Fundstrat Predicts Bitcoin Could Hit $500k Within Five Years

Market research boutique Fundstrat envisions Bitcoin (BTC) reaching $500,000 per coin within the next five years – in large part due to expected Bitcoin spot ETF approvals.

“I think in five years, something around half a million would be potentially achievable,” said Fundstrat’s Tom Lee in an interview with CNBC on Wednesday.

How Meaningful Is A Bitcoin ETF?

Lee stood by his prior predictions that Bitcoin could reach above $100,000 and possibly tap $150,000 within 2024 alone.

“There’s a finite supply, and now we have a potentially huge increase in demand with a spot Bitcoin approval,” he explained.

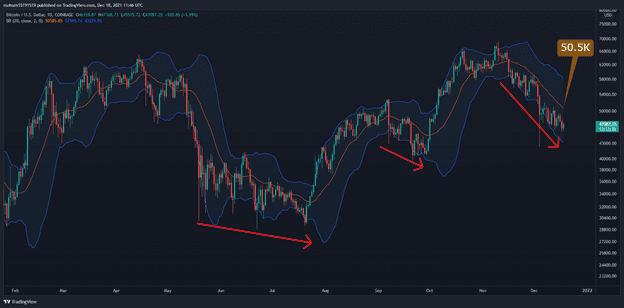

Bitcoin underwent major volatility on Tuesday after a fake SEC tweet claiming spot ETFs were approved sent the asset to a new multi-year high of $47,800.

Industry figureheads have predicted for months that ETF approvals would unlock vast pools of institutional capital previously incapable of purchasing spot Bitcoin.

In November, ex-NYSE president Tom Farley – who now spearheads his own crypto exchange – predicted that money will “flood” into Bitcoin after ETF approvals.

Impending Capital Inflows To Bitcoin

According to Lee, approvals will likely establish a generational divide in terms of how investors gain exposure to Bitcoin.

While younger investors may prefer to own the coins in their actual wallets, those over age 50 – who control 76% of all wealth in America ($120 trillion) – may stick to public markets and proxies.

“There’s a generation of folks who would rather allocate through their 401(k), or through public markets, or liquid assets,” Lee added.

The analyst previously called for $180,000 BTC by the April 2024 “halving” back in June, due to expectations that an ETF might have been approved by Q3 of last year.

Lee isn’t alone in his bullish projections. Bernstein analysts wrote in November that Bitcoin would likely reach $150,000 by mid-2025 based on its theoretical four-year-cycle.

On Monday, Standard Chartered published a note calling for Bitcoin to reach $200,000 by the end of 2025, with ETFs soaking in $50 billion to $100 billion by the end of this year.

Meanwhile, April’s halving event is widely expected to trigger a supply crunch for new coins, coupling a supply shock with the demand shock brought about by ETFs.

The post Fundstrat Predicts Bitcoin Could Hit $500k Within Five Years appeared first on CryptoPotato.