FTX Bankruptcy Claims Soar in Value in Over-the-Counter Markets as Estate Recovers $7.3B

-

The expected payout to FTX creditors has more than tripled this year after a successful asset recovery.

-

FTX marshaling over $7 billion of assets, its valuable stake in Amazon-backed AI-startup Anthropic and the potential restart of the exchange contributed, Matrixport said.

-

The optimism about improving recovery pushed the bankruptcy claims market into a frenzy.

The crypto exchange FTX’s bankruptcy has been characterized as one of the messiest in U.S. history. Legal fees in the bankruptcy case have already topped $200 million. Founder CEO Sam Bankman-Fried’s criminal trial is scheduled to get under way next week.

But in over-the-counter markets where investors trade bankruptcy claims, the level of expected payouts for FTX creditors has more than tripled this year – reflecting success in the estate’s efforts to recover billions of dollars of assets.

According to data gathered by Matrixport, a crypto services provider that is tracking the market, the expected payout for creditor claims against FTX has surged to an average of 37 cents on the dollar, its highest since the bankruptcy filing in late 2022, and up from just over 10 cents at the start of 2023.

“This development is promising news for all FTX creditors,” Matrixport analysts wrote this week in a report.

When a company declares bankruptcy or files for Chapter 11 bankruptcy protection, as FTX did in November, creditors who choose not to wait until the resolution of proceedings to get money back can dispose of their credit claims to speculators focused on distressed assets. The price of these claims often serves as a proxy for the expected recovery for victims.

The expected payout, as it looks now, represents a remarkable improvement since the aftermath of FTX’s bankruptcy filing. Last November, creditors offered their claims at only a few cents on the dollar and almost no one was buying them, CoinDesk reported.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JI5ELVMVMVG53NXC5DXODWO774.jpeg)

How did FTX recover $7.3 billion of assets?

Matrixport attributed the improvement to the successful efforts to recover and claw back assets.

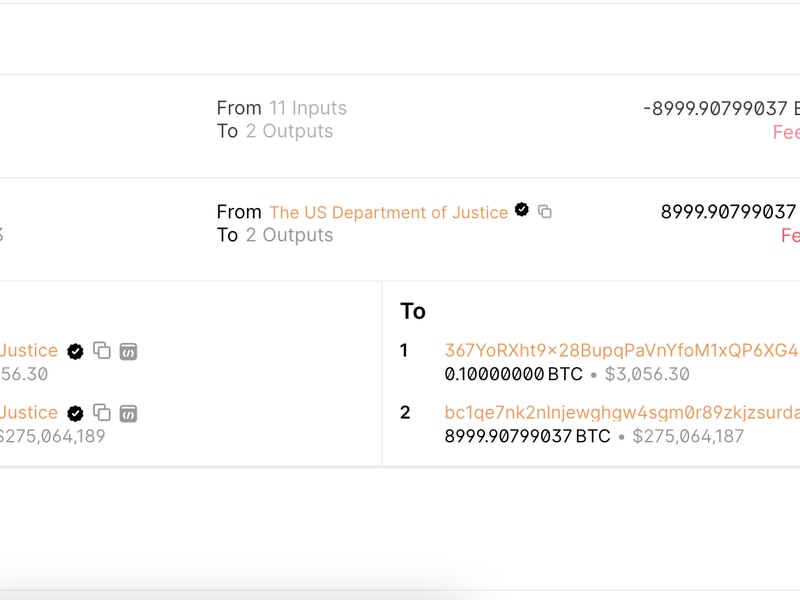

FTX reported earlier this month that under John Ray III’s leadership, the veteran Wall Street bankruptcy lawyer who is shepherding the exchange through the bankruptcy process, had managed to marshal $7.3 billion of assets, including $3.4 billion in crypto, $1.1 billion in cash and $200 million worth of real estate on the Bahamas.

“The FTX recovery process appears to be largely complete, amounting to $7.3 billion, with only minor donations – such as to Stanford University – still pending,” the report said.

There might be some additional clawbacks that could improve creditor payouts, Matrixport said, such as a $2.1 billion claim against once-rival crypto exchange Binance and another $700 million claim from investment firm K5, related to Michael Kives, a former aide for Bill and Hillary Clinton.

The company also holds a highly-coveted $500 million stake in artificial intelligence (AI) startup Anthropic, which the exchange used customer funds to acquire so creditors have a claim on it. FTX explored the sale of the stake, but decided to halt the process in June. This might turn out to be a savvy move, as tech giant Amazon has said it plans to invest up to $4 billion in the startup earlier. Amazon’s investment “could lift the value of FTX creditor claims,” Matrixport said.

Lastly, a potential restart of the exchange – often referred to as FTX 2.0 – could be promising for creditors.

“The successful recapitalization of an exchange has been achieved before, with every creditor becoming an equity owner,” Matrixport said. “Understanding this dynamic could be of material significance to claims holders.”

FTX claims market fires up

“The market is so hot that distressed asset investors are absolutely clambering over each other for claims.”

Thomas Braziel, co-founder and managing partner of 507 Capital

Improving chances of recovery unleashed a new wave of demand for FTX creditor claims among distressed asset investors, market participants told CoinDesk.

“FTX [claims] are probably the hottest ticket in town,” said Thomas Braziel, co-founder and managing partner of distressed asset investment firm 507 Capital. “The market is so hot that distressed asset investors are absolutely clambering over each other for claims.”

He said that the market activity for FTX claims dwarfs that of other bankrupt crypto firms, constituting 90% or even more of the overall trade volume.

The guide price for FTX claims was recently around 35-40 cents on a dollar on Claims Market, a bankruptcy claim marketplace operated by distressed asset investor Cherokee Acquisitions.

The court update about the $7.3 billion assets recovered was a pivotal moment for claims investors, according to Brian Ferrara, director of Cherokee Acquisition’s Claims Market.

“We have seen several new buyers step into the market after FTX’s Sept. 11 Stakeholder Update and meetings, which has increased competition,” Ferrara said in an email.

Markus Thielen, Matrixport’s head of research and strategy, explained that the actual price of a claim may depend on different factors such as jurisdiction, size and “cleanness” of the holder.

“There’s a big bifurcation going on in the market,” 507 Capital’s Braziel said, with larger claims changing hands at a much higher price than smaller ones. The “clean, small” claims under $1 million usually trade anywhere between 15 and 25 cents on the dollar. Claims over a million are priced at low 30s, while $5-$8 million tickets could sell in the 40s.

Regardless of size, claims have multiplied in price since FTX’s bankruptcy filing, and it’s due to John Ray III’s efforts to recoup assets, according to Braziel.

“All eyes are on John Ray,” he said. “[He] is going to take all these distressed asset guys to promise land.”

Edited by Bradley Keoun and Marc Hochstein.