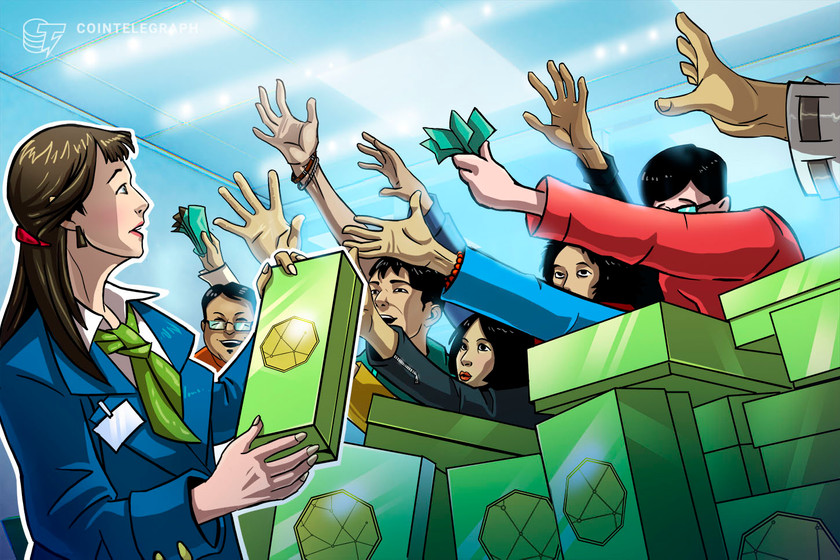

Grayscale’s Litecoin-Based Asset Sees Wild Premium Swings

Prices are volatile for Grayscale’s LTCN stock asset.

Grayscale’s LTCN asset, boasting publicly quoted over-the-counter shares, currently trades far above the price of Litecoin (LTC) — its underlying asset.

At press time, Litecoin trades at $60.62, while LTCN shares trade at $54.01. The two prices seem close, although each share of LTCN equals just 0.094 LTC, according to Grayscale’s website.

Buying roughly 10.64 LTCN equates to ownership of 1 LTC. At current prices, however, buying 1 LTC worth of LTCN costs about $574 — over $500 more than the price of 1 LTC purchased on the crypto markets. Aug. 20 yielded an even higher premium, with each share of LTCN holding a price tag of $99.

In July 2020, Grayscale announced its LTCN shares for public OTC quotation and trading, touting regulatory approval from the U.S. Financial Industry Regulatory Authority, or FINRA. Grayscale originally made LTCN available in March 2018, but only for accredited participants.

Grayscale’s time-tested Bitcoin (BTC) trading product, called GBTC, often holds a notable premium over its underlying spot asset, but not one as unusually high as seen in LTCN.