Fujitsu interested in crypto trading services, trademark application reveals

The brand wants to offer financial services, including accepting deposits, financing loans, financial management and the exchange of crypto assets.

244 Total views

20 Total shares

Own this piece of history

Collect this article as an NFT

Japanese tech giant Fujitsu filed a trademark application with the United States Patent and Trademark Office (USPTO), revealing its intent to offer brokerage services for cryptocurrency trading, among other crypto and non-crypto financial facilities.

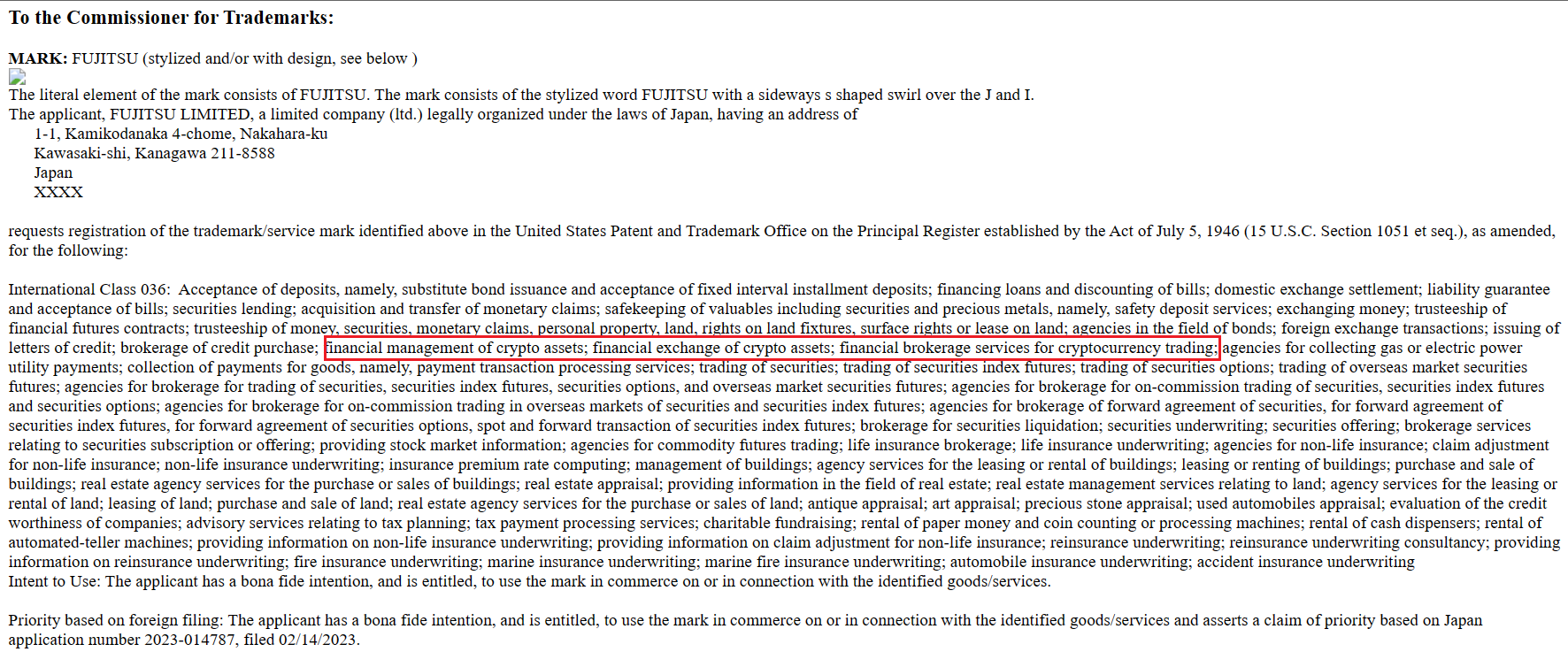

Fujitsu’s trademark application aims to register a new mark which “consists of the stylized word FUJITSU with a sideways s-shaped swirl over the J and I,” according to the official document filed on March 16. The branding is dedicated to offering financial services, including accepting deposits, financing loans, financial management and the exchange of crypto assets.

The image above represents the updated logo Fujitsu intends to trademark for the services. In addition, the snippet below provides an overview of the services Fujitsu disclosed with the USPTO, along with the trademark request.

Fujitsu’s growing interest in Web3 became evident when it launched a Web3 acceleration platform for startups and partner companies in February. The platform aims to support the creation of a diverse ecosystem of Web3 applications across a range of use cases, such as digital content rights management, business transactions, contracts and processes.

Related: Japanese prime minister says DAOs and NFTs help support government’s ‘Cool Japan’ strategy

At the beginning of 2023, financial regulators in Japan urged global regulators to introduce stricter banking rules for the crypto sector.

「当社におけるお客様の資産の管理状況等について(1月16日時点)」お知らせを掲載致しました。こちらをご確認ください。https://t.co/Y9D2RQAsgB

— FTX Japan (@FTX_JP) January 16, 2023

Deputy director general of the Financial Services Agency’s Strategy Development and Management Bureau, Mamoru Yanase, acknowledged that the problem wasn’t with crypto. “What’s brought about the latest scandal isn’t crypto technology itself,” he said, adding that the blame lay with “loose governance, lax internal controls, and the absence of regulation and supervision.”

Magazine: Samsung’s Bitcoin ETF, $700M bust, Coinbase exits Japan: Asia Express