Genesis Sues Gemini To Recover “Preferential Transfers” Worth $689m

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Crypto lender Genesis Global Capital has sued cryptocurrency exchange Gemini Trust, its former business partner, to recover more than $689 million, according to a court filing late on Tuesday.

It alleges that Gemini made preferential transfers of the “aggregate gross amount of no less than approximately $689,302,000” from Genesis at the expense of other creditors and asked the court to “correct this unfairness.”

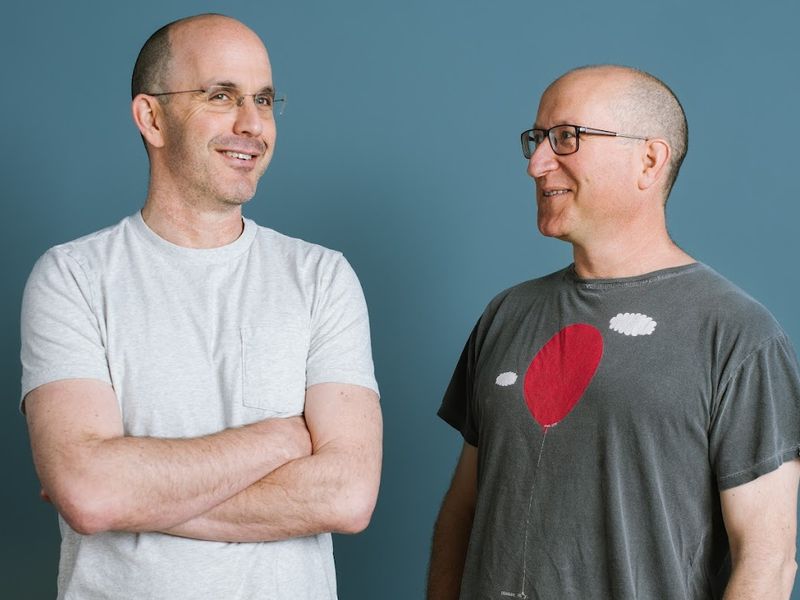

Genesis and Gemini have been embattled in a public and legal feud ever since the collapse of FTX. Genesis filed for bankruptcy in January. Its parent company, Digital Currency Group (DCG), was sued by Gemini in July over allegations that DCG then described as “defamatory” and a “publicity stunt.” In September, Genesis sued its parent company, DCG, seeking the repayment of multiple loans worth over $600 million. And then, in October, Gemini sued Genesis over 60 million shares of the Grayscale Bitcoin Trust (GBTC), valued at around $1.6 billion. Gemini’s co-founders are the Winklevoss twins, Tyler & Cameron.

The saga has seen enforcement action from U.S. authorities, too. In January, days before Genesis filed for bankruptcy, the U.S. Securities and Exchange Commission (SEC) alleged Genesis and Gemini sold unregistered securities. Last month, New York Attorney General Letitia James filed a lawsuit against DCG, Genesis and Gemini for allegedly defrauding more than 230,000 investors, including at least 29,000 New Yorkers, of more than $1 billion.

The filing alleges that as market turmoil caused by the collapse of LUNA and TerraUSD and digital asset hedge fund Three Arrows Capital unfolded, Gemini made “unprecedented withdrawals” before the bankruptcy filing, contributing to a “run on the bank.” During a ninety day period known as the preference period, Gemini demanded repayment of prior loans made to Genesis. These transfers were “avoidable” and upon “information and belief” that Genesis was “insolvent.”

Gemini didn’t immediately respond to a CoinDesk request for comment.

Edited by Omkar Godbole.