Harvest Finance Doubles Total Value Locked to $704M in One Week

Harvest Finance, a decentralized platform that lets users automatically “farm” assets for the highest returns in other decentralized finance (DeFi) projects, now has more than $700 million in total value locked, according to DeFi Pulse, unseating decentralized derivatives exchange Synthetix.

- The total value locked in Harvest Finance surged to $704.1 million on Tuesday, up 110% from $334.41 million a week earlier.

- The project is now ranked seventh on DeFi Pulse in total value locked (TVL), surpassing popular DeFi projects including Synthetix, yearn.finance, RenVM, and Balancer.

- According to Harvest Finance’s website, the total value of its deposits has crossed $1 billion Wednesday.

- Harvest Finance’s dramatic growth took place during a time when enthusiasm around the DeFi space has slowly hit a wall.

- The anonymous team behind the project told CoinDesk in a Telegram message the gain was partly due to “vault migration,” meaning users were moving their funds from existing pools to newly created ones in order to maximize returns on assets.

- The asset management platform, which was launched in September, aims to make so-called “yield farming” easier for small and novice investors in the DeFi sector.

- According to Harvest Finance, yield farming has become harder for small investors due to volatility in the DeFi space, high transaction fees and potential security risks on smart contracts.

- The project itself is audited by third parties and 10% of the protocol’s token supply is used to support the audit process.

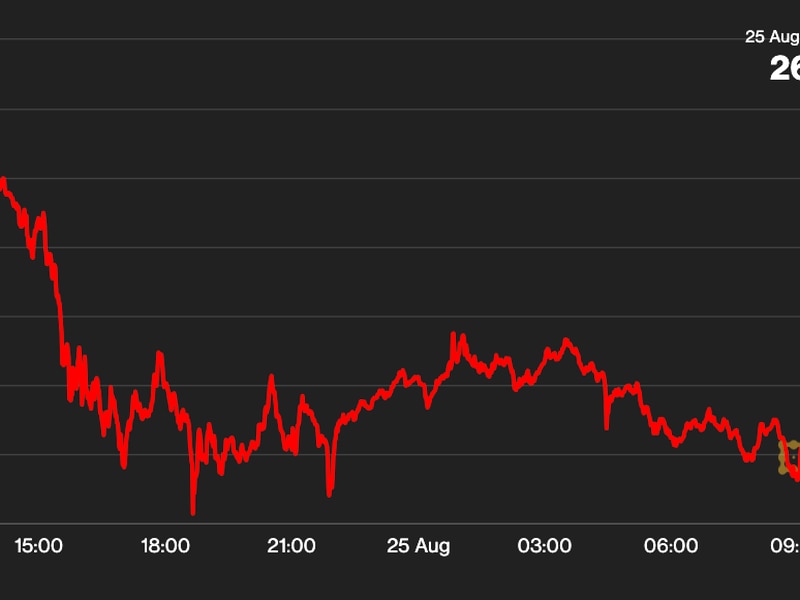

- The platform’s token FARM also saw a big jump, up by 35.72% over the past 24 hours, according to Messari.

- At the press time, FARM was trading at $322.64.