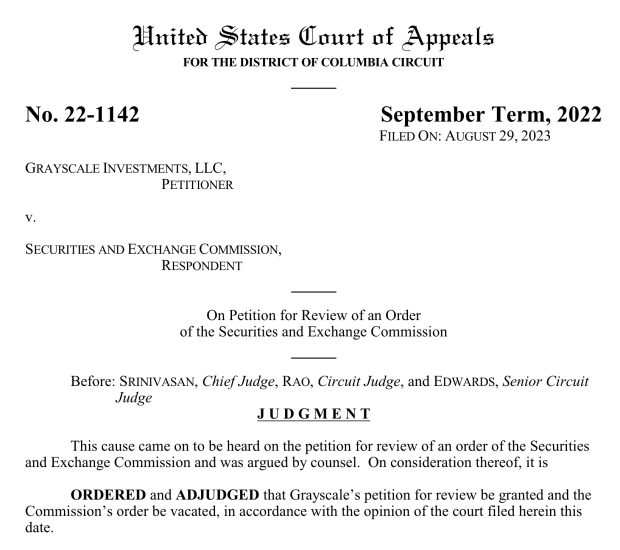

Grayscale Wins Its Lawsuit Against The SEC Over Converting Its Fund To A Spot Bitcoin ETF

Today, it was announced that the DC Circuit court of appeals is vacating SEC’s denial of Grayscale’s $GBTC conversion into a spot Bitcoin ETF.

“We agree,” said Circuit Judge RAO. “The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products. We therefore grant Grayscale’s petition and vacate the order.”

It is important to note that this does not mean GBTC is automatically being converted to a spot Bitcoin ETF, although this victory does bring us one step closer to that reality. The order is being vacated and sent back to the SEC. The SEC now has 45 days to appeal and file for an en banc hearing, which means the case will be heard by all 17 judges on the court instead of just the three that were involved in today’s decision, according to Bloomberg ETF analyst James Seyffart.

“The Commission neither disputed Grayscale’s evidence that the spot and future markets for bitcoin are 99.9% correlated, nor suggested that market inefficiencies or other factors would undermine the correlation…The Commission’s unexplained discounting of the obvious financial and mathematical relationship between the spot and futures markets falls short of the standard for reasoned decision making,” Circuit Judge RAO. continued.

The price of GBTC pumped over 19% on the news and Bitcoin rose above 5%.