Grayscale Says Institutions Invested Record $900M in Crypto Products in Q2

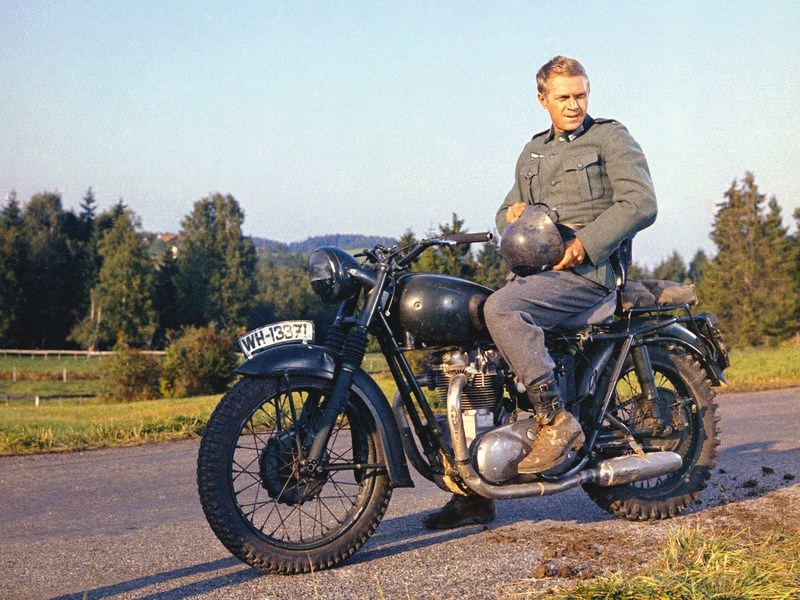

Grayscale Managing Director Michael Sonnenshein. (Credit: CoinDesk archives)

Grayscale has reported its best quarter ever after it raised a total of $906 million for its crypto products in Q2 2020.

- The New York-based fund provider reported two consecutive record quarters Wednesday, with more than $400 million increase in capital inflows quarter-on-quarter.

- Grayscale raised $500 million in Q1 2020 – the previous record.

- Overall, Grayscale raised $1.4 billion in H1 2020 – the first time capital crossed the billion-dollar mark in a six month time frame, it said.

- Grayscale is part of Digital Currency Group, CoinDesk’s parent company.

- The firm creates single asset funds that allow investors to gain exposure to cryptocurrencies in a regulated asset-class.

- This week’s results mean total cumulative inflows into Grayscale’s products since inception has more than doubled to $2.6 billion.

- The vast majority of commits (85%) came from institutional investors in H1 2020; Grayscale said most have started diversifying away from just bitcoin.

- Total capital inflows into altcoin products increased 35% QoQ; it’s up nearly 650% over the 12-month period.

- Inflows into the Ethereum Trust made up 15% across the whole product range in Q2 2020: an all-time high.

- Bitcoin trust inflows came to $751 million in the same quarter; Grayscale successfully registered it with the Securities and Exchange Commission (SEC) in January.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.