HBAR, XRP Defy Market Sentiment as BTC Dumps by $3K in Hours (Market Watch)

Bitcoin’s price actions during the weekend hinted at a potential break out toward $100,000, but Monday started on the opposite corner, slumping to $95,000.

Many of the larger-cap alts are also in the red now, with SOL losing over 4% and DOGE dropping by 3%.

BTC Slides to $95K

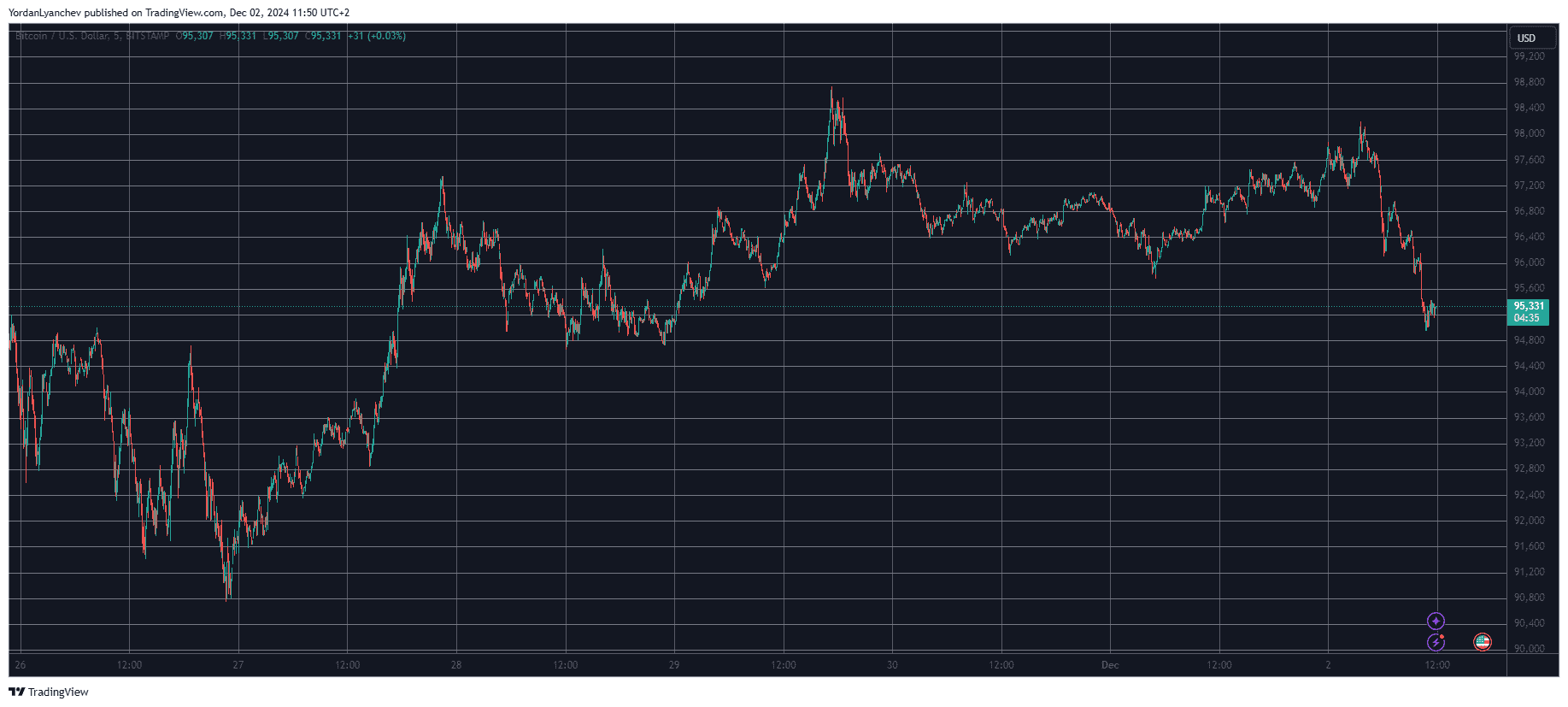

Last week saw quite a few fluctuations for the primary cryptocurrency, with the bears taking control at the start and dumping the asset to under $91,000 on Tuesday. After that, though, the bulls took charge and initiated a few consecutive leg-ups that resulted in bitcoin exploding above $97,000 on Wednesday and nearing $99,000 on Friday.

However, the cryptocurrency failed to maintain its run and retraced during the weekend by a few grand. The Monday morning Asian trading session saw a brief price surge to over $98,000, but BTC was quickly and violently rejected.

In the following hours, the asset slumped by over three grand and slipped below $95,000 for the first time since Friday. This came amid reports that a few whales had deposited large quantities of BTC to exchanges, potentially to secure some profits.

Bitcoin’s current price tag means that its market cap has dropped below $1.9 trillion, and its dominance over the alts is down to 53.2% on CG.

XRP, HBAR on Another Planet

Most larger-cap alts have followed BTC’s example with some price drops. Such examples are ETH (-2%), SOL (-4.3%), BNB (-2.6%), DOGE (-3%), and TON (-4%).

In contrast, ADA, XLM, AVAX, LTC, and LINK have all posted gains of up to 17% in the Litecoin case.

However, the day belongs to XRP, which is up by 22% since yesterday. Moreover, it tapped $2.5 earlier today to mark a new multi-year high and briefly became the third-largest cryptocurrency.

HBAR is another mindblowing gainer, having surged by over 26% and trading close to $0.25.

The total crypto market cap, though, has declined by about 2.5% in a day and sits below $2.550 trillion now.

The post HBAR, XRP Defy Market Sentiment as BTC Dumps by $3K in Hours (Market Watch) appeared first on CryptoPotato.