Goldman Sachs Adds Bitcoin to its Year-to-Date Returns Report

Goldman Sachs, one of the biggest US banks and former bitcoin critique, has added the primary cryptocurrency to its year-to-date asset returns report. Interestingly, BTC occupies the first spot with over 100% early returns as the next assets are far behind.

Goldman Sachs Adds BTC to Returns Report

Founded in 1869 in New York, Goldman Sachs is a large multinational investment bank, which had a negative stance on the cryptocurrency industry for the majority of the last few years.

However, the bank has apparently started to change its mind, on bitcoin in particular, and the latest evidence came from its Global Investment Research department.

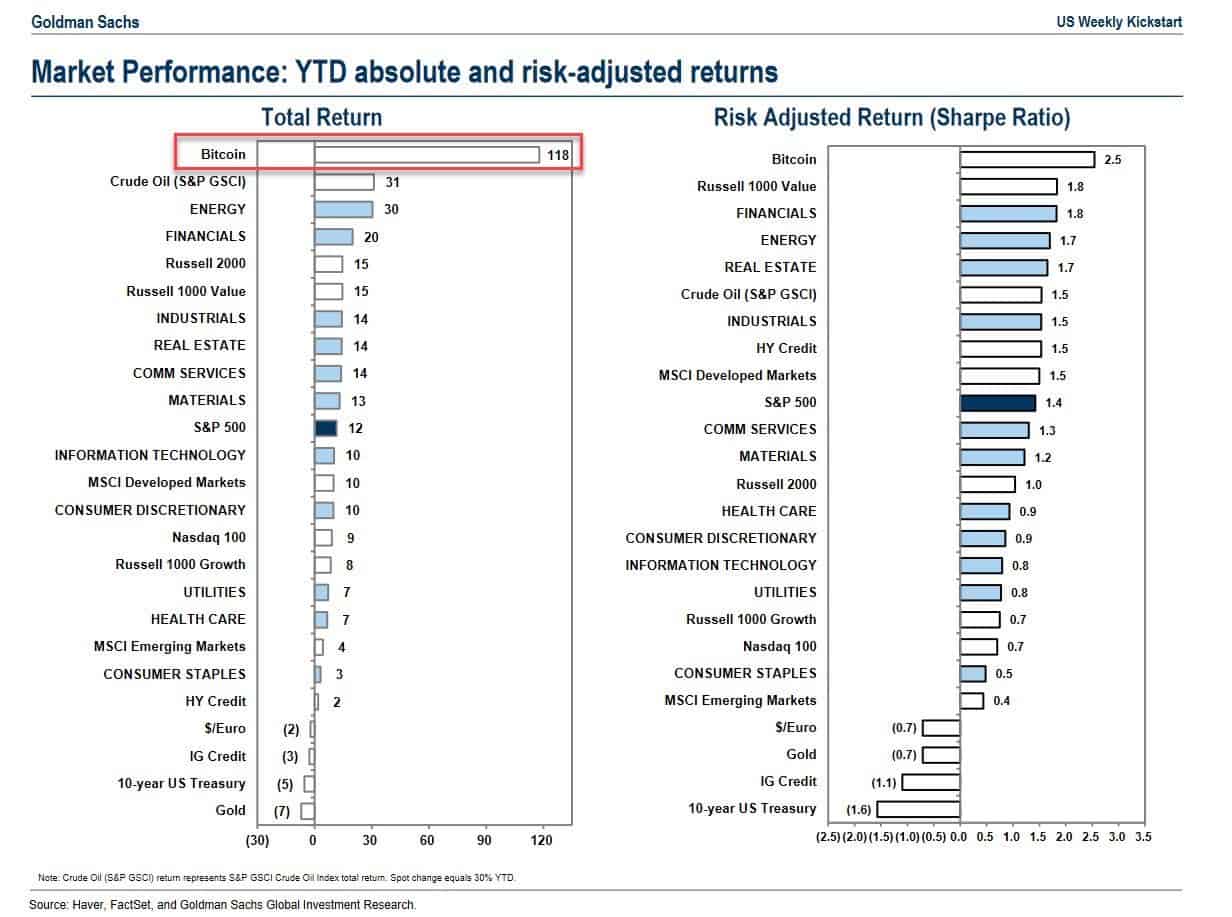

As seen in the above graph, the giant investment bank has included the cryptocurrency in its year-to-date absolute and risk-adjusted returns. Bitcoin leads in both.

The first part shows BTC’s total yearly returns, which, despite yesterday’s market crash, are still above 100%. Crude Oil is next with 31%, while the S&P and Nasdaq 100 are with 12% and 9%, respectively.

When it comes down to the risk-adjusted return, meaning the raw profit taking into account the degree of risk the asset contains, BTC leads again with 2.5, followed by Russel 1000 Value.

Why Is This News Big?

As briefly mentioned above, Goldman was among the most vocal bashers of bitcoin and the entire industry. The bank initially started a crypto trading desk in 2017, halted it a year later, and then restarted it in 2021.

In the meantime, though, Goldman held a conference call asserting that BTC and all digital assets are not an asset class. The bank’s executives were frequently criticizing the cryptocurrency’s infamous volatility and questioning its merits.

However, the trend started to reverse again a few months ago. Goldman led Coinbase’s direct listing, it outlined plans to enable its institutional clients to receive exposure to bitcoin as demand increased, and filed to launch a BTC ETF.

The addition of bitcoin in its YTD asset returns report seems like the latest pro-cryptocurrency endeavor initiated by the bank, signifying its change of heart moment.