GoldenTree Moves $5M of SUSHI, Sparking Fear It’s Exiting

The move comes as Sushi, a decentralized exchange for trading cryptocurrencies on the Ethereum blockchain, faces fresh scrutiny from U.S. regulators. On Tuesday, Sushi’s leader, Head Chef Jared Grey, revealed he and the decentralized autonomous organization were subpoenaed by the U.S. Securities and Exchange Commission. Grey didn’t elaborate on the focus of the apparent investigation but called on the DAO to raise a $3 million legal defense fund.

Related Posts

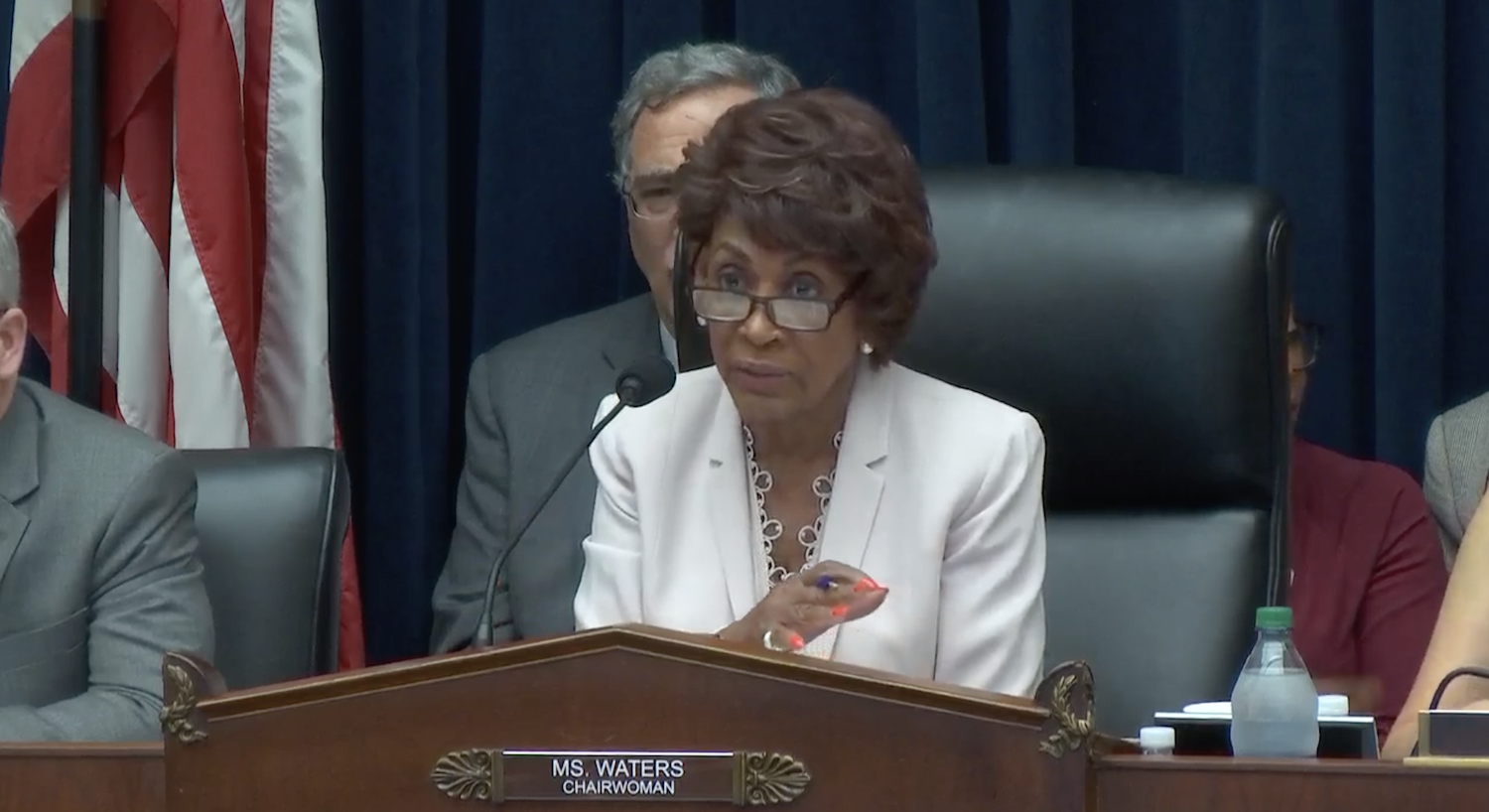

Lawmakers Amp Up Pressure on Facebook to Halt Libra Cryptocurrency Development

news U.S. lawmakers repeatedly pressed Facebook’s top blockchain executive to halt development of the Libra cryptocurrency during a contentious hearing on the project Wednesday. They didn’t get far. David Marcus, the CEO of Facebook’s subsidiary Calibra, reiterated his promise that Libra would not launch until regulators’ concerns were fully addressed. But he stopped short of…

Alibaba’s Ant Financial Backs $10 Million Round for Blockchain Privacy Startup

news QEDIT, a developer of privacy technology for enterprise blockchains, has closed a $10 million Series A round from investors including Ant Financial, the payments affiliate of Chinese e-commerce giant Alibaba. Ant Financial will also be incorporating QEDIT’s zero-knowledge proof (ZKP) tech into its blockchain projects, the companies announced Tuesday. Other high-profile partnerships applying QEDIT’s…

Huobi US Affiliate Launches Institutional Group for OTC Crypto Trading

news The U.S. affiliate of the Huobi Global crypto trading marketplace is courting big-money investors with the introduction of a new institutional team. Announced today, the new group at HBUS will be headed up by Katelyn Mew, a veteran of asset management powerhouse BlackRock and discount brokerage Charles Schwab, and Oren Blonstein, who comes from…

Silvergate Capital 3Q EPS Beats Estimates; Digital Currency Deposits Grew to $11.2B

Silvergate Capital’s 3Q net income rose 12% to $23.5 million, or 88 cents a share, topping the FactSet estimate of 71 cents.Average digital currency deposits grew to $11.2 billion from $9.9 billion in the second quarter.The increase was accompanied by a growth in digital currency customers to 1,305, compared with 1,224 at the end of…

First Mover: Elon Musk’s #bitcoin Bet Pays Off With $270M Gain on First Day

Tesla has forged a path other corporate treasurers might follow into bitcoin. PLUS: Ether hits new record price above $1,800 as CME futures debut.Feb 9, 2021 at 2:44 p.m. UTCUpdated Feb 9, 2021 at 3:29 p.m. UTCFirst Mover: Elon Musk’s #bitcoin Bet Pays Off With $270M Gain on First DayPrice PointIn a run reminiscent of its…

Tencent to Lead Drafting of International Blockchain-Based Invoice Standards

news WeChat parent company and Chinese internet giant Tencent has received the green light to draft blockchain-based invoice standards from China’s tax officials. As reported by Global Times, Tencent’s blockchain invoice project was backed by multiple countries including the U.K., Switzerland, Sweden and Brazil, as well as China’s State Administration of Taxation, at the ITU-T international…

Bitcoin Miner Marathon Digital-Linked Startup Auradine Raises $81M

Brandy covers crypto-related venture capital deals for CoinDesk. Auradine, a Silicon Valley-based provider of web infrastructure solutions, has emerged from stealth and announced an $81 million Series A funding round. The fundraise amount is notable during an extended bear market that has seen a slow down of investments, in even crypto-adjacent companies.Founded in 2022, Auradine…

Trading Bitcoin in Africa Is a Way for Some to Escape Poverty

Learning to trade bitcoin has become a valuable skill set for Africans looking to boost their income.Trading bitcoin carries potential for profit and risk.(PeopleImages/iStock/Getty Images Plus)Jan 21, 2021 at 2:34 p.m. UTCTrading Bitcoin in Africa Is a Way for Some to Escape PovertyFor years, Stephen Aluko lived “hand to mouth” in Nigeria, home to a…