Grayscale’s Bitcoin ETF Sees First Inflow After Billions Lost Since January

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

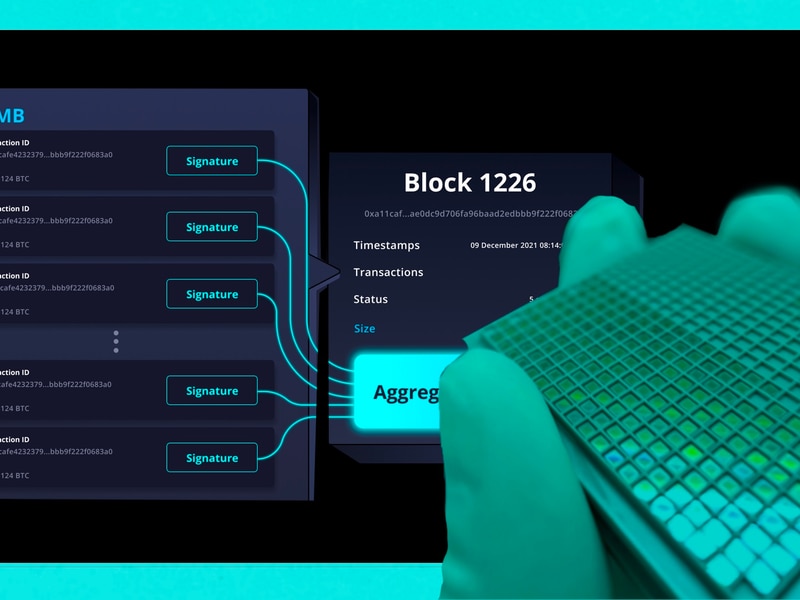

The Grayscale Bitcoin Trust (GBTC), the largest bitcoin ETF by assets, saw a net inflow of new money from investors, according to Farside Investors, the first daily increase since the product debuted in January.

A net $63 million was added on Friday, according to Farside’s tally.

14:12

Why MoonPay and PayPal Partnered to Expand Crypto Adoption in the U.S.

00:55

Friend.Tech’s Native Token Tanks After Airdrop

01:56

Coinbase’s Blowout First Quarter; Could Hong Kong ETFs See $1B AUM by 2024 End?

00:59

BronxCrypto Founder on Major Challenges Faced by Crypto Education

The Grayscale product had been the dominant conventional investment vehicle for those looking to invest in bitcoin (BTC) without directly purchasing the cryptocurrency. But it got competition in January when it was converted into an easier-to-trade ETF at the same time nine rival spot bitcoin ETFs began trading.

GBTC has much higher fees, and investors yanked billions of dollars from it. Its bitcoin holdings have dropped from more than 600,000 bitcoin to around 290,000 bitcoin, according to fund data compiled by CoinDesk.

While the Friday inflow ends the streak of net GBTC withdrawals, BlackRock’s iShares Bitcoin Trust (IBIT) is challenging the fund for the title of biggest bitcoin ETF. GBTC now has $18.1 billion in assets, versus IBIT’s $16.9 billion. IBIT, now in second place, started at zero in January, while GBTC had more than $26 billion.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/316ac93f-4b4a-4379-be0d-fc94b27772c2.png)

Nick Baker is CoinDesk’s deputy editor-in-chief and a Loeb Award winner. His crypto holdings are below CoinDesk’s $1,000 disclosure threshold.

Follow @inkbacker on Twitter

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.