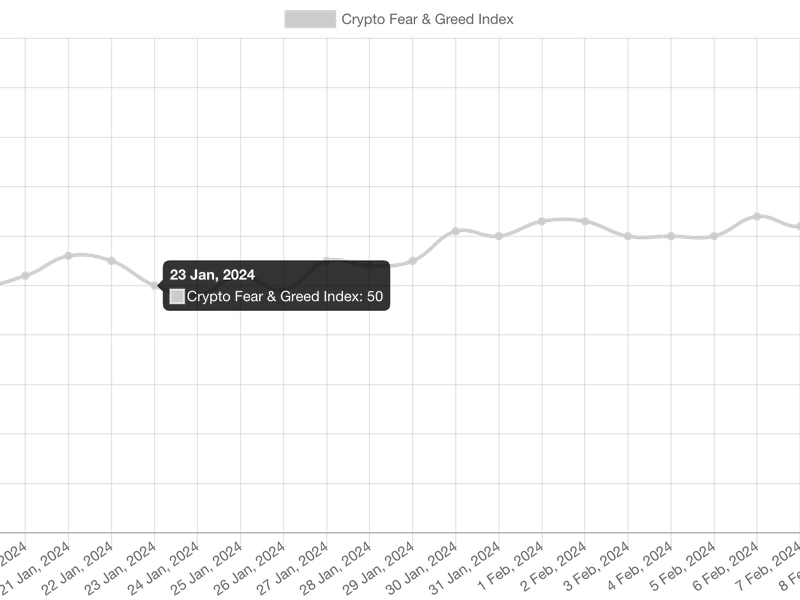

HBAR funding rates are negative as traders look to short the recent spike.

-

Liquidity remains thin relative to volume, indicating a volatile trading period ahead.

Hedera’s native HBAR token surged by over 107% on Tuesday, then slipped 25%, as investors believed that BlackRock was involved in a fund tokenization project on the Hedera blockchain.

On Tuesday, Hedera announced that BlackRock’s ICS U.S. Treasury money market fund had been tokenized on the Hedera blockchain in collaboration with Archax. Hedera supporters on social media began claiming that BlackRock chose Hedera to tokenize its fund, although this wasn’t the case.

Archax CEO Graham Rodford said that “it was indeed an Archax choice to put [the fund] on Hedera,” in response to criticism about misleading marketing from Hedera.

BlackRock entered the real-world asset (RWA) tokenization sector last month when it launched its USD Institutional Digital Liquidity Fund on Ethereum.

The HBAR token is still up by 61% over the past 24 hours, but the 2% market depth remains relatively thin, with $900,000 in cumulative bids on the Binance and Upbit order books within 2% of the current price of 14 cents. The token has over $2.6 billion in trading volume over the past 24 hours, according to CoinMarketCap.

CoinGlass data shows that funding rates across all derivative exchanges are heavily negative, which means those holding short positions have to pay those holding long positions, indicating a bearish bias. The ratio of longs and shorts on Binance is currently 0.85.

The weighted short interest, coupled with a lack of liquidity, creates a landscape for a volatile trading period that could culminate in a return to parity or a short squeeze, with open interest having risen by 442% to $160 million in the past 24 hours.

Edited by Parikshit Mishra.