From Chaos to Crypto: The Crecimiento Movement Igniting Argentina

Today, Argentina stands on the brink of a technology renaissance. Long a symbol of economic instability, Argentina is now emerging as the world’s testbed for economic transformation, through crypto.

Amid soaring inflation and crippling debt, Argentina is turning to crypto as a tool to stabilize its economy and drive growth. As the U.S. retreats from its leadership role in crypto, Argentina is seizing the opportunity to step into the void.

At the heart of this transformation is the Crecimiento movement uniting crypto believers, entrepreneurs, and innovators working toward sustainable, crypto-driven reform. With a newly-elected President showing interest in crypto’s potential, Crecimiento is harnessing crypto to help reshape the economy, focusing on payments, credit, property, and more.

Crecimiento’s bold vision is coming to life at Aleph, a month-long pop-up city in Buenos Aires where over 2,000 Argentine and global founders, builders, investors, and policy leaders have gathered to launch crypto startups and fuel innovation.

Argentina’s economy

Argentina’s economic narrative is one of stark contrasts. Once among the world’s wealthiest nations in the early 20th century with a higher per capita income than Germany and France, Argentina now grapples with the world’s highest inflation and a depreciating peso impacting economic confidence. To illustrate: $100,000 in Argentine pesos from 1995 would be worth about $310 today.

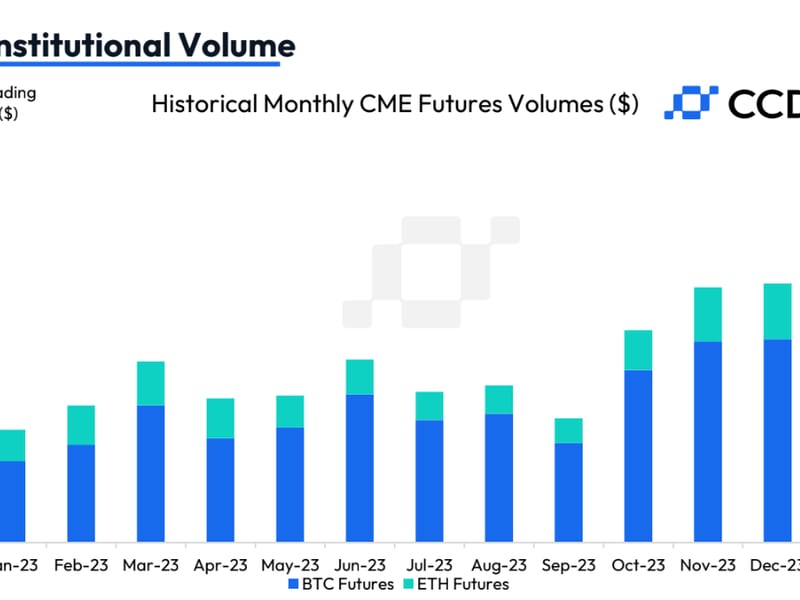

But Argentina’s high crypto adoption (4th globally), a thriving crypto ecosystem with companies like OpenZeppelin, Ripio and RSK, and a supportive political environment are now converging to position the country as a digital leader.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/QOKBVDM5UNBTBFCJNMPQLKG47U.png)

This grassroots embrace of crypto, coupled with a government eager to experiment with financial innovation, means Argentina is positioned to pioneer a new crypto-enabled frontier.

A testbed for crypto-powered transformation

Born out of the 2008 financial crisis, crypto was designed to decentralize control, breaking away from traditional financial systems that are often opaque, centralized, and prone to failure.

In Argentina, where economic and social structures have left many behind, crypto offers not just a financial lifeline but a blueprint for a new kind of society. It’s a chance to rethink how communities function, how opportunities are distributed, and how trust is built.

Argentina’s economic challenges have unlocked a wave of crypto experimentation. More than a third of the population uses crypto for everyday transactions and the country also has seen the highest number of crypto-paid employees in the world, with over 50% of the freelance economy powered by crypto in recent years.

These aren’t just abstract statistics; they represent a population that has already embraced the technology as a practical tool for daily life. From stablecoins that combat inflation to decentralized finance (DeFi) platforms that provide access to global markets, to on-chain tools offering mortgages and access to credit, Argentina is proving crypto can be a viable alternative to broken financial systems.

Filling the U.S. regulatory void

As the U.S. regulatory environment drives crypto innovation and talent offshore, an opportunity for global leadership has emerged. Some economies have been moving first to fill this void through specific crypto-first initiatives – like Abu Dhabi’s Hub71, Zug’s Crypto Valley, Brazil’s Drex CBDC – though these efforts are still isolated.

Argentina is adopting a more comprehensive approach to digital assets under President Javier Milei, who is attracting foreign investment and eliminating legal tender laws to promote the use of crypto. Recent reforms, such as approving the tokenization of certificates – enabling the creation of LLCs entirely using crypto, highlight this shift.

Unlike the U.S., Argentina’s regulators, including the CNV (Securities Commission), BCRA (Federal Reserve), and UIF (equivalent to U.S. FinCEN), are actively engaging with the crypto industry to improve clarity and operations. The CNV has clarified private offerings and, with UIF, established a Virtual Assets Service Provider Register. And the BCRA is considering lifting its 2022 ban on crypto services. This collaborative effort is driving the creation of a nationwide sandbox for crypto experimentation and revising the Incentive Regime for Large Investments (RIGI) to extend incentives to tech and crypto innovations, led by the Crecimiento movement.

A movement for economic rebirth

Crecimiento’s core contributors have been hard at work for months problem-solving and conducting research to identify crypto-enabled solutions to Argentina’s hardest economic frictions.

The aim is to revolutionize lending, insurance, supply chains, taxation, and digital identity, to bring the next 10 million people on-chain with innovative products, expand Argentina’s startup ecosystem, and establish a regulatory framework for 20 years of stability for startups.

Aleph: Pop Up City Catalysing Argentine Innovation

Crecimiento’s ambitions are being kickstarted through Aleph, a month-long pop-up city transforming Buenos Aires into the epicenter of global crypto innovation.

Throughout August, more than 300 talks, events, hacks, and Asados are unfolding, all focused on catalyzing crypto solutions and catalyzing innovation.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/SMAT6PNTBJGCNNKBICMO3MZ64A.png)

Aleph is home to 67 promising startups, ranging from pre-seed to Series A, handpicked by Crecimiento to tackle Argentina’s most pressing challenges. These include projects bringing housing rentals and RWAs on-chain, tokenizing financial receivables, and creating new yield-bearing stablecoins.

These startups are building alongside with Argentine crypto pioneers like Demi Brener (OpenZeppelin), Seba Serrano (Ripio), Mariano Conti (Maker), Marcelo Cavazzoli (Lemon), and Santi Siri (Democracy Earth), alongside global leaders like Juan Benet (Protocol Labs), Alex Gluchowski (ZKsync), and David Hoffman (Bankless).

Aleph has captured global attention, earning praise from leaders like Buenos Aires’ Chief of Government, Jorge Macri. A prominent crypto founder also called it “a torch of freedom to the world.”

Aleph is driving innovation with decentralized identity credentials via QuarkID, its ERC-20 token MORFI —accepted at 25+ merchants — and more. Officially recognized as of “Scientific, Technological, and Economic Interest” by Buenos Aires, Aleph is not just a meetup but a hub of innovation, accelerating startups, forging partnerships, and fueling Crecimiento’s momentum.

Aleph buzzes with the energy of a future that’s within reach. A feeling that Argentina’s crypto evolution is not just a possibility; it’s an unstoppable force, and the Crecimiento movement is helping drive a new paradigm.

For Argentina to claim its role as a global crypto leader, it needs the support of the entire ecosystem. If you believe in crypto’s power to create a more equitable world, Argentina is where you need to be.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

Edited by Benjamin Schiller.