Goldman Sachs, FTX CEOs Met to Discuss Possible Collaborations: Report

After years of bashing the cryptocurrency industry, the Wall Street giant now has an entirely different stance with frequent positive comments and new initiatives. The latest example, according to a Financial Times report, comes in the form of a meeting with FTX to discuss a closer relationship.

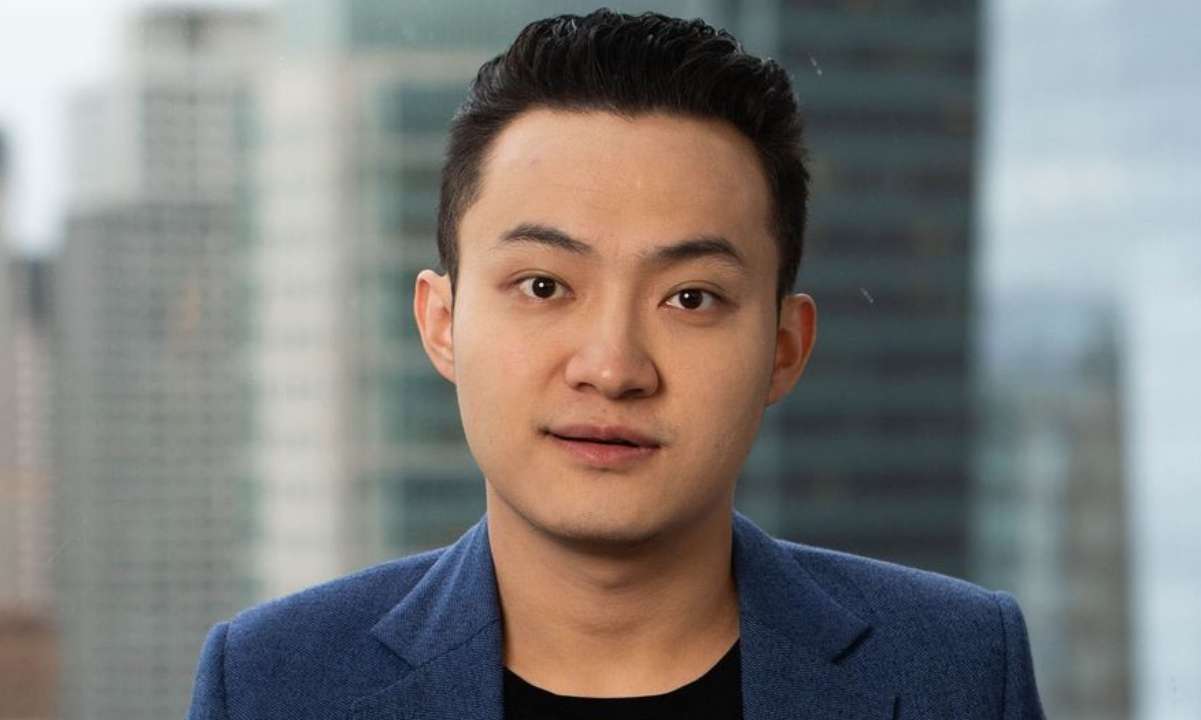

- The FT coverage informed that David Solomon, the bank’s chief executive met with FTX Founder and CEO – Sam Bankman-Fried – last month. The idea was to “discuss forging closer ties between the Wall Street bank” and the rapidly-growing cryptocurrency exchange.

- Citing people familiar with the matter, the report indicated that the two executives were mostly talking about regulations and FTX’s recent application with the US derivatives agency – the Commodity Futures Trading Commission.

- As reported last month, the CFTC extended the deadline for the public comment period for the LedgerX (FTX US) case in which the exchange wanted to receive the green light to offer derivatives products.

- Goldman also reportedly plans to participate in FTX’s future funding rounds. The company has completed several such events in the past year or so, with its total valuation now exceeding $32 billion.

- Additionally, the Wall Street behemoth offered its services to help FTX if the exchange wanted to follow Coinbase’s route and become a publicly-traded company. However, SBF reportedly said his firm is more interested in private funding rounds instead of going public, at least for now.

- Interestingly, SBF made an intriguing comment last year when asked about his company’s expansion plans, suggesting that if FTX becomes big enough, it could buy giants like CME and even Goldman Sachs.

- The giant bank has quite a turbulent relationship with the cryptocurrency industry, being among the most vocal critics until last year before it suddenly did a 180-turn. Since then, Goldman has been an active participant in the growth of the digital asset ecosystem by offering such investment services, working on Coinbase’s direct listing, and predicting a $100K price tag for bitcoin.