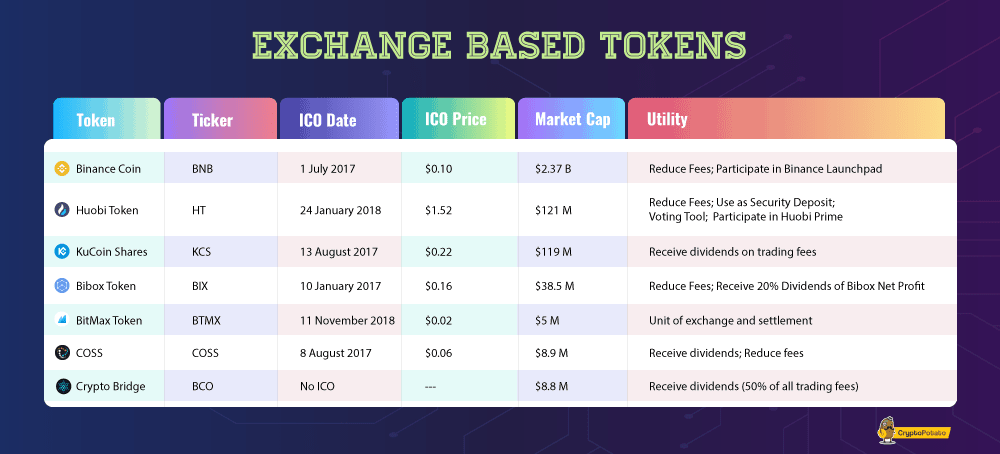

From BNB to HT: What Are Exchange Based Tokens? The Complete Guide

Cryptocurrency exchange tokens have been around for quite some time, as platforms found a convenient way to increase liquidity by also providing additional value to their native token holders, as well as discounts for trading fees.

However, 2019 has turned out to be particularly fruitful for the major exchange tokens which mark notable gains throughout the past few months, despite the stagnant overall market.

We take a closer look at some of the leading cryptocurrency exchange tokens, their price action, utility, and overall usability.

Binance Coin (BNB)

Binance Coin (BNB) is undoubtedly the most popular exchange token, as it’s the native cryptocurrency for the world’s leading exchange in terms of traded volumes – Binance.

Changpeng Zhao, CEO of Binance, has made it clear on multiple occasions that their goal is to “gear BNB with as much utility as they can.”

The primary function and use case for BNB is to reduce trading fees on Binance. In other words, users of the platform are provided with various discounts if they were opt-in to pay their trading fees with BNB.

Moreover, the coin is also the only method to participate in the popular Binance Launchpad fundraising events. With certain exceptions, those who want to participate in those initial exchange offerings are only allowed to purchase the sold tokens using BNB, creating substantial demand for the exchange’s cryptocurrency.

Since the beginning of the year, Binance Launchpad has seen some successful token sales including BitTorrent, Fetch.AI, and Celer Network, which had a massive impact over BNB’s demand. Recently Binance had initiated lottery draws for receiving the right to participate in future Launchpads IEOs.

Recent Binance Launchpad IEOs

| Name | Hardcap | CryptoPotato Score | |

|---|---|---|---|

Matic Network (Binance Launchpad) |

Hardcap $5.0 M | 8.7/10 | More Infromation |

Celer Network (Binance Launchpad) |

$4.0/4.0 M(100%) | 8.5/10 | More Infromation |

Fetch AI (Binance Launchpad) |

$21.0/21.0 M(100%) | 8.3/10 | More Infromation |

BitTorrent (Binance Launchpad) |

$7.2/7.2 M(100%) | 0unrated | More Infromation |

Huobi Token (HT) – Huobi

Huobi is yet another leading crypto exchange. According to data from CoinMarketCap, it has an adjusted daily trading volume of $463 million at the time of this writing. The platform was founded back in 2013, and it reportedly became the leading digital asset trading platform in China back at that time. It has seen investments from leading and marquee VCs such as Sequoia Capital.

As Cryptopotato reported at the beginning of this year, the cryptocurrency exchange launched its own interchangeable stable coin called HUSD.

Huobi Token (HT) was announced with a few interesting use cases: Naturally, one of them is to reduce trading fees on the platform, much like BNB. Furthermore, it can be used as a security deposit in order to become a certified OTC trader on Huobi. It can also be used as a voting tool when it comes to deciding the listing of new coins on the exchange.

Huobi announced the launch of a similar blockchain project launching platform named Huobi Prime. Unlike Binance Launchpad, however, Huobi Prime has said that it will have an eligibility criterion which requires interested investors to hold a daily average of 500 HT for at least 30 days prior to the fundraising event. The move, of course, is likely to incentivize further HT holding.

In fact, the platform already saw the success of its very first token sale. The project was TOP network, and it reached its designated hard cap in a matter of seconds. For this first sale, Huobi didn’t implement the 500 HT minimum holding requirement.

KuCoin Shares (KCS)

Perhaps one of the reasons for which KuCoin gained significant traction in early 2018 was because it was listing less-known and smaller-cap cryptocurrencies which, at the time, more major expenses refused to list.

Nevertheless, the exchange boasts a reported daily trading volume of around $15 million according to Coinmarketcap.

The exchange launched its native token called KuCoin Shares. As the name stipulates, it does involve asset allocation. The exchange distributes 50 percent of its trading fees daily to KCS token holders. Hence, it’s somewhat of a dividend payout scheme.

More interestingly, jumping on the IEO bandwagon, KuCoin recently announced that they also intend to launch KuCoin Spotlight, which is a blockchain project launching platform, similar to those of Huobi and Binance.

KuCoin Spotlight had a successful first sale of a project called MultiVAC.

OKEx Token (OKB)

OKB is the native token of another leading cryptocurrency exchange – OKEx. OKB is the utility token which is issued by the OK Blockchain Foundation. The token didn’t have an initial coin offering or any kind of public fundraising.

OKB is an ERC-20 based utility token which is touted to be transitioned on OKEx’s public blockchain called OKChain in the future.

One of the things to note is that OKEx launched a token-sharing system which gave out 60% of all OKB tokens to OKEx users for free.

The main features of the OKB token are to eliminate transaction barriers, as well as to increase the operational efficiency within its ecosystem.

One of the things to consider, however, is that investors who have over 500,000 OKB locked in escrow get to review and endorse listing candidates on the exchange, which is a nice utility.

Like the mentioned exchanges, OKEx had initiated their fundraising platform as well, in the name of OKEx Jumpstart. Their first planned token sale would be Blockcloud.

Bibox Token (BIX)

Bibox is not among the top exchanges by volume; however, it has its focus is placed in the Asian market. The platform saw some traction in early 2018 as it began listing some of the more popular Asian based tokens. It’s also one of the most significant markets for DAI, the stable coin.

The platform also has its native coin. It’s ticked as BIX, and it comes with a few use cases. First off, BIX holders can benefit from reduced trading fees – a model, which as we saw from above, is commonly used.

Additionally, however, it also provides 20% dividends based on the Bibox exchange net profit. Recently, Bibox had announced on their exchange based fundraising platform – Bibox Orbit.

BitMax Token (BTMX)

BitMax is a relatively lesser known digital asset trading platform. However, Coinmarketcap does show a daily trading volume of $56 million, at the time of this writing, placing it as the 47th largest cryptocurrency exchange.

The native token of the exchange is called BitMax Token, and it carries the BTMX ticker. According to the project’s whitepaper, BTMX “does not in any way represent any shareholding, participation, right, title, or interest” in the company. Additionally, the document also stipulates that the token won’t “entitle token holders to any promise of fees, dividends, revenue, profits or investment returns.”

As such, the main idea behind BTMX is to serve as a unit of exchange and settlement between participants who interact with BitMax’s ecosystem.

Other Exchange Tokens to Mention

The above are some of the well-known and popular cryptocurrency exchange tokens. However, there are also others that are interesting and deserve a worthy mention, mainly as they paint the picture that not everything is all fun and games.

COSS

COSS is a cryptocurrency exchange based in Singapore. Its main idea is to bring all the necessary trading functionalities under one roof. Coinmarketcap shows that its daily traded volume is currently about $10 million.

It also has its token, unsurprisingly called COSS token. It distributes a certain amount of the platform’s trading fees to its holders, and it can be used to reduce trading fees – a pattern, we’ve found out to be followed by many.

Crypto Bridge (BCO)

Crypto Bridge is the only one on the list which is a decentralized exchange, which is built on top of the Bitshares platform. It’s focused on small-cap Proof of Work (PoW) coins.

The native cryptocurrency of Crypto Bridge is called Bridge Coin (BCO). It can be mined, and it pays out 50% of all trading fees to those who hold it.

The post From BNB to HT: What Are Exchange Based Tokens? The Complete Guide appeared first on CryptoPotato.