Goldman Sachs Sees Fed Delivering First Rate Cut in Q3 2024: Reuters

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Investment banking giant Goldman Sachs brought forward its estimate for the Federal Reserve’s first interest-rate cut to third-quarter 2024 from a previous forecast of the fourth quarter, Reuters reported Monday.

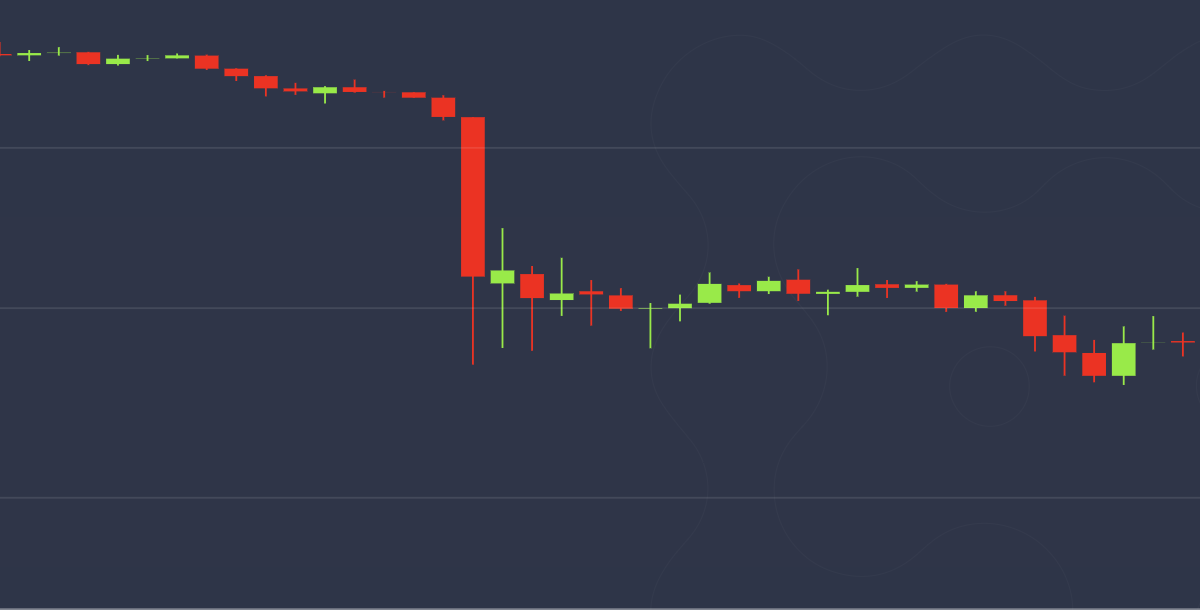

The shift comes as bitcoin (BTC) and the broader crypto market has surged in recent weeks on a bullish cocktail of an expected spot ETF launch in the U.S., the impending Bitcoin mining reward halving and the decline in the 10-year U.S. Treasury yield, the so-called risk-free rate.

The Fed’s benchmark interest rate is currently 5.25% to 5.5%, with traders of the Fed funds futures anticipating a decline to a range starting at 4% by the end of the next year.

When interest rates drop, borrowing becomes cheaper, spurring risk-taking in the economy and financial markets, including cryptocurrencies. The opposite happens when rates rise rapidly, as observed in 2022.

The Fed kicked off its tightening cycle in March 2022 to tame inflation, raising rates from as low as 0%-0.25% with the most recent increase occurring in July. The rapid rise in borrowing costs weighed on risk assets, including cryptocurrencies, last year.

Edited by Sheldon Reback.