Has Ethereum Lost Its Way?

Ethereum has come a long way since the network went live in 2015 under the codename Frontier, transforming from a grand idea into what is now the foundation for thousands of decentralized applications.

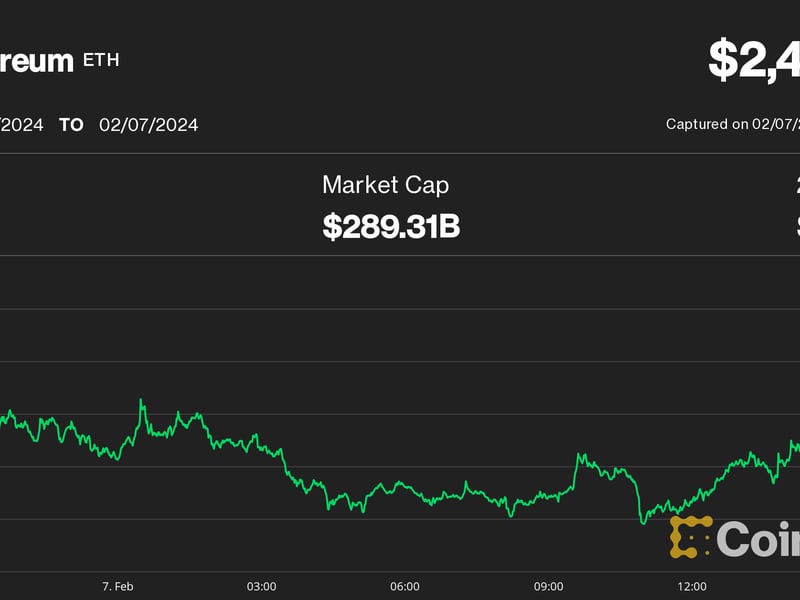

Still, with a rise in blockchains like Bitcoin and Solana competing for Ethereum’s developer and user base, the ecosystem is beginning to falter and lack direction, losing sight of what it originally intended to do. Even its value remains a bit flat. Ethereum’s token price still hasn’t successfully broken its all-time high of $4700, which it reached in 2021.

This raises the question, has Ethereum lost its way? If so, how do we get it back on track?

As Confucius once said, “The man who chases two rabbits, catches neither.” Between chasing Solana’s faster execution and the ultra-sound money narrative that competes with Bitcoin’s hard money, Ethereum has lost sight of its original vision of becoming the World Computer. Péter Szilágyi, an Ethereum Team Lead, said “Ethereum is losing the plot.” Even Ethereum’s “ultrasound money” status is being questioned as its inflation rate reaches 0.74%, driven by the reduced transaction activity and ETH burn rate. While others advocate for ETH to retain its deflationary nature, it is important to remember that ultrasound money was never the goal.

Ethereum is more than just a currency and it has never been about having the fastest TPS or the lowest gas fees; it has always been about building a truly decentralized future. Vitalik Buterin and other co-founders created Ethereum to become a World Computer — a universal network consisting of thousands of computers on which anyone can build decentralized applications from anywhere. While building to enhance accessibility and interoperability, the ecosystem is distracted by the latest trends and has lost focus.

With the price dropping below $2500, it’s been thought that the cause of ETH underperforming is related to the applications being built on the network. Many of today’s dApps on Ethereum gain short-term hype, but the reputation of a clunky UI and underdeveloped platforms lead to limited usage and slow user growth. Additionally, these applications often garner the attention of the same users siloed in various L2s. Without usable applications, Ethereum can’t reach its goal of becoming the World Computer.

Ethereum’s primary ambitions hinge on robust infrastructure, not applications. Decentralized compute, with secondary and tertiary networks that feed into Ethereum, are being developed as we speak, indicating how Ethereum’s infrastructure is showing signs of advancement. Even enterprises are beginning to favor permissionless networks like Ethereum over private corporate networks now that it’s become much cheaper to develop on permissionless chains.

But, even with these advancements, Ethereum is still improving at a slow place with the network stuck in the middle of the scaling roadmap, a less exciting time where Merkle Trees, zkSTARKS, account abstraction, and technologies that unify desperate L2s are coming to fruition.

There needs to be less short-term thinking. Like Bitcoin, Ethereum will come out of the doldrums of seemingly little activity. Ethereum is having its “Lightning moment” and it needs to drop the ultra-sound money narrative and stop trying to catch Solana. Ethereum has a clear path to fix this for those who pay attention. For example, we still haven’t seen how people will use Blobs beyond being a space for rollup fraud-proof challenge windows.

Following the Dencun upgrade in March, Pectra is the next major Ethereum upgrade scheduled for the end of 2024, and further down Ethereum’s roadmap is The Purge. This upgrade will play an important role in Ethereum keeping pace with other chains and handling the influx of activity once the chain achieves broader adoption. The Purge will simplify the protocol by clearing old history, which will eliminate technical debt and reduce costs of participating in the network.

While removing historical state comes with benefits, it leaves the chain vulnerable to data being gobbled up by centralized entities making Ethereum a data-centered chain. Ethereum then becomes more of a billboard with less trustlessness properties. This problem hinders the next phase of the World Computer because downstream activity, like multi-agent AI systems and decentralized compute, can’t scale if there’s no data to look to. This is solved through one type of solution: decentralized long-term data availability.

Yes, right now, Ethereum is stuck in the middle of the scaling roadmap. However, Ethereum can get back on track by directing its focus to infrastructure. This is what will truly allow the network to fulfill its role as the World Computer. As Ethereum reaches the end of the roadmap and achieves decentralized compute in the years to come, the World Computer will function effortlessly bolstered by none other than robust global infrastructure.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

have been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of

editorial policies.

CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.

:format(jpg)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/coindesk/0be8fa64-7cca-4ee6-b3b3-3729b3457d80.jpeg)

Ganesh Swami is a co-founder of Covalent, a modular onchain data infrastructure network. With a background in building protein simulation algorithms to solve cancer, Ganesh is a serial entrepreneur and has over a decade of experience in big data analytics. The network provides onchain data to over 200+ chains including Ethereum, Polygon and Base.