Gold Bug Peter Schiff Says He Wishes He’d Bought Bitcoin in 2010

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

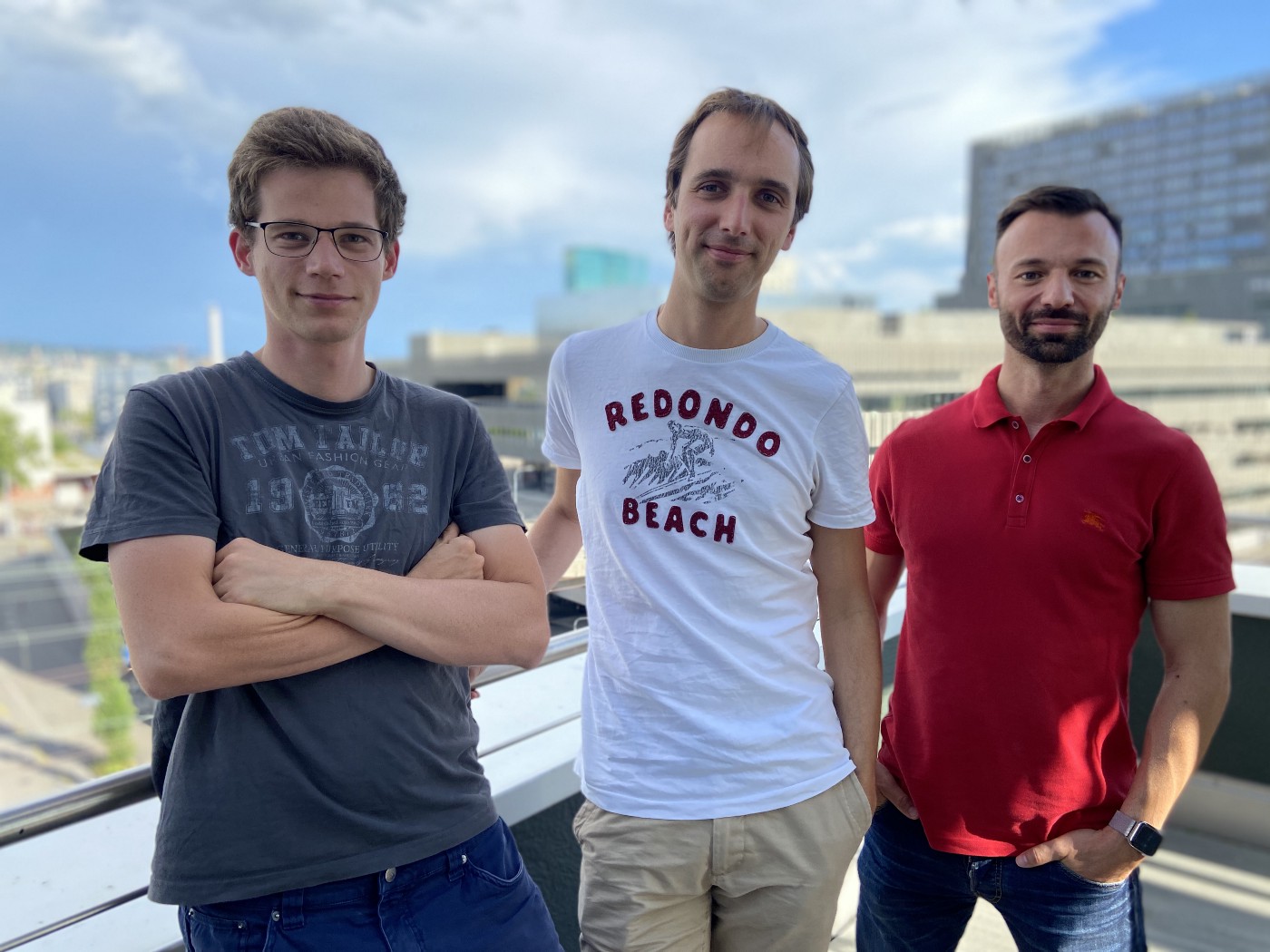

Peter Schiff, a prominent stockbroker and gold investor, rejected the opportunity to invest in bitcoin when it was trading at a few dollars in 2010.

-

Despite his long-standing criticism and comparing bitcoin to “tulip mania 2.0,” Schiff said he would have invested solely for the potential profit, likening it to a gamble rather than a “genius” move.

One of bitcoin’s (BTC) staunchest critics said he wished he’d bought some regardless of his belief in its long-term thesis.

Peter Schiff, a prominent stockbroker and gold investor, recently said he’d looked at bitcoin back in 2010 – when it was valued around a few dollars – but didn’t see the investment value at the time. The largest cryptocurrency is currently trading around $73,000.

Schiff had predicted bitcoin’s decline in a 2014 interview with CoinDesk and likened it to “tulip mania 2.0” in a 2013 CNBC interview. He hasn’t changed his stance since, but wouldn’t have shied away from investing given the potential for profit.

“Do I wish I had made the decision to have thrown $10,000, $50,000, $100,000 into it?” Schiff said on an Impact Theory podcast on Wednesday in a debate with crypto investor Raoul Pal, discussing if bitcoin was going to $1 million or zero. “Sure. I may be worth hundreds of millions assuming I didn’t sell. But again, I don’t know what I would have done had I made that decision.”

Bitcoin has surged over 200% in the past year on multiple catalysts, such as growth in underlying technology and demand from spot exchange-traded funds (ETFs) offered in the U.S. Gold has risen 13% over the past year, data shows, with an estimated market capitalization of $14 trillion.

“I would have bought it just betting on other people being dumb enough to buy it and pay a higher price,” he said, likening a successful bitcoin investment to a gamble rather than a “genius” move.

Edited by Sheldon Reback.