Greenpeace USA’s Misinformed Environmental Attacks Only Energize And Galvanize Bitcoiners

Underlying disinformation exposed during Greenpeace USA’s “Change The Code” campaign only served to rally the Bitcoin community.

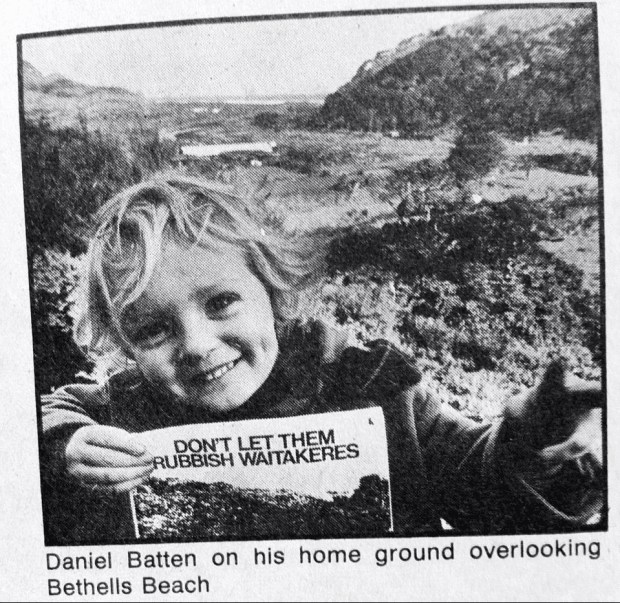

This is an opinion editorial by Daniel Batten, a Bitcoin ESG analyst, climate tech investor, author and environmental campaigner.

Growing up in the ’70s, our local council tried to put a rubbish tip into our coastal New Zealand community. The whole community came together — not just to fight a common enemy (and win), but to discover the power of what is possible as part of a grassroots movement, which is impossible alone. In years to come most of that community, including myself, would go on to become voices for humanitarian and climate justice.

Fast forward to October 2022: I would never have imagined I would be part of a community of environmentalists defending the environment against Greenpeace USA.

A period of intensive data analysis six months earlier had led me to the inescapable conclusion that Bitcoin was a net positive to the environment, but powerful forces were at work to hoodwink the world’s environmentally-minded through a seemingly orchestrated misinformation campaign. The misinformation was strong enough that I initially fell for it myself.

In a world where retorting the hobby website of a paid employee of a central bank is treated as canonical truth by mainstream media, right up to the White House and conflicts of interest evades mainstream media scrutiny, there have been precious few public relations victories for the Bitcoin community when it comes to the environmental narrative.

“Bitcoin uses too much energy,” has become the new “immigrants are taking our jobs”: the incantation of vested interests and the hoodwinked who, wittingly or unwittingly, stoke the fires of populism with sound bites over sound analysis.

What we are seeing is not new.

We saw the tobacco industry influence medical opinion for many years about the safety of smoking. We saw the print media criticize the environmental credentials of the internet, predicting it would cause coal factories to fire up worldwide. Today, it’s unsurprising that central banks that want their central bank digital currencies (CDBCs) to be the future of digital currency, not Bitcoin (which disintermediates central banks), should happily fan the fires of doubt about Bitcoin using environmental credentials as its attack vector.

In this historical context, it is no surprise that Ripple’s executive chair Chris Larsen, among others, paid $5 million to launch a Greenpeace USA campaign attacking Bitcoin’s energy use. And Ripple is not just another altcoin, it is launching its own CDBC pilot project. CBDCs and Bitcoin represent fundamentally-competing visions for our digital currency future.

Nor should we be surprised that seemingly no mainstream journalist has publicly questioned either Larsen or Greenpeace about an evident conflict of interest.

But despite the money, the compassionate pass from mainstream media and a well-trained in-house media team that did its best to neuro-associate Bitcoin with stock video footage of climate catastrophe, Greenpeace USA’s campaign did not go well.

The “Change The Code” campaign actually energized and galvanized strong environmentalist voices within the Bitcoin community including Troy Cross, Margot Paez, Adam Wright and others.

It motivated podcasters such as Bitcoin Archive, Pomp and Crypto Birb who had not previously examined the environmental benefits of Bitcoin to start doing so.

It was also the catalytic moment that took me from being a read-only Twitter user, to becoming one more outspoken voice for the environmental merits of Bitcoin.

Greenpeace USA had the opportunity for a strategic retreat, but it did not take it.

Instead, in September — timed seemingly for after the Ethereum merge — Larsen and others spent an additional $1 million with Greenpeace USA to intensify the attacks on Bitcoin.

This time, the backfire was even more pronounced.

On Greenpeace USA’s Twitter feed, a horde of Bitcoiners weighed in with data and fact, mercilessly counter-attacking Greenpeace’s campaign for what they perceived as its misinformation, ignorance, questionable ethics, lack of science, use of psyop-style messaging and inability to see how thoroughly it had been played by central bankers.

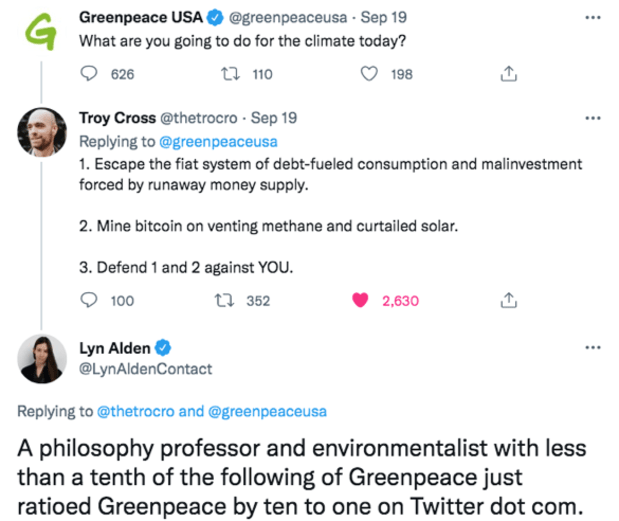

Remarkably few of Greenpeace USA’s own 218,000 followers, nor any other branches of Greenpeace internationally came to its aid. And Greenpeace USA wasn’t just repeatedly ratioed. It was honey badgered. Lyn Alden’s commentary on Troy Cross’ reply to a Greenpeace USA tweet captures the extent of the backfire:

No other branch of Greenpeace seems to have retweeted any of the “Change The Code” campaign since September.

Organizers set up a Change The Code Twitter handle which spent many months limping to 1,300 twitter followers — 80% of whom seem to be Bitcoiners based on their profile descriptions.

With the clockwork relentlessness of an oil pumpjack, the account continues to grind out near-daily anti-Bitcoin sound bites, only to see nearly every tweet ratioed by about 20:1 by the community.

It has proven a valuable resource for Bitcoiners. Not only is it very useful to see all the misinformation cataloged in one place but, more importantly, each time a tweet is ratioed, it allows Bitcoiners to educate themselves and others in the community about how to counter Bitcoin misinformation.

Far from turning more people against Bitcoin, the campaign has served only to draw attention to Greenpeace USA’s departure from grassroots funding while providing a forum for Bitcoiners to demonstrate the weakness of the anti-Bitcoin case once mainstream media was no longer there to insulate the attacker from a horde of highly-informed Bitcoiners.

Willy Woo calculated the campaign lost for Greenpeace at a minimum of $7.1 million in subscriptions worldwide. The brand and reputational damage will likely have been much more, and take much longer to recover from.

While outwardly Greenpeace USA will shrug shoulders and say “Well, you always lose some supporters on direct action campaigns, and Bitcoiners are vocal on Twitter,” behind closed doors its executive management will be asking “What went wrong?” in what has been an unprecedented social media catastrophe.

So, Why Did The ‘Change The Code’ Campaign Perform Badly?

The first foreboding signs came one year earlier. In the only level playing-field debate on if Bitcoin if a threat to the environment — a predominantly anti-Bitcoin general audience swung 17.9% to become predominantly pro-Bitcoin after just one hour of hearing for the first time not just a central banker’s narrative, but a Bitcoiner’s right of reply, according to a calculation of voters from the user forum on the video itself.

Plus 17.9% is a swing of gargantuan proportions.

The second alarm bell for Greenpeace USA was much closer to home. Greenpeace’s base is 18 to 34 year olds: This age group is twice as likely to think climate change poses a serious threat. What Greenpeace USA seemed not to realize until it was too late was that 18 to 34 year olds are also almost twice as likely to hold bitcoin as the rest of the general population.

The third alarm bell should have been that these 18 to 34 year olds are the least likely to trust mainstream media. Meaning: Greenpeace USA’s base was the least likely to have believed the highly-skewed narrative about Bitcoin propagated through mainstream news channels.

Greenpeace USA completely miscalculated what would happen in forums where the “Bitcoin can be good for the environment” case could not be censored the way it had been throughout mainstream media outlets.

To illustrate the extent of the amplify/censor imbalance in mainstream media, a single case where Bitcoin mining used an off-grid natural gas plant has been amplified by continual regurgitation, but the 31 cases where Bitcoin mining operations use zero-emission or carbon-negative energy sources have gone unreported.

Greenpeace’s direct action campaigns typically target large corporations with something to hide. Greenpeace USA also miscalculated what would happen when it took on a grassroots movement founded on the values of consensus and transparency, which had nothing to hide, and an untold story to tell.

It miscalculated how Bitcoiners would unite together to defend an attack from an environmental goliath that they perceived to have compromised its integrity by taking private money from a conflicted billionaire to fund their campaign.

But it also perhaps miscalculated how unsympathetic its 18-to-34-year-old base would be to its anti-Bitcoin narrative. For when the ratios came thick and fast on Twitter, its base did not defend it.

That vacuum allowed Bitcoin Twitter to do the job that mainstream media once did: hold an organization to account for taking funding from an apparently conflicted source.

What positives can Greenpeace USA take away from this campaign? Well if its intention was to…

- Galvanize the Bitcoin environmental movement and create new leaders within it

- Provide a forum where Bitcoiners can educate and inform its base about the environmental benefits of Bitcoin

- Highlight a tactical error from its executive management team to its supporters

…then its campaign has been a resounding success.

It wasn’t supposed to be like this. Even before the extra $1 million from Ripple was paid to amplify Greenpeace USA’s message directly after the Ethereum merge, Cross warned the Bitcoin community in July that more pressure would come on Bitcoin post-merge.

It seemed the antagonists of Bitcoin were expecting this to be the turning of the tide, where they triumphantly cried, “Ethereum has proven it can do the right thing for the environment, now it’s Bitcoin’s turn” to a choir of cheerleaders.

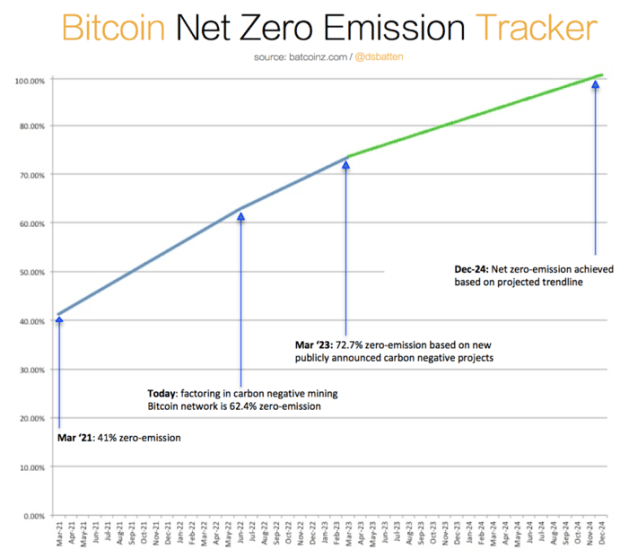

They did not expect the reply: “Bitcoin is now the only major cryptocurrency that can become an emission negative network.” Nor did they expect the supporting data, showing that 7 megawatts (MW) of vented-methane=based mining per month is all it takes to make the whole Bitcoin network emission negative by December 2024, a monthly rate already surpassed using flared methane power.

As for Bitcioners, we can celebrate this moment. It is not the final battle. Not even close. The opponents of Bitcoin will re-gather stronger. We can expect new missiles of misinformation, new angles of attack vectors through the curatable channels of mainstream media and political influence that have worked for them to date.

But they have also learned that in an open forum where the right of reply cannot be censored, the truth will shine: social media is one stadium where they cannot win.

If Greenpeace USA introspects deeply, it will realize that we are on the same team: Bitcoin is a reflection of its own core values, not just a financial sovereignty movement, but a human rights movement and an environmental movement. It is a movement built on Satoshi Nakamoto’s vision of peer-to-peer solidarity, returning power to the people algorithmically through the proof-of-work consensus mechanism, while disintermediating the unelected financial elites who, by virtue of wealth or position, can make decisions that are bad for the people and widen wealth inequality.

They will come to understand that Bitcoin is hope for non-violent revolutionaries in the environmental movement who seek to end the petrodollar, usher in a world that is not based on the excessive consumption that inflationary (fiat) currencies incentivize, stabilize the intermittency of renewable energy, find a home for new solar and wind on the grid and mitigate methane that would otherwise have become atmosphere-borne and contributed to climate change.

Bitcoin cannot fix the environment. Only people can do that. But Bitcoin was created to help the people, and that spirit of its founder lives on in everyone who is behind it.

The environmentalists within the Bitcoin community are growing rapidly, in number and in valor. Just like that coastal community of the ’70s, each attack on what we hold dear serves only to energize and galvanize us, creating new leaders who will go on to become irrepressible voices for humanitarian and climate justice.

This is a guest post by Daniel Batten. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.