Galaxy Plans to Raise $100M for Crypto Venture Fund

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Galaxy Digital’s venture team has long invested its own money in crypto companies. Now, it’s planning to do that with outside investors’ capital, too.

The crypto investments giant is putting together a $100 million fund that will invest in early-stage crypto companies, according to an investor email shared with CoinDesk. Galaxy moved its venture capital franchise into its asset management business in 2023.

00:57

Bringing Real World Assets on Chain Makes Them ‘More Productive,’ Securitize CEO Says

02:25

Bitcoin Hovers Near $65.5K; Cross-Chain Bridge Wormhole Debuts at $3B Valuation

01:07

Bitcoin ETF Trading Volumes Tripled in March on Record-High BTC Price

00:53

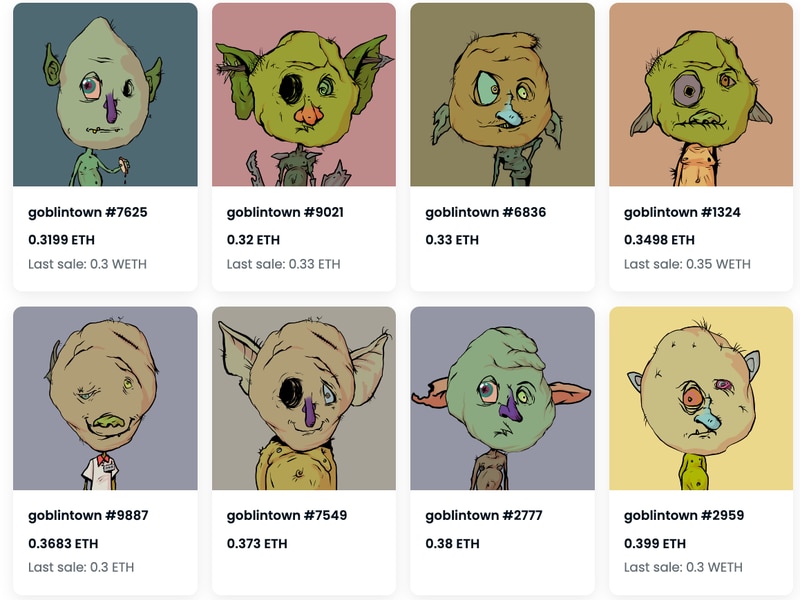

Called Galaxy Ventures Fund I, LP, the fund aims to invest in as many as 30 startups over the next three years, with checks starting at $1 million. It will target financial applications, software infrastructure and protocols building in crypto, the email said.

Galaxy is already a prolific investor in crypto companies; according to the email, it invested $200 million into more than 100 projects over the past six years. While Galaxy’s Interactive team has taken outside capital previously, this is a first for the venture team.

The new fund “will continue the success of our proprietary balance sheet investing but through a direct, institutional-grade fund,” the email said.

Correction: Galaxy has previously taken outside capital through its Interactive division.

Edited by Nikhilesh De.