FTT Bucks Market Turmoil As FTX Estate Revealed To Be Behind GBTC Sales

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Hopes of creditor repayments led to FTT, the tokens of the now-defunct FTX exchange, rising by 11%, with claims rising to 80 cents on the dollar.

FTT trading volumes jumped to $90 million from Sunday’s $22 million, CoinGecko data shows. The tokens allowed holders to access certain benefits on the Sam Bankman-Fried-owned FTX exchange before it collapsed in late 2022.

The tokens have largely remained a speculative instrument since FTX’s collapse. But plans of an FTX restart, or creditor repayments, have previously caused brief price spikes.

The price action came after CoinDesk reported that FTX’s bankruptcy estate had dumped 22 million shares of Grayscale’s GBTC bitcoin exchange-traded fund (ETF). These were worth nearly $1 billion and accounted for almost half of all GBTC sales since the product went live earlier in January.

As such, claims on FTX deposits over $1 million have continued to increase. Market prices as of Jan.12 are up 2 points from the prior week.

The prices continue to increase in anticipation of an upcoming Claims Estimation Hearing, as per Claims Markets, which tracks bankruptcy claims.

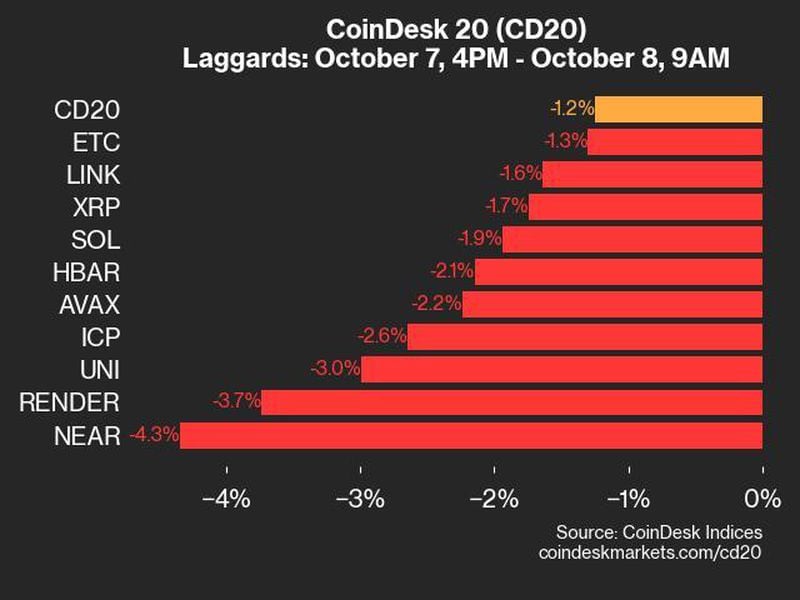

FTT was among the only gainers on Tuesday morning. Bitcoin slumped 3.5% to $39,500 in Asian afternoon hours, while the CoinDesk 20, which tracks the highest tokens by market capitalization, was down nearly 5%.

Edited by Parikshit Mishra.