Fun Facts About The Halving

The halving is a pivotal moment in Bitcoin’s monetary policy every four years, having massive implications for the economic viability of individual mining operations, the overall market dynamics of the asset, and generally the block alcohol content present in Bitcoiners’ bloodstreams.

Everyone celebrates the halving each cycle as a moment where Bitcoin becomes a more scarce asset, an event where historically the price has skyrocketed in reaction to the change in the issuance schedule and everyone waits with bated breath for history to repeat itself.

I’m sure everyone is all too familiar with these dynamics, so today as we all sit around waiting for block 840,000 to hit, let’s look at a few lesser known facts about Bitcoin’s supply schedule and halvings:

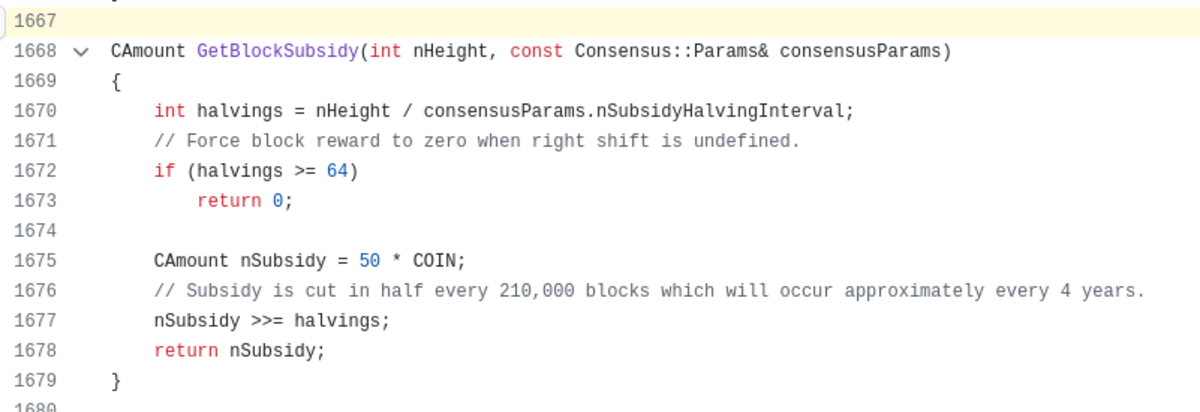

- The total supply of Bitcoin is actually not present anywhere in the codebase. The code simply specifies a starting reward of 50 BTC per block and modifies that value each halving by cutting it in half.

- The total supply of Bitcoin is actually not 21 million coins. Because of how the code in Bitcoin actually works, simply cutting the supply in half every halving, there will only ever be 20999999.97690 BTC in circulation by the time the coinbase subsidy drops to 0 satoshis.

- The supply, due to a quirk in how the programming language (C++) that Bitcoin is written in, was not capped at all originally. In 2214 the entire supply would have started issuing again, resetting the block reward back to 50 BTC per block and going through the issuance of another 21 million coins again. The BIP is written up in a joking manner, but this was corrected by BIP 42 in 2014.

- The halving supply curve in combination with the total supply has an interesting property. During the first subsidy period of 50 BTC coinbase rewards, 50% of the supply entered circulation. In the next halving period of 25 BTC rewards, 25% of the supply entered circulation. Each halving the value of the coinbase reward is the percentage of the total supply that enters circulation.

- During the first halving when the block reward decreased from 50 BTC per block to 25 BTC, a group of miners altered their Bitcoin clients and attempted to continue mining on a chain where the block subsidy remained 50 BTC after the halving.

A lot of less technical people, or newer people, in this space probably weren’t aware of most of these little factoids. Interesting little tidbits about things tend to fade off into the historical memory and disappear. If we do wind up seeing a reorg this halving over the Epic sat in block 840,000, maybe in 15-20 years most people using Bitcoin then similarly won’t remember or know such an event occurred back in 2024.

If you are lucky enough to be around now to see these little moments in history, cherish the experience. They’re once in a lifetime things you can look back on, and probably use to annoy people around you despite their lack of caring.

Happy Halving everyone.