Hamster Combat Says It Skipped VC Fund Offers, Bashes ‘Exit Liquidity’ Behaviour

-

Hamster Combat, a viral play-to-earn crypto game, criticized venture capital funding as an “exit liquidity” activity and turned down all investment offers.

-

Developers said they hope to “return to the fundamentals of the web3 space,” by focusing on creating innovative projects that generate real value and revenue rather than using their audience for funding.

-

Hamster Combat has gained significant popularity with a claimed 200 million users as of July and 53 million subscribers on its Telegram channel

Viral play-to-earn crypto game Hamster Combat criticized crypto venture capital funding as an “exit liquidity” activity in a Tuesday broadcast to community members – stating it has turned down every offer.

“Since our explosive growth began, we’ve received numerous investment offers from some of the biggest venture capital firms in the Web3 space,” the game’s admins said in its official Telegram group. “We’ve turned down every single one.”

“Too many Web3 projects have built audiences only to use them as exit liquidity for their venture capital backers. This has, unfortunately, become the norm in the industry,” they said.

“We stand against this practice. We want the web3 space to return to its fundamentals.”

“Instead of creating innovative projects that generate real value and revenue, companies often focus on making a convincing pitch to secure funding, spend it on marketing, conduct an airdrop or even a public ICO, and then walk away—leaving users holding the bag.”

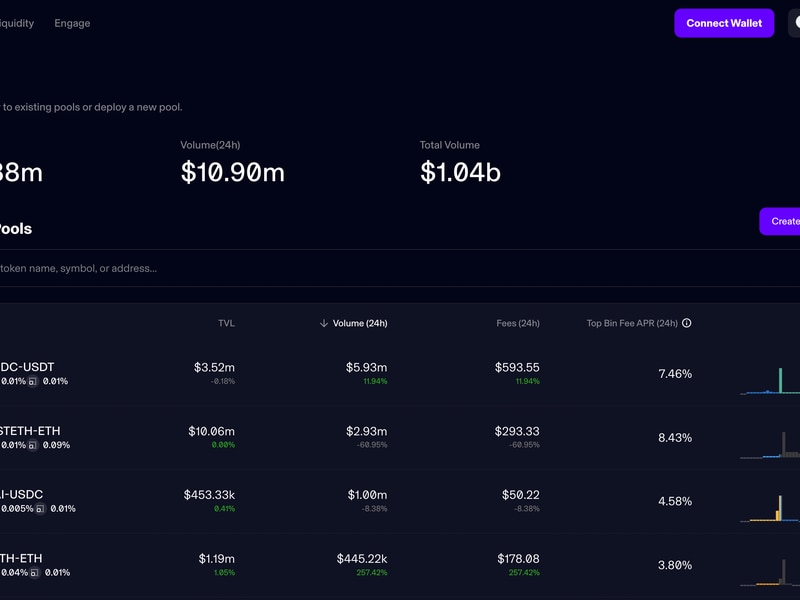

Hamster Kombat allows its gamers to become the virtual hamster CEO of a crypto exchange of their choice, such as Binance, OKX, and others, on its platform. Players tap the hamster on the screen to start earning some points that can be used to acquire upgrades for their in-game exchange.

The game uses the TON blockchain and claims to have 200 million users as of July. Players can convert their in-game coins into HMSTR tokens which are tradable on cryptocurrency exchanges. The game has gained significant popularity since its April release – with 53 million subscribers on its Telegram channel.

The only way to obtain the future HMSTR token is by playing the game. Some 60% of the total supply is reserved for the players, with the rest reserved for providing market liquidity, future ecosystem partnerships and grants, rewarding squads, and other items.

Why is VC funding getting a bad rep?

In recent months, crypto venture firms have been criticized by parts of the crypto industry, with a specific focus on investing in projects whose tokens eventually have a higher valuation than the venture firm’s initial investments.

This tends to create downward pressure after exchange listings and leaves public investors with losses.

As CoinDesk previously reported, newer tokens such as Aptos’ APT and Sui Network’s SUI have fallen as much as 70% since their 2023 peaks, while bitcoin (BTC) kept rising and made new highs in 2024.

“Venture capital funds invested $13 billion in Q1 2022, while the market turned into a steep bear market,” Markus Thielen, founder of 10x Research, said in a June report. “Those funds are now under pressure from their investors to return capital as artificial intelligence (AI) has become a hotter theme.”

Crypto funding took a hit in 2023 but has recorded growth past three quarters, as per a PitchBook report on August 9. Deal value hit $2.7 billion in Q2, marking a 2.5% increase in total invested capital but a 12.5% decline in the number of deals compared to Q1.

As for Hamster Combat’s future HMSTR token, developers say venture funds will access the token in the same way that users would: by buying it on exchanges after it is eventually issued and listed.

Edited by Parikshit Mishra.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Follow @shauryamalwa on Twitter