Gold Erases All Yearly Gains After a 7% Decline in 2 Weeks, How Does it Compare to Bitcoin?

Ever since the word investing existed, gold has been among the most popular (if not the most popular) investment tools for wealth preservation. This is because of its unique characteristics like limited supply (scarcity) and lack of central authority behind its creation (kind of). However, its performance on weekly, yearly, and even 10-yearly scales is not all that impressive.

At the same time, BTC is a much newer concept that takes gold’s unique qualities a step further. And, even though it has disadvantages of its own, it has performed much better lately.

Gold’s Price Dumps

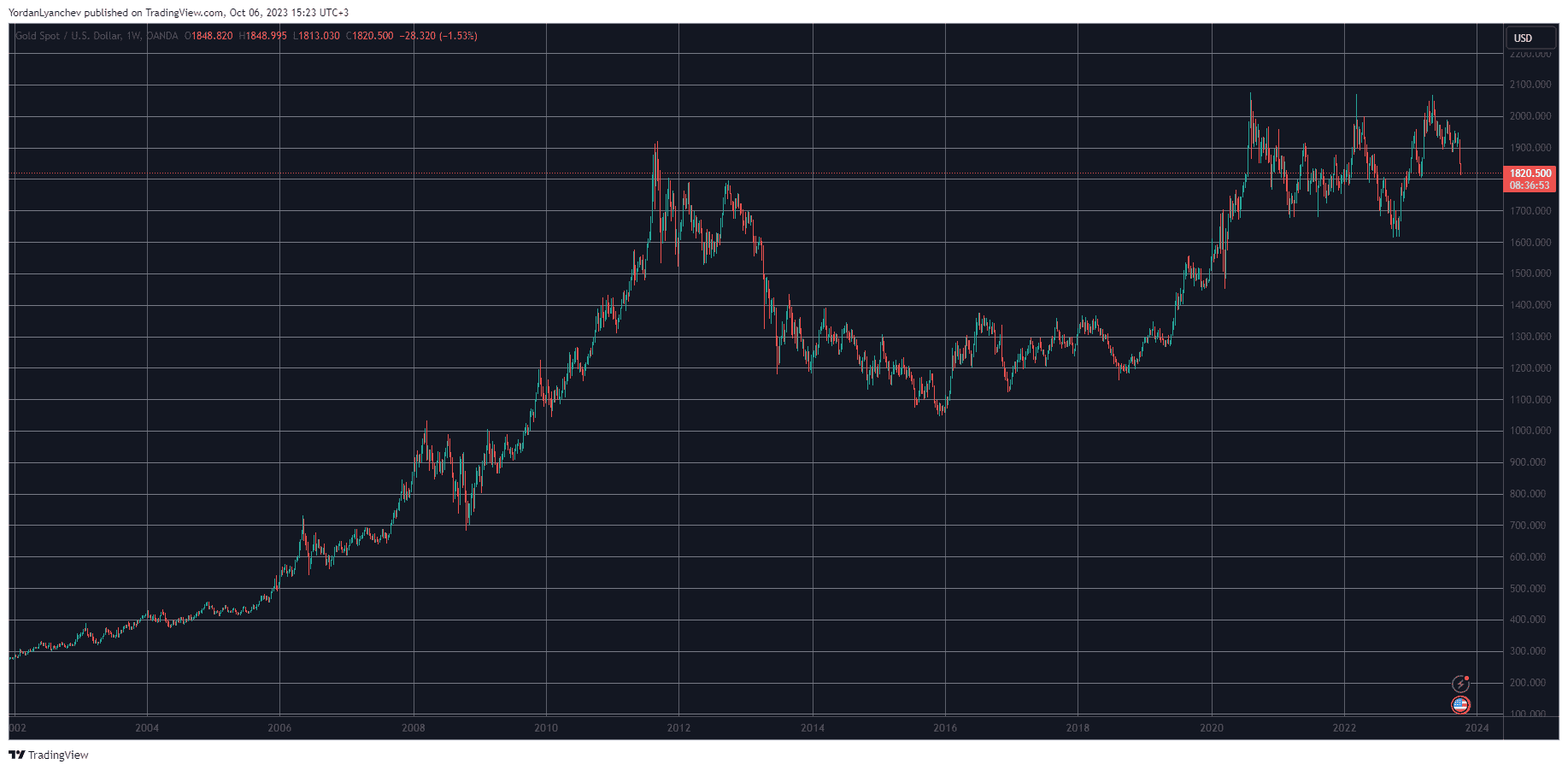

Being a less volatile and risky asset, gold’s price performance has typically blossomed during economic uncertainty. This can be seen during (and mostly after) several previous global financial crises, including the one from 2008. The precious metal soared to new peaks a few years later but never managed to near the coveted $2,000 mark.

The following eight years (2012-2020) were among the most prosperous in terms of global economic growth, which resulted in skyrocketing prices of risky assets, such as stocks and, yes, you guessed it – bitcoin. But more on BTC later.

Within this timeframe, gold disappeared from the vocabulary of investors, and its price dumped from over $1,900 to under $1,100 during its worst days. It went on the offensive by the time the decade was coming to its end, and when COVID-19 surprised the world, it exploded due to the new wave of uncertainty and economic turmoil.

The same thing happened once again when the Russia-Ukraine “special military operation” (also known as war) broke out. The US government shutdown speculations and the country’s inability to pay its own debts resulted in similar developments.

However, the past few weeks have been rather painful for the bullion, which is down by 7% (more than $130). Its price against the dollar, which has been quite solid (against other currencies), is at $1,820 as of Friday’s closing price. This leads to a few compelling conclusions – 1) gold lost all of its yearly gains with its latest price drop, and 2) the metal is currently valued less than it was over a decade ago when it peaked after the 2008 banking crisis.

At the same time, it’s no surprise to anyone that the dollar has lost a massive amount of its purchasing power, especially after the pandemic and following the numerous special relief packages (meaning mindblowing amounts of the greenback being printed and sent out to people for questionable reasons).

As such, the question arises whether gold is still the undisputed leader in terms of safe haven investment assets. Also, is the yellow metal’s performance still related to the US interest rates?

“The whole narrative of holding rates higher for longer is the big reason why people are removing positions from gold as the opportunity cost of holding it has risen,” – said Bart Melek, head of commodity strategies at TD Securities.

What About Bitcoin?

So, gold’s performance against the USD was quite impressive until around 2012, when it peaked at over $1,900, as it did during the previous massive economic crashes. What changed?

Although there could be a number of reasons why gold no longer seems to serve as a safe haven, we would focus on a particular one – the existence of bitcoin. The cryptocurrency was created during that aforementioned 2008 banking crisis, carried a designated message for the billions and trillions of fiat money that was printed back then in its initial code, and also contains numerous of gold’s qualities but also takes them to a whole other level.

While it’s also scarce (but with proven scarcity, unlike gold’s), it also lacks central authority that can inflate the circulating amount for reasons known only to itself. But it’s also censorship-resistant, easy to access, doesn’t discriminate, and it’s digital.

That last part made it especially lucrative during the pandemic when the world shutdown halted gold production and restricted transportation. People were unable to get their hands on physical gold. At the same time, BTC is all digital; transfers take a few minutes and are generally very cheap.

BTC’s price performance was quite spectacular and highly volatile up to 2020 but skyrocketed in the year after the pandemic and shot up from $8,000 to $69,000.

Although 2022 carried an entirely different sentiment, due to the ongoing war, industry crashes, and growing interest rates, the network operates on all cylinders. 2023 has so far been quite positive as well, with BTC trading 65% higher than January 1, unlike the precious metal.

Of course, it would be considered quite arrogant and (perhaps) not true to claim that BTC has outplaced gold as the most preferred hedge against inflation and economic turmoil. Nevertheless, its name should find a place among the noteworthy successors or alternatives of the yellow metal, as many financial gurus and prominent investors have asserted over the past few years.

The post Gold Erases All Yearly Gains After a 7% Decline in 2 Weeks, How Does it Compare to Bitcoin? appeared first on CryptoPotato.