Hayden Adams: From Ethereum Idealist to Business Realist at Uniswap

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

The creation of Uniswap was cinematic.

In 2018, just a few months after Hayden Adams was introduced to crypto (by Karl Floersch, who also appears on the Most Influential 2023 list), Adams flew to South Korea to attend the Deconomy conference. He had been laid off from his first job out of college, a Siemens mechanical engineer, in mid-2017, and spent the intervening time learning to code, beginning essentially with beginner’s-unfriendly smart contracts.

This profile is part of CoinDesk’s Most Influential 2023. For the full list, click here.

He was 24, broke and primarily invested in cryptocurrency that had lost almost all of its value, purchased during the rising tide of 2017. But he also had a working prototype, a website and a name: Uniswap.

His friend Floersch had suggested Adams build something called an automated market maker (AMM), a type of decentralized protocol to swap assets without needing permission – first proposed by Ethereum creator Vitalik Buterin.

On an act of faith, he bought a plane ticket but not a conference ticket, intent on demonstrating “version 0” of Uniswap to Buterin. He snuck into Deconomy. Then got kicked out. In a twist of fate, he ran into Floersch, who was working at the Ethereum Foundation. Floersch introduced Adams to Buterin. Within a couple months, Adams was presenting on his own at conferences: in Toronto, New York, Hong Kong.

At the time, there were big things built on Ethereum – but nothing quite like Uniswap. While giving speeches or meeting kindred spirits the world over, Adams would discuss not only the decentralized exchange but the meaning behind it. After the market collapse of 2018, continuing hacks of corporate crypto exchanges and rampant profiteering, crypto lacked a tool it could truly call its own, Adams wrote in a history of Uniswap. He recounted his thinking at the time:

“Something felt off in the ether. The major projects on Ethereum embodied some of its properties, but few embraced them fully. Central points of failure, censorable applications and overly complex architecture. Dapps were designed entirely around the idea of having a token for use cases that clearly did not need one.”

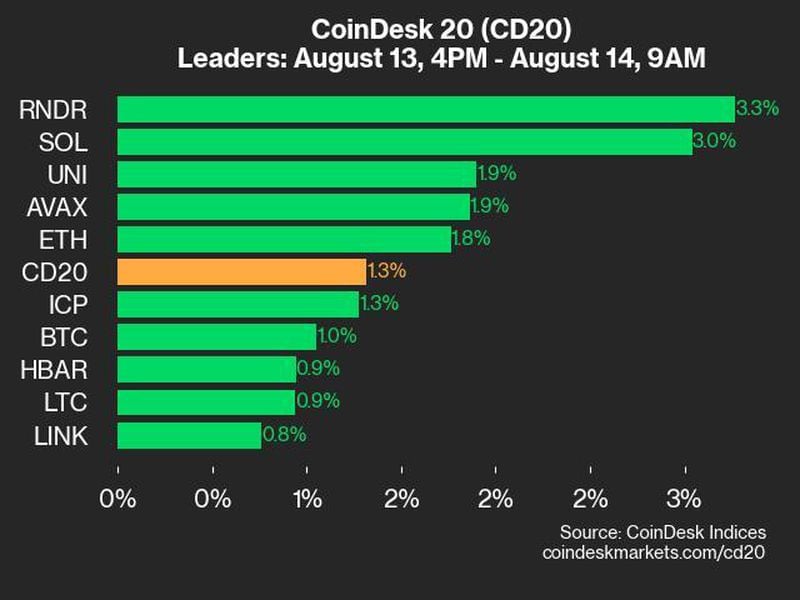

Today, Uniswap is one of the largest and most successful DeFi projects, and Adams is reportedly one of the wealthiest founders in the industry. It’s the largest decentralized exchange, or DEX, by total value locked (TVL), with over $3.9 billion committed to the platform at writing. It earns something in the order of $1.5 million per day in fees (often more), which accrue in part to holders of UNI, a protocol token distributed in 2020 in one of the earliest experiments in distributed governance.

Its daily trading volumes are commensurate with and often surpass those of Coinbase, the largest U.S. exchange.

To say Adams has influence in crypto is an understatement. He has envy, respect and love. Uniswap may not be his brainchild (Adams credits Gnosis’ Alan Lu for the specific swapping mechanism), but he did build it, with significant help along the way. In the beginning, there were people like Floersch and Buterin, of course, but also Pascal Van Hecke, Callil Capuozzo and Uciel Vilchis, who contributed code; friends like Philip Daian, Dan Robinson, Andy Milenius and Jinglan Wang who gave advice and comfort; and financiers like Richard Burton.

Business concessions

Adams also has his controversies. Following the U.S. Treasury Department’s sanctioning of Tornado Cash, Uniswap Labs said its supported front end (a.k.a. onramp) onto the protocol would begin censoring addresses that interact with the cryptocurrency mixer – diluting the “permissionless” and “censorship-resistant” properties that Adams wrote attracted him to Ethereum in the first place.

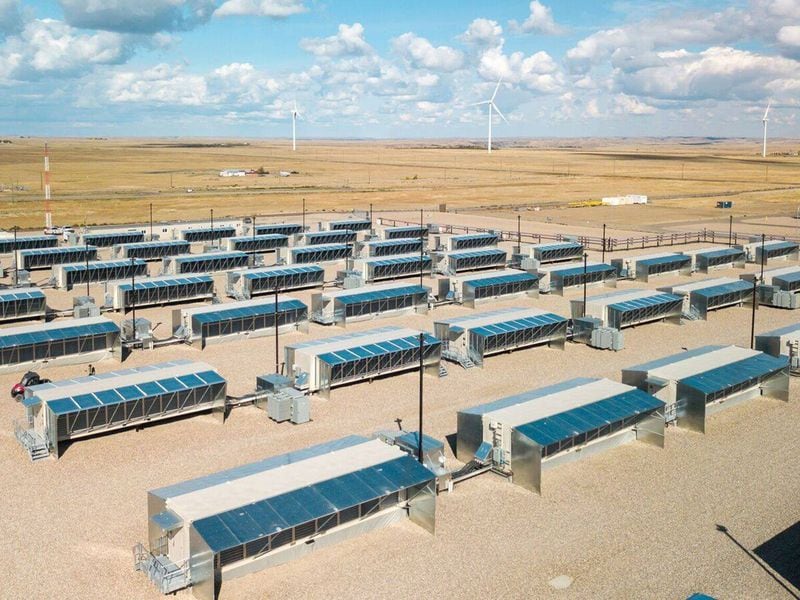

In June, Uniswap also announced it would soon launch its latest version, V4. This upgrade would come with a number of new features and changes, including a single contract address (called Singleton) that would house all of the pools needed to swap different crypto assets, reducing gas fees for all users. Plus, a new feature called “hooks” would allow devs to add code that changes how the protocol acts under different conditions.

Hooks have their haters, with some saying it improves customizability at the expense of decentralization. But the single most controversial aspect of Uniswap V4 is the “Business Source License” it’ll be released under. The license limits the use of the source code in commercial settings, meaning it isn’t exactly open source, at least until the license expires in up to four years.

Indeed, Uniswap, while a revenue generator, also has financial backers. And with financial backers comes an incentive to protect your profits and limit risks. Ethereum has changed since Adams discovered it, in part because of Adams’ influence.

The Uniswap team, however, is building the app in public and soliciting advice. There’s no official release date for the app, which will require “Ethereum Improvement Proposal 1153“ to work, as part of Ethereum’s Cancun upgrade expected by the end of the year. Such are the realities of open-source development.

Edited by Ben Schiller and Marc Hochstein.