FTX News Causes Fear as Green Light Given to Liquidate $3.4b Digital Assets, But New Cryptocurrency Bitcoin BSC Still Raises $2 Million

In a significant development, the bankrupt FTX exchange has officially been given the green light to liquidate its crypto assets worth over $3.4 billion.

The exchange has large holdings in altcoin giants like Solana, Ethereum, and Aptos – putting traders on edge as they anticipate another crash.

Despite this, the FTX exchange has smaller holdings in Bitcoin, leading investors to flock to safe havens with no ties to FTX, such as Bitcoin BSC (BTCBSC), which raised $2 million over the last ten days during this uncertain period.

Crypto Crash Incoming? FTX Given Green Light to Liquidate Assets

FTX has officially been given the court approval to sell or stake all of its assets from the U.S. Bankruptcy Court for the District of Delaware this week.

Delivered by Judge John Dorsey, the court approved FTX exchange to sell its crypto assets worth $3.4 billion for the benefit of the estates and creditors.

The ruling allows FTX to sell up to $100 million in cryptocurrency weekly and enter into hedging and staking agreements to enable Debtors to earn a passive income on idle assets.

Galaxy Digital will handle all asset sales.

The FTX news is starting to inject fear of another crypto crash as the exchange holds extensive holdings in popular cryptocurrencies like Solana (SOL), Bitcoin (BTC), and Ethereum (ETH).

The following chart from the court filing breaks down the exchange’s holdings;

The most significant fear concerns Solana (SOL), as the exchange holds $1.16 billion worth of the asset. It also holds $192 million of Ethereum (ETH) and $137 million of Aptos (APT).

Are Bitcoin and Its Derivatives Safe Havens Right Now?

With the uncertainty looming in the market, investors suggest that Bitcoin and its derivatives can provide safe havens during the turbulence.

With Solana (SOL) and Aptos (APT) shrinking by 4% and 6.5% respectively, Bitcoin (BTC) is holding strong with a 1.5% rise.

Although FTX exchange owns $560 million in bitcoin, the asset’s sale is unlikely to cause a crash in the number one-ranked cryptocurrency due to its $520 billion market cap.

In addition, investors are flocking to new cryptocurrencies with zero FTX holdings exposure.

In particular, Bitcoin BSC (BTCBSC) is gaining momentum during the FUD as it raised $2 million over the past ten days, demonstrating the building hype behind the project.

Investors Flock to New Cryptocurrency Bitcoin BSC As It Raises $2 Million in 10 Days.

Bitcoin BSC is quickly gaining traction after raising $2 million in ten days.

The project introduces an intuitive stake-to-earn system expected to ease the selling pressure on the token following the launch and foster long-term participation from holders.

The total supply for BTCBSC mirrors the 21 million $BTC supply, with the presale selling 6.125 BTCBSC in two phases for $0.99.

The presale phases mimic the early days of Bitcoin when there were 6.125 million $BTC in circulation for $1 in April 2011.

Investors are rushing to the presale as it provides the opportunity to get positioned in an upgraded version of Bitcoin at $0.99.

The staking mechanism releases BTCBSC tokens in line with the original Bitcoin block rewards schedule.

Those staking BTCBSC earn a percentage of the rewards through the accessible PoS consensus mechanism, with the more BTCBSC staked resulting in a higher share of the rewards.

The staking concept is expected to cause a supply shock on the open market, as most of the total supply will be locked in the staking contract.

For example, 14.455 million BTCBSC will be locked in the staking contract to provide rewards for 120 years – that’s 69% of the total supply.

In addition, most presale buyers are locking their tokens into the already launched staking pool.

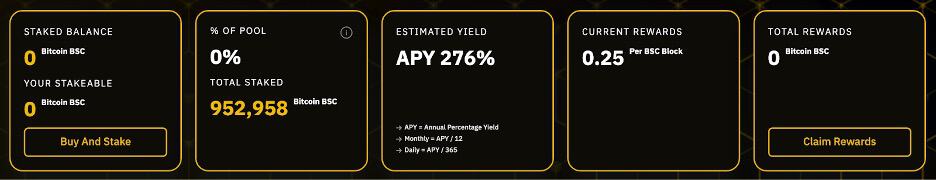

According to the stats, almost 1 million BTCBSC have already been staked, providing an impressive 270% APY. That’s around 50% of the purchased presale tokens staked;

As a result, there will be a shortage of BTCBSC tokens on the market to be purchased by newcomers following the presale, forcing them to enter at higher prices.

The project is gaining industry-wide attention after being featured on Cointelegraph, CoinMarketCap, Yahoo Finance, and thirty other media outlets.

After raising $2 million in just ten days, it’s quickly becoming one of the most hyped tokens this month, with investors intrigued by its long-term prospects as the FOMO builds.

The presale isn’t expected to last more than a week at the current fundraising rate.

Join the community through its growing Telegram channel and stay updated through Twitter.

Visit the Bitcoin BSC Presale

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post FTX News Causes Fear as Green Light Given to Liquidate $3.4b Digital Assets, But New Cryptocurrency Bitcoin BSC Still Raises $2 Million appeared first on CryptoPotato.