From deposits suspension to today’s mess: All the speculations surrounding Tether and BitFinex

TL;DR

• Conspiracy and a pump scheme for Bitcoin and stable coins. Crazy, even for the volatile crypto markets.

• The current market situation seems to have brought Bitfinex exchange under the spotlight.

• This seems to be far from being the end of odd happenings at Bitfinex.

Bitfinex, among the largest cryptocurrency exchanges, announced four days ago on its plans to pause fiat deposits (USD, GBP, EUR, JPY) on their platform. According to their Medium post, this will only affect certain accounts, and it is necessary due to processing complications.

Fiat deposit update – October 15th, 2018. https://t.co/F8o2ltVCN4 pic.twitter.com/ukE9JsRB0j

— Bitfinex (@bitfinex) October 15, 2018

Following this, today, Bitfinex claims that all cryptocurrency and fiat withdrawals have been processed regularly up to this point and that the new deposit pause is temporary. According to them, the new deposit system is being implemented, and the process will be done within 24 hours.

Tether meltdown causes BTC to hit $7,700 on Bitfinex

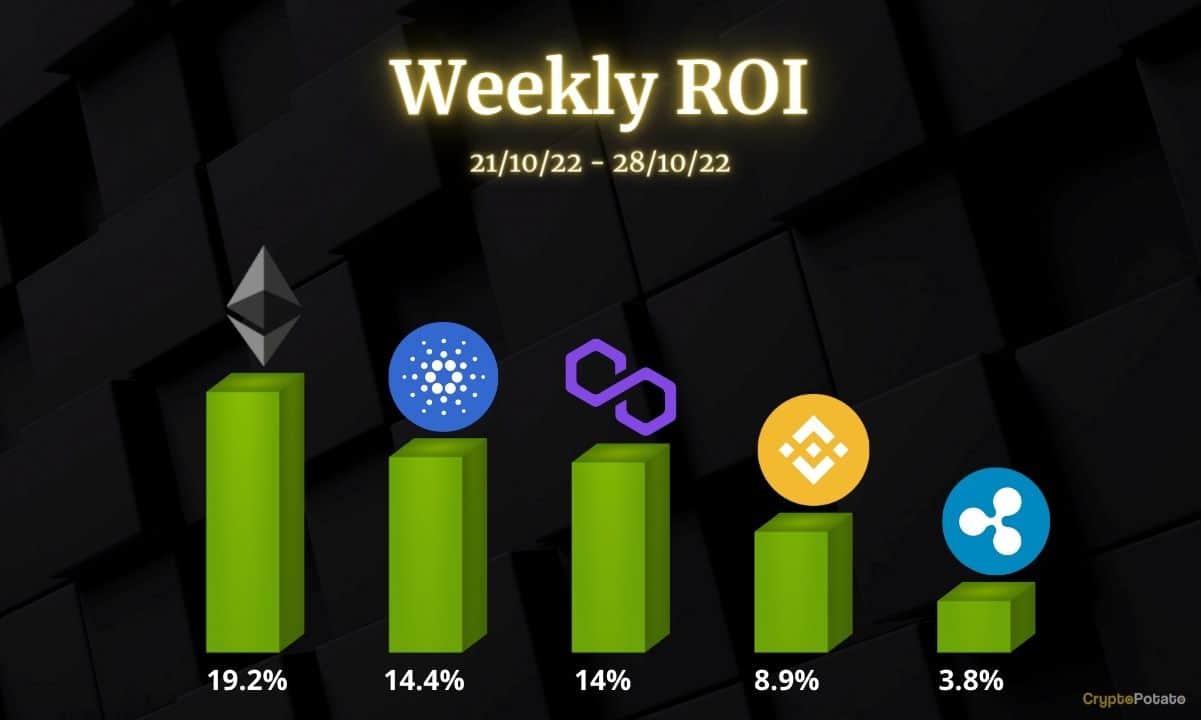

In the last few hours, a lot of new activity has brought Bitfinex, and more importantly, Tether (USDT). New events include what can only be described as a Tether meltdown, which has caused a lot of investors to quickly sell their USDT and buy Bitcoin or other stablecoins, such as TrueUSD (TUSD) that was equaled $1.15 in its daily high. As of writing this, TUSD equals $1.07.

Tether, which is backed by the USD, and thus promises stability and total elimination of volatility, has dropped below $0.96 in the last 12 hours, with a daily low of $0.9. As soon as USDT dropped, the crypto community entered speculations regarding why this has happened. Some claim that rumors of Tether not being fully backed by USD have finally been confirmed. There are also those who argue that Asian investors have been bringing cash injections to the market, and destabilizing Tether as a result.

It would seem that every member of the crypto community has their theory regarding what is going on, but most investors are merely confused regarding the new situation. Simultaneously, the late bull run, likely caused by this Tether situation, brought most cryptocurrencies in the green for their USD value.

Bitcoin itself managed to achieve its recent price of over $6,600 per coin on most exchanges, as well as on CoinMarketCap. However, due to Tether oversale caused by the USDT price drop, all exchanges that are offering Tether now feature an extreme premium against it. Bitfinex leads in this as well, with its BTC price being over $7,700.

Many blame Tether’s team for the current situation, claiming that the lack of a proper financial audit is the cause of the meltdown. Generally speaking, the controversies regarding Tether, and whether or not the USD actually backs all of its coins have been around for a long time. Some have connected the current deposit pause with a brilliant scheme that has a goal of pumping the price of other cryptocurrencies. On January this year, just as the crypto bubble had started to pop, there were lots of speculations around the Tether issue. Some are even comparing Bitfinex current situation to the MT.Gox crash, back in 2014.

Whatever the case may be, the current situation is not exactly good for Tether or its reputation. However, many are taking advantage of the pumped-up Bitcoin, not really caring about the reason behind this “incident.”

The post From deposits suspension to today’s mess: All the speculations surrounding Tether and BitFinex appeared first on CryptoPotato.