Grayscale Confirms Plans to Convert GBTC into a Bitcoin ETF

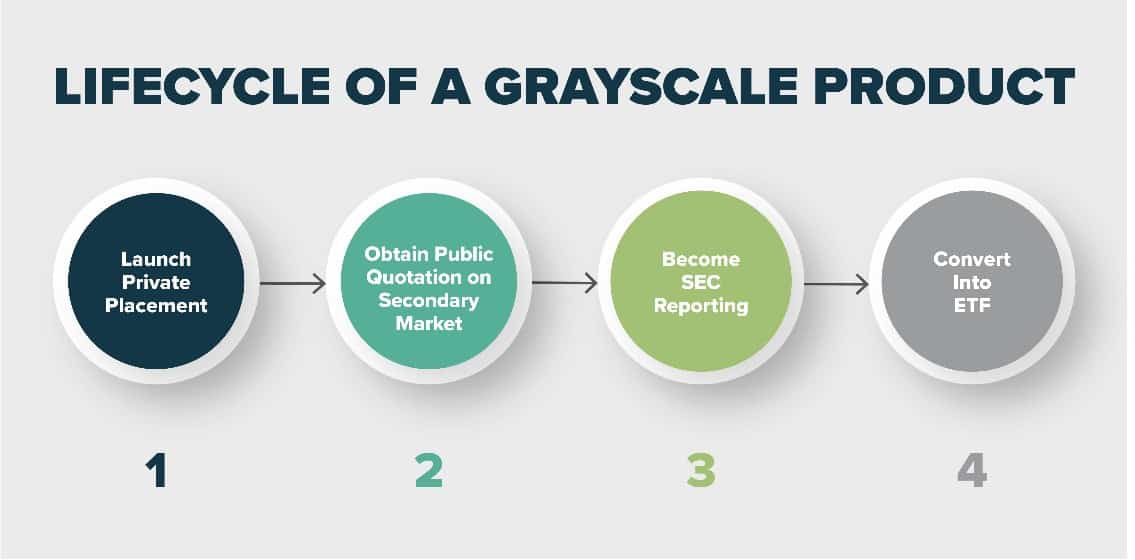

The world’s largest cryptocurrency asset manager, Grayscale, has confirmed its commitment to convert the GBTC trust into a Bitcoin ETF. The company has filed documents with the US Securities and Exchange Commission indicating that it has completed all steps before such a transition.

- Launched in 2013, Grayscale is a digital asset manager enabling institutional and accredited investors to receive exposure to BTC and other cryptocurrencies without worrying about storing and managing the holdings.

- The company has enjoyed the past year or so with a massive increase of its AUM, which is well above $45 billion as of Friday. Just for reference, Grayscale ended 2019 with about $2 billion.

- Naturally, the first launched product was the Grayscale Bitcoin Trust, which also accounts for the majority of the company’s holdings with roughly $39 billion.

- The company has further plans for its most successful trust, according to a recent filing with the SEC. In it, Grayscale asserted: “first and foremost we wish to make clear: we are 100% committed to converting GBTC into an ETF.”

- The asset manager said that its intentions from the start were to complete the transition into an ETF, and it had made the last step a few years ago when GBTC became an SEC-reporting product.

- Grayscale also outlined a massive uptick of demand from current clients and potential customers inquiring whether or not the firm will introduce a Bitcoin ETF. The company made such an attempt several years ago, but the SEC rejected it, as it has done with every other endeavor.

-

“The timing for converting GBTC to an ETF will be driven by the regulatory environment.” – concluded Grayscale’s filing.