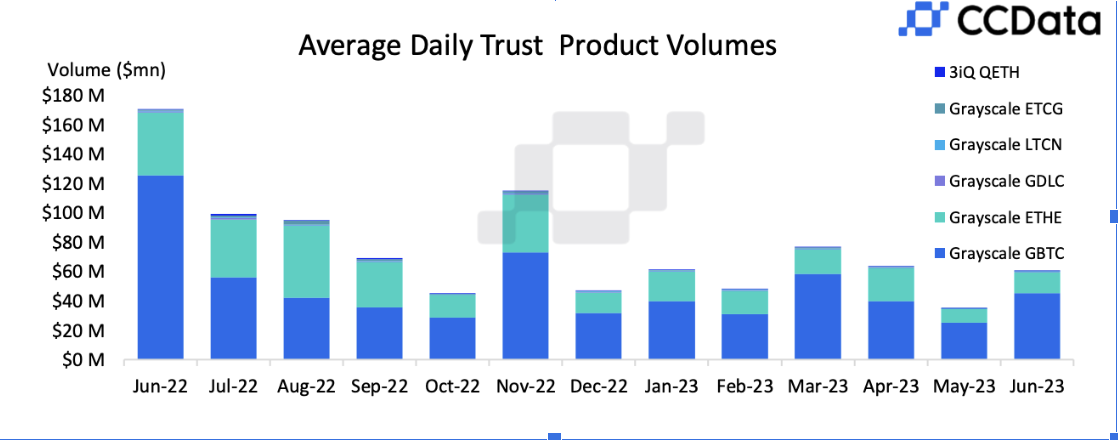

GBTC Volume Increases 79% in June Amid TradFi ETF Applications

The volume of Grayscale’s Bitcoin Trust product, GBTC, increased almost 80% in June, amid asset manager BlackRock’s application to the U.S. Securities and Exchange Commission (SEC) for a spot bitcoin exchange-traded-fund (ETF) and similar filings by two other large financial services firms.

The trust’s trading volume increased to $45 million in June, maintaining its position as the industry’s most traded trust product, accounting for 74% of the volumes, according to CCData.

This comes as multiple high-profile institutions have filed for ETFs in June, including Invesco and WisdomTree, along with BlackRock.

“The surge in GBTC’s volumes and market share aligns with the growing positive sentiment towards the underlying asset,” CCData said.

Compared with Grayscale’s ETHE trust, GBTC’s volume significantly outperformed in trading volume. Since September, GBTC’s trading volume rose from $35.6 million to $45 million in June 2023, capturing 74% of the total trading volume for trust products, compared to 50.9% in September. ETHE’s volumes declined from $31 million in September to $14.4 million in June 2023, and from 44.4% to 23.6% market share.

GBTC also witnessed its share price surge to a one-year high after a report about investment asset manager Fidelity Investments preparing to follow BlackRock’s application for a spot bitcoin ETF with its own.

The discount on the GBTC’s share price relative to its net asset value – a widely followed metric in the digital asset space – also closed below 30% on Tuesday, a level not seen since July 2022.

Edited by James Rubin.