Give Me Self-Custody Or Give Me Death

It feels like this year is going by at the speed of light, doesn’t it? I can hardly believe that it’s already June. Everyone is in vacation mode and ready to relax by the pool and forget the daily grind of work and taking care of a family.

I completely understand the sentiment. Who doesn’t want to stop thinking about wallet-crushing inflation, high interest rates, credit card debt, and the sense that whatever you do you can’t advance in life? It almost feels like this whole system is rigged against you right?

Well, it is, to be honest, but that’s a story for another time. The powers that be who want you fat, happy, and stupid have largely succeeded in that mission. Now that they have succeeded in dumbing down the populace, they literally can do whatever the hell they want and get away with it with impunity.

The thing is their hubris has gotten the best of them. The Federal Reserve and its zero interest rate policy (ZIRP) royally screwed things up to the detriment of the American people and the federal government.

Before the pandemic of 2020, the government had a hard time keeping the inflation rate around its 2 percent benchmark. Certain economic factors such as improved technology, a declining birth rate, baby boomer retirement, and globalization made it where inflation was trending down over time.

The Federal Reserve, in their infinite wisdom and constantly worried about deflation, kept cutting interest rates to spur borrowing and lending in the American economy, which worked for a time until we got to 2008 and the Great Financial Crisis (GFC).

The increased borrowing and lending overheated the housing market and almost took down the global economy, but luckily we had the “mighty” government to step in a fix a problem they helped create. That being said you would think they would have learned their lesson and got their fiscal house in order.

It’s the government, of course not! They did nothing of the sort, what they did do is keep going on their spending binge through the 2020 pandemic. It didn’t matter what political party was in office, the spending kept going up and up.

Did you know that former President Trump added $8.4 trillion to the national debt while he was in office and President Biden is not faring much better with total debt looking to clock in around the $7.9-$8 trillion mark? Needless to say, the government is broke and is living on borrowed time.

Whoever “wins” the election will be the captain of a sinking ship. Medicare and Social Security are broken and completely unaffordable but politicians don’t dare tell the millions of Americans who “paid” into their entire working lives that there is no pot of money set aside for them and that it was just an elaborate tax scheme to fund the government.

You are NOT entitled to receive social security “benefits”, I hope you know that by now. If the government told you f**k you, you ain’t getting Social Security or Medicare, there isn’t a damn thing you could do about it. There are no lawsuits that you could file to compel the government to give you your money back or elect the “right” congressman to fix things. Once the government taxes your paycheck, that money is GONE forever.

You can’t trust the government to keep its end of the bargain or not to debase the currency and destroy your quality of life. With a government like this, why would you trust them with anything? Self-custody of assets is going to determine the winners and losers over the next 5-10 years.

Storm Clouds Gathering

I don’t know about you but I have this unsettling feeling that we are on the precipice of something major. It is going to be a paradigm shift for the whole world. If you look out over the horizon you can see all the pieces falling into place. Just take a look at what is going on:

The United States government is $34 trillion in debt with no end in sight.

Israel/Gaza War

Israel bombing the Iranian military in Syria

BRICS expansion and de-dollarization ongoing

China/Taiwan

Russia/Ukraine War

Global birthrate under replacement levels

All across the globe there is open hostility or simmering tensions about to blow out in the open. I’m not sure if this is how the world felt pre-WW2 but it sure feels like the world is coming apart at the seams. With all this going on, how can you trust the current dollar-based system to protect your hard-earned wealth?

Nothing New Under The Sun

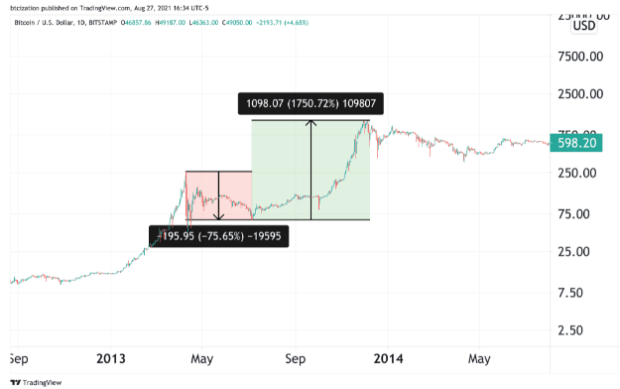

If you have large amounts of dollars in the bank, your wealth is at risk. The banks can confiscate or severely restrict your access to your money, especially during a bank run or some other unforeseen crisis. This is exactly what happened in 2013 during the Eurozone crisis.

During this time Cyprus’ two largest banks were in trouble and need of a bailout from the European Union. The Cypriot government was desperate and the EU knew it, so in classic mob fashion, they insisted on the bank conducting a bail-in using customer funds!!

It doesn’t get any worse than this people. According to a 2018 survey, 55 percent of households who were over the $100k threshold in deposits experienced direct financial loss, and 28 percent experienced a bail-in of deposits.

If you think it can’t happen to you, think again. I bet the Cypriots thought it couldn’t happen to them yet it did. Now is not the time to be complacent and think that everything is fine. If you are a Bitcoiner you understand the world we live in right now.

This is why self-custody of your assets, principally Bitcoin is a must if you want to survive the economic armageddon with your wealth intact.

Self Custody Is The Best Tool For Economic Freedom

Satoshi created Bitcoin and gave us the monetary policy that we need to change the trajectory of humanity from endless fiat wars and a dystopian surveillance state to a bright orange future where human potential can flourish.

In addition to creating a just and fair monetary system, Satoshi gave us the ability to self-custody our wealth without the need for a middleman such as a bank. A simple Bitcoin wallet address and your private key are all you need to secure your wealth from confiscation by a malicious third party. This is truly revolutionary, I mean this is a true 1776 moment in history that was fired back on Jan 3, 2009.

Self-custody gives you the ability to move across borders with your wealth and start over in a new place if push comes to shove. You can’t do that with gold, you can’t do that with silver, you can’t do that with your 401k or the brand new shiny Bitcoin ETFs.

Not your keys, not your coin is the mantra that should be drilled into the head of every single new person coming into Bitcoin. Trusting a custodian to hodl your Bitcoin wealth is just as risky as keeping money in the bank.

There is so much educational material and Bitcoiners willing to help people new to Bitcoin that quite frankly it is unacceptable to have anyone holding any amount of Bitcoin on an exchange. If a majority of Bitcoin holders are keeping their coins on an exchange or purchasing a Bitcoin ETF instead of the real deal, what are we even doing here? It’s self-custody or bust. This is the mission at hand. Are you ready anon?

This is a guest post by Robert Hall. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.