FTX and the Case for Web3 YIMBYism

Sam Bankman-Fried, the founder of FTX, was the latest in a long and storied line of personalities whose compelling elevator pitches papered over their poor management practices.

Though it purported to raze the walled gardens of traditional finance, FTX was probably just garden variety fraud. In the aftermath of the exchange’s collapse, Congressman Patrick McHenry (R-NC) urged his colleagues “to separate out the bad actions of an individual from the good created by an industry and innovation.”

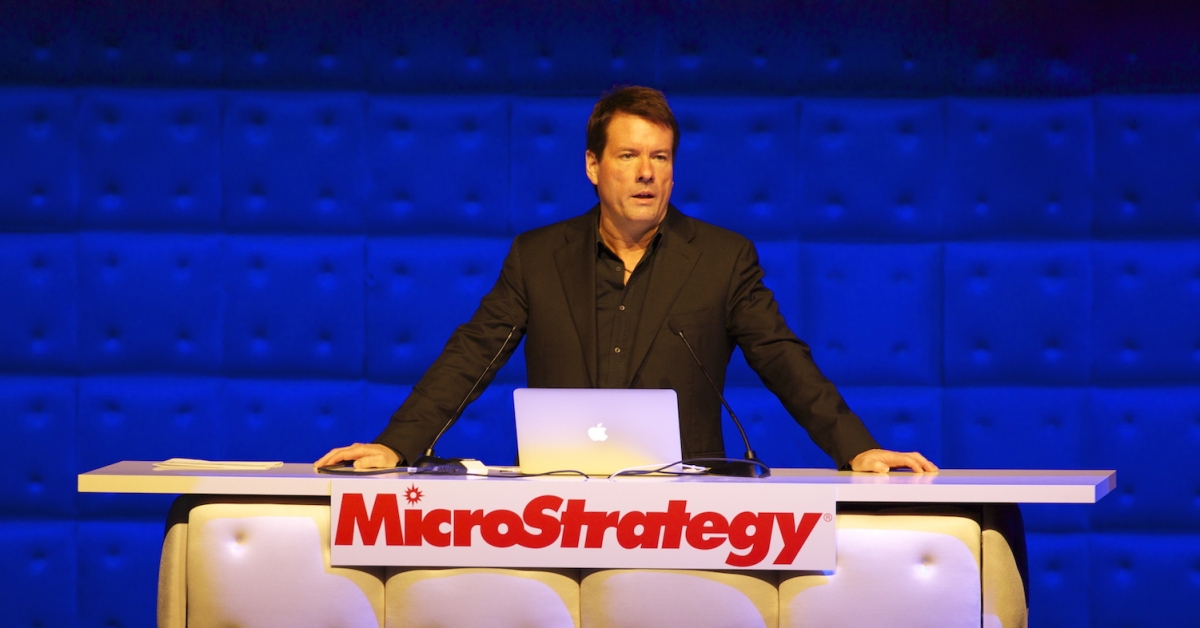

Alex Tapscott is a portfolio manager at Ninepoint Partners and the author of the new book “Web3: Charting the Internet’s Next Economic and Cultural Frontier” (Harper Collins), available now.

Rep. Tom Emmer (R-MN) called it “a failure of centralization, a failure of business ethics, and a crime. It is not a failure of technology.” As the trial unfolds and as more evidence comes to light, these early insights appear prescient and true.

Web3’s Chernobyl

Still, is it possible the collapse of FTX derails Web3’s growth?

Throughout history, promising innovations and even groundbreaking technologies have been sidelined by disasters, which change public perception. Chernobyl put a halt to new nuclear power projects which could have otherwise supplied the planet with abundant green energy. When the South Sea Company’s bubble burst in 1720, critics blamed its joint-stock structure as a high-risk legal invention; and governments banned their formation for a century.

Stung by those calamitous failures, people became NIMBYists not in my backyard, choosing to halt all innovation rather than learn from their mistakes. These examples teach us that early failures and the response from governments can bend the arcs of technological adoption and diffusion, shortening their development horizons by years —or extending them by decades.

FTX punctuated an era. It’s time to forge anew

“Some people in crypto have acted for too long as if Web3 was a given, as if it would follow the same trajectory as the Web in the 1990s,” Albert Wenger of Union Square Ventures told me in an interview for my new book “Web3: Charting the Internet’s Next Economic and Cultural Frontier.” “There was no sales tax on the iternet. There was the safe harbor of the Digital Millennium Copyright Act of 1998, the safe harbor of the Communication Decency Act, that famous Section 230. We had all these regulatory tailwinds.”

By contrast, “Web3 has regulatory headwinds everywhere in the world, especially in the United States,” he said.

Wenger’s prescription for scaling Web3 starts with regulatory clarity about what’s a security and what’s not. The uncertainty around how to classify tokens has pushed innovation offshore.

FTX operated offshore in part because of a lack of clarity in the U.S. By pushing capital formation offshore the U.S. risks losing oversight and transparency into their doings (and in this case wrongdoings).Nuclear power is a useful analogy here too. Where would you rather develop nuclear power and harness its awesome power in America – with strong laws and oversight – or offshore and risk meltdown?

A growing chorus of academics, economists and businesspeople agree that we need a workable long-term framework. In a 2023 speech, Hester Peirce of the U.S. Securities and Exchange Commission (SEC) observed: “If we continued with our regulation-by-enforcement approach at our current pace, we would approach 400 years before we got through the tokens that are allegedly securities.”

Enterprises, financial institutions and other large players will also be reluctant to invest long-term until there are clear rules of the road.

Strong policies can amplify the positive effects of clear regulations.

In ”The Innovators,” Walter Isaacson reminds us that “innovation occurs when ripe seeds fall on fertile ground.” Like the earth beneath our feet, we stand on stratums of innovation with markers of their age. Government can help to sow the seeds of innovation too and the solution can be bipartisan.

Legislators can unleash the power of the private sector by turning barriers to entering traditional financial markets into guardrails for innovation. Rather than reshoring only legacy businesses of legacy industries, the Biden administration can also reshore Web3 firms and create good paying jobs in the U.S. in next era of the internet.

Reject Web3 NIMBYism and build it here in America. That’s pushing Web3 forward responsibly.