Grayscale Bitcoin Trust Hits Record Low Against NAV

Why has the Grayscale Bitcoin Trust hit a record low against net asset value?

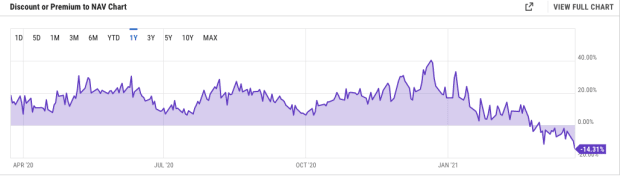

Shares of the Grayscale Bitcoin Trust (GBTC) hit a new record low against net asset value (NAV) this week, touching as low as negative 14.31 percent as bitcoin continues to face downward pressure, with the asset down 8.02 percent on Thursday.

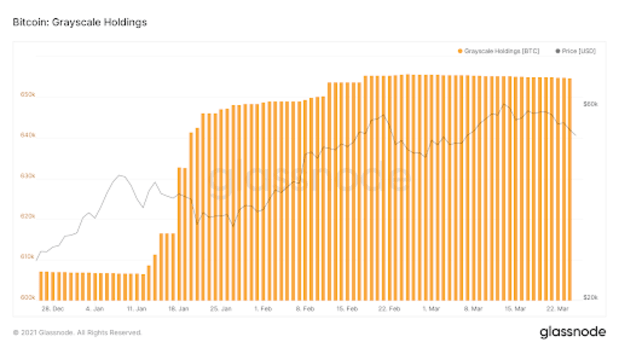

The world’s largest bitcoin fund in terms of assets under management, with 654,850 bitcoin, worth $33.3 billion at the time of writing, first started trading at a negative premium to NAV in late February in a surprising development to investors. While there are assuredly many factors at play, a deeply negative premium can be attributed to various developments in the ecosystem.

Most notable is the introduction of Bitcoin exchange-traded funds (ETFs) in the market, with three having been recently released in Canada, and a large number of applications to launch an ETF in the U.S. hitting the U.S. Securities and Exchange Commission’s (SEC) desk in recent weeks, including investment services giant Fidelity announcing its ETF application on March 24 in a filing with the SEC.

Shares of GBTC come with a built-in 2 percent annual management fee, which has become increasingly unattractive as more institutional investment vehicles are brought to market. Additionally, the Grayscale Bitcoin Trust operates quite differently than an ETF, as it operates as a closed-end fund that trades over the counter. GBTC does not offer redeemability back into bitcoin, acting as a one-way street for supply. New shares of the trust are available to be minted through private purchases by accredited and institutional investors who pass certain income and/or asset thresholds, who are able to buy shares of the trust at NAV, with an agreement that they cannot sell shares on the secondary market for six months.

Until recently, GBTC was one of the only options for institutional investors to gain exposure to bitcoin, with the funds premium reaching as high as 40 percent over the past year.

You can find additional information on the structure of the Grayscale Bitcoin Trust here.

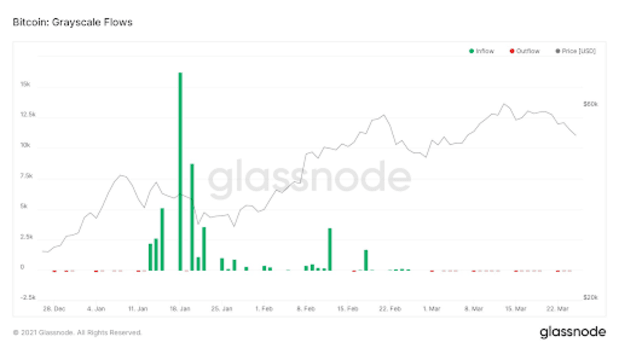

The development of a negative GBTC premium throws a wrench in the popular carry trade of redeeming Grayscale shares at a premium and shorting bitcoin futures. This offered a relatively risk-free yield to investors for some time, while simultaneously acting as a one-way street for locking up bitcoin. Now, with the premium deeply in the negative, the incentive has disappeared to redeem shares of GBTC, and this, unsurprisingly, is what has occurred.

Notably, in what can be seen as an attempt to raise the premium back to positive territory, Digital Currency Group, the parent company of Grayscale, announced that it would be purchasing up to $250 million worth of GBTC shares on March 10.

The GBTC premium and fund structure will be interesting to keep an eye on over the coming months.