FTX CEO’s Legal Billings Continue to Hint at ‘2.0 Reboot’

The new CEO of FTX, John Ray III, appointed to manage the disgraced exchange’s bankruptcy process, hinted in January that the exchange could be rebooted.

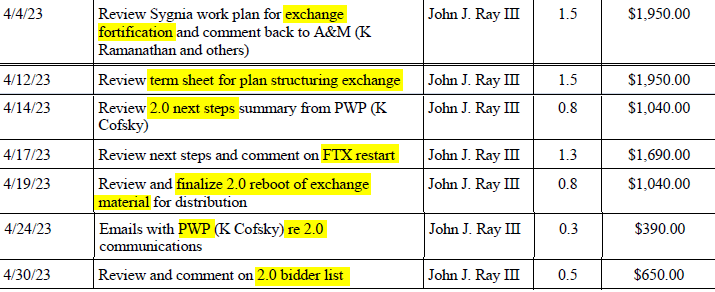

Now, new items on his latest billing report suggest there is work underway to do just that.

Filings show that Ray spent 6.7 hours on items related to “2.0” which is thought to mean FTX 2.0, a reboot of the exchange.

To date, there is no evidence, aside from hypothetical statements, that there is a concrete plan to restart the exchange aside from internal sketches, though Ray has not ruled it out entirely.

“Everything is on the table,” Ray told the Journal in January. “If there is a path forward on that, then we will not only explore that, we’ll do it.”

In April, Andy Dietderich, FTX’s lead attorney, suggested that the cryptocurrency exchange may potentially restart operations, an action that would require significant capital and might offer customers interest in the future exchange, though he stressed that this is one of many possibilities and decisions are far from final.

VC firm Tribe Capital has reportedly expressed interest in leading a funding round to restart the exchange.

However, industry insiders have casted doubts on the viability of such a plan due to persistent technical deficiencies, notably high latency, and software bugs, that plagued FTX from its inception and played a part in its financial collapse in 2022.

With all the work that would be required to bring fix FTX’s trading engine and other bugs, one could simply build a new exchange from the ground up – minus the baggage associated with the name.

FTX’s former token FTT is up 12% on the news, according to CoinGecko data. Should FTX be restarted, it’s unlikely that FTT would play much of a role as the Securities and Exchange Commission considers it a security.