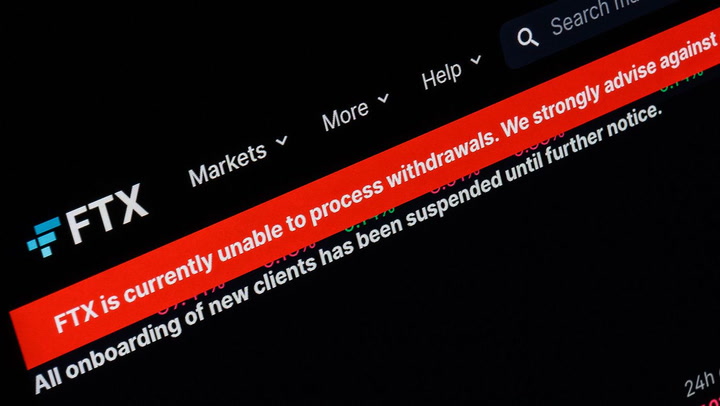

FTX Dotcom Creditors Vote Massively in Favor of Reorganizing Plan

-

Over 94% of so-called FTX Dotcom customers voted to accept the reorganization plan.

-

Nearly all creditor classes voted in favor of the plan.

-

Two creditor classes did not return ballots and were presumed to accept.

02:26

DCG Reaches In-Principle Deal With Genesis Creditors

02:06

Crypto Custodian Prime Trust Files for Bankruptcy

04:58

Celsius Can Start Converting Altcoins to Bitcoin, Ether as of July 1, Judge Says

05:48

FTX’s Bankruptcy Fees on Track to Be ‘Very Expensive’, Court Examiner Says

A plan to reorganize bankrupt crypto exchange stalwart FTX has gained support from 94% of creditors who were clients of the FTX.com offshore exchange, the so-called Dotcom creditors, results of a vote from restructuring agent Kroll show.

The plan promises to return 118% of claims in cash to most creditors, who represent about $6.83 billion in claims by value. Two classes of creditors did not return ballots and are presumed to accept the plan, Kroll said.

With creditor approval secured, the next step is for the bankruptcy court to confirm the reorganization plan. A hearing is set for Oct. 7. Potential challenges remain, however, including possible objections from the U.S. Securities and Exchange Commission regarding the use of stablecoins for repayments, as previously reported.

Edited by Sheldon Reback.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Follow @shauryamalwa on Twitter