Free Markets Don’t Create Free People: Bitcoin’s Tech Success Masks Its Failure

James Bridle is a writer working across technologies and disciplines and author of “The New Dark Age: Technology and the End of the Future.” His work can be found at http://jamesbridle.com. The following work will appear as an introduction to “The White Paper by Satoshi Nakamoto” to be published by Ignota Books.

For more on bitcoin’s 10th anniversary, check out our new interactive feature Bitcoin At 10.

————-

It’s difficult to know when humans first started securing or ‘encrypting’ messages to hide them from unwanted readers; the practice must, by human nature, be almost as old as written language, although examples are sparse. We know, for example, that Julius Caesar used a simple form of letter substitution to communicate with his generals, shifting each character three steps down the alphabet in order to scramble it.

The ancient Greeks, particularly the military-minded Spartans, used a device called a scytale, which allowed a hidden text to be read by wrapping a strip of parchment around a cylinder of a particular size so that the letters lined up in a particular order. Tales of the Greco-Persian Wars are full of secret messages, not least the story of Histiaeus, a commander who, according to Herodotus, shaved the head of his favorite slave and had it tattooed with a message urging revolution in the city of Miletus.

When the slave’s hair grew back he was dispatched to the city, with the instructions that the recipient should shave him once again and read the message there revealed.

Such extreme measures were taken due to the fear of government surveillance, a justification often cited today. The Persian king controlled the roadways, and had the power to examine any message – and messenger – that travelled on them. From the very beginning, cryptography has been both a military technology and a tool for undermining existing powers.

Cryptography’s value as a military tool is double-edged, of course.

Like other weapons, its effectiveness depends on the ability of one side to outgun the other. For a long time, this balance mostly held, with efforts by one side to crack the secrets of the other forming long-running and fascinating backstories to many conventional conflicts. It was an act of decryption that brought the United States into the First World War when British intelligence services decoded the infamous Zimmermann Telegram proposing an alliance between Germany and Mexico.

In the closing months of the war, the cracking of Germany’s ADFGVX cipher by French cryptanalysts enabled the Allies to stave off a final German offensive on Paris.

Cryptography was first mass-manufactured in the Second World War, in the form of the Third Reich’s Enigma machines, and then digitized in the form of the Colossus, the world’s first programmable electronic computer, developed to break the German military’s Lorenz cipher. The wild invention and ultimate success of the Bletchley codebreakers over their Nazi adversaries can be read as the first of many instances of the digital overcoming the physical; the Lorenz SZ42 was a massive, complex machine of rotating cogs and wheels which defied codebreakers for years.

By the end of the war, it was completely readable by an electronic machine. The secrecy around the Colossus itself meant that its existence had little influence on future computer design, but it marks the point at which cryptography changed radically in nature – because what is digital is ultimately distributable, although it would take the growth of the internet in the 1990s for this to become widely understood.

In 1991, a computer security researcher called Phil Zimmermann created a programme called Pretty Good Privacy (PGP), which enabled users of home computers to strongly encrypt email messages using a combination of numerous well-known algorithms. What turned PGP from another homemade software product into one of the most contentious artifacts of the decade wasn’t how it was made, but how it was distributed. Since the Second World War, nations had been forced to legally define cryptography as a weapon; like any other munition, cryptography was subject to something called the Arms Export Control Act.

At the time of PGP’s release, any cryptosystem which used keys – the strings of randomly generated numbers which secured hidden messages – longer than 40 bits required a licence for export.

PGP used keys which were 128 bits long and almost impossible to crack at the time, and this made it precisely the kind of technology that US authorities wanted to prevent falling into foreign hands. Zimmermann never intended to export PGP, but, fearing that it would be banned outright, he started distributing it to friends, saying, “I wanted to strengthen democracy, to ensure that Americans could continue to protect their privacy.”

Shortly after that, PGP found its way onto the internet and then abroad. In 1993, the US government started a formal investigation into Zimmermann – for exporting munitions without a license. As knowledge of the case spread, it became a flashpoint for early digital activists who insisted on the rights of everyone to protect their own secrets and their own private lives.

The freedoms and dangers of code became the subject of earnest debate, and in another foreshadowing of future digital style, of hacks, pranks and stunts. Zimmermann had the software’s source code printed as a hardback book, allowing anyone to purchase a copy and type up the software themselves.

As he was fond of pointing out, export of products commonly considered munitions – bombs, guns and planes – could be restricted, but books were protected by the First Amendment. Variants on the RSA algorithm – the 128-bit process at the heart of PGP – were printed on T-shirts bearing the message ‘This shirt is classified as a munition’. Some went further, having lines of code tattooed onto their arms and chests.

The crypto wars

The Crypto Wars, as they became known, galvanized a community around the notion of personal – rather than national – security, which tied into the utopian imagination of a new, more free, more equal and more just society developing in cyberspace.

Another development that prompted widespread public disquiet was the US government’s proposal for a chipset for mobile phones. The Clipper chip was designed by the NSA to provide encryption for users while allowing law enforcement to eavesdrop on communications – a situation that was ripe for abuse, either by corrupt officials or by skilled hackers.

Clipper chip via Wikimedia.

The idea that a government would deliberately weaken the protections available to its citizens made for an even more powerful and accessible argument for the individualists than the attack on PGP. By the late 1990s, Clipper was dead – and so was the case against Zimmermann. The hackers and privacy activists declared victory in the Crypto Wars.

Yet what’s often regarded as a victory for everyone against government overreach can also be read as a moment of terrifying breach: when the state’s most powerful weapons escaped government control and fell into the hands of anyone who wanted to use them. Today, thanks to the rise in digital communications, cryptography is everywhere, not least in banking systems, protecting the billions of electronic transactions that flow around the planet every day.

Even more than in the 1990s, the idea that anyone would deliberately make it easier for someone to steal money seems like an attack on the basic functions of society, and so it should come as no surprise that it’s a technology best known for – but by no means limited to – the distribution of currency that should be the focus of a new outbreak of the Crypto Wars, as well as the full flood of individualist, utopian thinking that accompanied the first round. There’s something about money that focuses the mind.

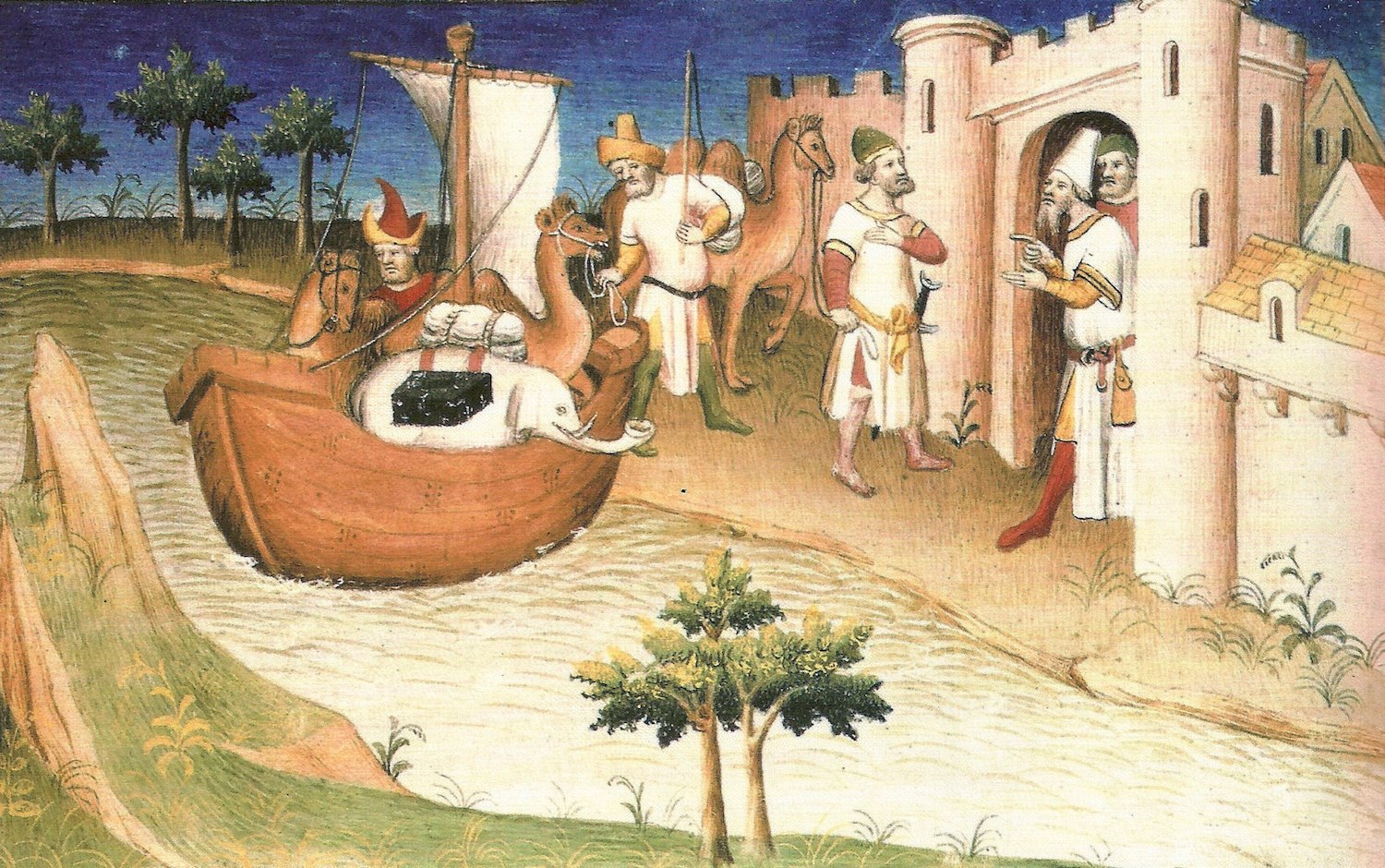

When Marco Polo first encountered paper money on his travels to China in the 13th century, he was astounded. In his Book of the Marvels of the World, he spends a great length of time explaining, and wondering at, the monetary system established by the Great Khan. Until recently, and as was still the case in Europe, the Chinese had used a range of value-bearing commodities to settle commerce and taxation: copper ingots, iron bars, gold coins, pearls, salt and the like.

In 1260, Kublai Khan decreed that instead, his subjects would use apparently valueless paper, printed and certified by a central mint, and, writes Polo, “the way it is wrought is such that you might say he has the secret of alchemy in perfection, and you would be right.” Through a carefully choreographed process of manufacture, design and official imprimatur, “all these pieces of paper are issued with as much solemnity and authority as if they were of pure gold or silver.”

The process was alchemical in the truest sense, as it did not merely transform material, but also elevated the Khan himself to even more unassailable heights of power: the only arbiter of finance. Those who refused to accept the new currency were punished with death, and all trade flowed through the state’s coffers. Like the Persian king before him, the Khan had realized that controlling traffic – in commerce and in information – was the way to situate oneself at the true heart of power.

True magic

The processing and accounting of money – fiat money, created by decree rather than having inherent value – is essentially the manipulation of symbols, and the gradual but ever-accelerating authority of capitalism, money’s belief system, tracks the development of symbol-manipulating technologies, from the double-entry bookkeeping of the European Renaissance to the development of databases and planet-spanning electronic networks; from physical technologies to virtual ones.

Money also involves the magical transformation of symbols into value. It requires belief to operate.

Around such belief systems other beliefs tend to gather, and the industrial quantities of belief required to breathe life into new systems of value tends to gives succor to any number of outlandish ideas, whether these be the divine right of kings, the supremacy of the nation state or the inviolable will of technology itself.

Money, then, is a belief system backed by state infrastructure which, for a long time, assured centralized power. But as computational technologies, long the sole province of the state, became less about asserting government power than asserting individual freedom – in other words, as the weapons forged in the crucible of the Second World War became increasingly available to the common citizen – it became clear to the veterans of the Crypto Wars how they might make other adjustments to ancient power dynamics.

The idea for digital money and virtual currencies had been floating around for some time before the Crypto Wars. Money has been

tending towards the virtual for some time, from the first ATMs and cards in the 1960s, to the spread of digital networks and connections between retailers and banks in the 1980s and 1990s. For anyone with a little technological foresight, it was easy to see which direction we were heading in.

For those concerned with privacy and individual sovereignty, it was a worrying development.

The first ATM via TIME

Digital money, significantly, has none of the advantages of cash; it can’t be stored and exchanged outside of the system of banks and third parties, such as credit card companies, which can regulate and impede its flow. To a cryptographer, or anyone who has imbibed cryptography’s lessons on the potential to separate oneself from overbearing powers, this arrangement looks like a kind of enslavement. So what would digital cash actually look like?

The first quality of digital cash is that it needs to be private, in the sense that no one other than the spender and receiver should be party to the transaction: no bank or security agency should know who is spending the money, who is receiving it, what it is for or at what time and place the exchange is taking place. Because no physical assets, such as notes or coins, are being exchanged, it should also be secure. The receiver should be able to verify they were paid and the spender that they had paid – a two-way receipt for the transaction.

In this way, digital cash would have all the privacy of physical cash, with the added benefit of the participants being able to prove that a transaction had actually taken place.

The opening shot

One of the earliest proponents of digital cash was an American computer scientist called David Chaum.

Chaum believed that both the privacy and the security problems of digital currencies could be solved by using cryptography: encoding messages between the two parties, the sender and the receiver, in such a way that nobody else can read them. Chaum’s solution to this problem involved both parties digitally signing the transaction with a private key, akin to an unforgeable and unguessable digital signature. In this way, both parties validate the transaction. In addition, they communicate through encrypted channels, so that nobody else can see that the transaction has taken place.

Chaum’s system worked, and was implemented by a number of companies and even one bank, but it never took off.

Chaum’s own company, DigiCash, went bankrupt in 1998 and there was little incentive to compete against the growing power of credit card companies. Chaum felt that people didn’t understand what they were losing as digital networks and the money that flowed across them became more centralized: “As the web grew, the average level of sophistication of users dropped. It was hard to explain the importance of privacy to them,” he said in 1999.

David Chaum via Elixxir project.

Yet some people, including those radicalized by the Crypto Wars of the early 1990s, did understand the value of privacy.

A group which came to be known as the Cypherpunks gathered first in San Francisco, and then online, with the intent of picking up from Chaum’s work the tools that could be used to disempower governments. From the very beginning, Chaum’s ideas about privacy and security had been tied to ideas about society and the way it was being changed by digitization.

“Computerisation is robbing individuals of the ability to monitor and control the ways information about them is used,” he wrote in 1985, foreseeing a Big Brother-like “dossier society” where everything was known about individuals but individuals knew little about the information held over them.

Yet Chaum was forced to partner with existing institutions to get DigiCash of the ground – and this was very far from the Cypherpunk dream. Eric Hughes, a Berkeley mathematician and one of the original Cypherpunks group, published ‘A Cypherpunk’s Manifesto’ in 1993, arguing that privacy was a requirement for an open society, and privacy on electronic networks could only be achieved through the use of cryptography.

Tim May, another member of the group and a former chief scientist at Intel, went further in the The Crypto Anarchist Manifesto:

“The State will, of course, try to slow or halt the spread of this technology, citing national security concerns, use of the technology by drug dealers and tax evaders and fears of societal disintegration. Many of these concerns will be valid; crypto anarchy will allow national secrets to be traded freely and will allow illicit and stolen materials to be traded. An anonymous computerized market will even make possible abhorrent markets for assassinations and extortion. Various criminal and foreign elements will be active users of CryptoNet. But this will not halt the spread of crypto anarchy. Just as the technology of printing altered and reduced the power of medieval guilds and the social power structure, so too will cryptologic methods fundamentally alter the nature of corporations and of government interference in economic transactions.”

Throughout the 1990s and into the 2000s, the Cypherpunks elaborated on the principles that would bring their utopia of encryption into being, as well as the technical innovations required to make digital currency possible.

One of the biggest hurdles to doing so was the double-spending problem. Physical cash can only be spent once; when a banknote is handed over to a merchant, the buyer can’t at the same time use the same note at another shop around the corner. Virtual currencies face the problem that while encryption can guarantee that this specific piece of data is a form of money belonging to this specific person, it can’t say whether that data has been copied and is also in circulation elsewhere.

In other words, it can’t say whether or not someone is trying to spend the same coin twice at the same time. The need to have a central register to check each transaction was what forced David Chaum to partner with banks.

This necessitated routing all electronic transactions through credit card companies, and re-introduce dthe Cypherpunks’ worst enemies: loss of privacy and the need to trusts some hierarchical organization, a government, bank or corporation, with the authority to verify and, if necessary, roll back transactions.

The blockchain

The solution to the double-spending problem appeared quite suddenly in October 2008, with the publication of a paper on the The Cryptography Mailing List entitled “Bitcoin: “A Peer-to-Peer Electronic Cash System.” Citing several forerunners in the field, the author of the paper, the previously unknown Satoshi Nakamoto, proposed one key innovation which solved the double-spending problem while preserving anonymity and preventing the need for trusting third parties.

This was called the ‘blockchain’: a distributed ledger, or record of transactions, which would be maintained by everyone participating in the system. It’s called the blockchain because groups of transactions are gathered together into ‘blocks’ as they occur, and as each block is turned out it is added to the ‘chain’ of all transactions. That’s it. It’s simply a list of things that happened.

If everyone can see every transaction, then there is no need to hand over control to banks or governments, and if everyone follows the encryption practices of the Cypherpunks, there is no way to know who is spending the money.

Of course, if everyone has a copy of this ledger, we need to know it hasn’t been forged or tampered with in any way. So in order to extend the blockchain, in other words to write in the ledger, a certain amount of computational ‘work’ has to be done: the computer doing the writing has to solve a particularly complex mathematical problem.

Bloomberg Magazine, 2015

The fact that it’s relatively easy for everyone else’s computers to check if this problem really was solved makes it very difficult – in fact, practically impossible – for anyone to create a fake version of the ledger. In a particularly clever twist, participants are incentivized to help maintain the ledger by receiving a small number of bitcoins when they do solve the mathematical problem. This is where the notional value of Bitcoin comes from: someone has to put in an amount of time and energy to produce it, which is why this process is known as ‘mining’.

Over time, more and more coins are produced, to an eventual total of 21 million sometime in or around 2140. Satoshi’s paper had the good fortune to appear at a particular time. Encoded into the very first block on the Bitcoin chain is a timestamp, the kind of timestamp more familiar from ransom demands: a proof of life.

The phrase embedded forever into the beginning of the blockchain is ‘The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,’ a reference to the front page headline of The Times newspaper on that date.

On one level, it’s a simple proof that no valid coins were mined before that date. On another, it’s an ironic comment on the state of the standard economic system that bitcoin set out to replace. It’s also, for those fascinated by such things, one of the earliest clues to the identity of Satoshi Nakamoto. Satoshi Nakamoto appeared in the world, as far as anyone is aware, with the publication of the Bitcoin white paper. There is no trace of the name before that date, and after a few months of interacting with other developers on the project, Satoshi Nakamoto disappeared just as abruptly from public view at the end of 2010.

With the exception of a couple of private emails (indicating that the developer had ‘moved onto other things’), and a forum post disavowing an attempt to ‘out’ the developer in 2014, Satoshi Nakamoto has not been heard from since. Perhaps instead, more accurately, we might say that the entity referring to itself as Satoshi Nakamoto has not been heard from since 2010.

For less interesting than the ‘real’ identity of Satoshi is the way in which that identity operates in the world – in a way that perfectly accords with Cypherpunk and blockchain doctrine.

Eating the dog food

In Section 10 of the Bitcoin white paper, Satoshi outlines the privacy model of the system. In the traditional banking model, the flow of money through an exchange is anonymized by the third party administering the transactions; they hide what they know from everyone else. However, on the blockchain, where all transactions are public, the anonymity happens between the identity and the transaction; everyone can see the money moving, but nobody knows whose money it is.

The common idea of cryptocurrencies is that they set assets free, but a cryptocurrency is a monetary unit like in any other currency system – one that, because of the blockchain, is closely monitored and controlled. What’s really liberated is identity. It is liberated from responsibility for the transaction and liberated from the ‘real’ person or persons performing it. Identity, in fact, becomes an asset itself. This is also what marks out the idea of the blockchain from earlier cryptosystems like PGP; it’s not the messages that are being hidden, but the actors behind them.

A necessary part of software development is the use of the technology in real-life situations for the purposes of testing.

This is often done by the developers themselves in a process known as ‘eating your own dog food.’ While the developers of bitcoin could test mining and transacting coins between them, the real ‘product’ of bitcoin – a decentralized, deniable identity – could only be tested by someone (or a group) willing to build and sustain such an identity asset over a long period of time – and who better to perform that test than the creator of bitcoin themselves?

Satoshi Nakomoto is an exercise in dogfooding – and proof of its efficacy.

Newsweek Magazine, 2014

When Satoshi disappeared into the ether, they left on the blockchain, unspent, the piles of bitcoins they’d personally mined in the early days of the project – over a million of them. These bitcoins are still there, and only someone who holds Satoshi’s private keys can access them. Today, Satoshi ‘exists’ only to the extent someone can prove to be that individual – the only proof of which is possession of those private keys. There is no ‘real’ Satoshi.

There is only a set of assets and a key. ‘Satoshi Nakamoto’ is creator, product and proof of bitcoin, all wrapped up in one.

Once again, the creation of money is the creation of a myth. In his book “Debt: The First 5,000 Years,” the anthropologist David Graeber proposes that the connection between finance and sacrifice runs deep in Western culture: ‘Why, for instance, do we refer to Christ as the ‘redeemer’? The primary meaning of ‘redemption’ is to buy something back, or to recover something that had been given up in security for a loan; to acquire something by paying of a debt. It is rather striking to think that the very core of the Christian message, salvation itself, the sacrifice of God’s own son to rescue humanity from eternal damnation, should be framed in the language of a financial transaction.’

Satoshi’s sacrifice is something different, but in the anarchic frame from which the individual emerged, not dissimilar. In order to secure the future of bitcoin, Satoshi gave up all personal gains from its invention: some 980,000 bitcoins, valued at $4 billion in late 2018. This is a gesture that will continue to inspire many in the bitcoin community, even if few of them understand or even consider its true meaning.

The power of brands

Back in 1995, another regular Cypherpunk contributor, Nick Szabo, proposed a term for the kind of sacrificial identity deployed so successfully by Satoshi: a ‘nym’. A nym was defined as ‘an identifier that links only a small amount of related information about a person, usually that information deemed by the nym holder to be relevant to a particular organization or community’. Thus the nym is opposed to a true name, which links together all kinds of information about the holder, making them vulnerable to someone who can obtain information that is, in the context of the transaction, irrelevant.

Or as Szabo put it: ‘As in magick, knowing a true name can confer tremendous power to one’s enemies.’

Szabo used as examples of nyms the nicknames people used on electronic bulletin boards and the brand names deployed by corporations. The purpose of the nym, in Szabo’s reading, is to aggregate and hold reputation in particular contexts: in online discussions on particular topics, or in a marketplace of niche products. But online handles and brand names are not the same things, and their elision is an early echo of the reductionism which the ideology forming around the blockchain would attempt to perform on everything it touched.

Brand names are a particular kind of untrue name, one associated not merely with reputation but also with financial value. If the brand attracts the wrong kind of attention, its reputation goes down, and so does its value – at least in theory. But because of their value (financial, not reputational), brands also bestow power on the corporations that own them – that know their real name – while often hiding behind them. Brands can sue. They can bribe. They can have activists harassed and killed. Because of their value, brands become things worth maintaining and worth defending. Their goal becomes one of survival, and they warp the world around them to that end.

Online handles are a different kind of untrue name. Their value lies precisely in the fact that they are not tied to assets, not associated with convertible value. They exist only as reputation, which has its own power, but a very different kind. They can be picked up and put down at any time without cost. The key attribute of online handles is not that they render one free through rendering one anonymous, but that they render one free through the possibility of change.

It is precisely this distinction, between financial freedoms and individual autonomy, that underlies many of the debates that have emerged around bitcoin in recent years, as it struggles to articulate a political vision that is not immured in a technological one. While bitcoin has proved to be a powerful application for the idea of the blockchain, it has also distorted in the minds of both its practitioners and many observers what the blockchain might actually be capable of.

In many of its practical applications, bitcoin has so far failed to deliver on its emancipatory promises. For example, one strand of bitcoin thinking is premised on its accessibility: the widely touted aim of ‘banking the unbanked’ claims that the technology will give access to financial services to the full half of the world who are currently excluded from real market participation. And yet the reality of bitcoin’s implementation, both technological and socio-political, makes this claim hard to justify.

To use the currency effectively still requires a level of technological proficiency and autonomy, specifically network access and expensive hardware, which put up as many barriers to access as the traditional banking system. Regulatory institutions in the form of existing financial institutions, national governments and transnational laws regarding money-laundering and taxation form another barrier to adoption, meaning that to use bitcoin is either to step far outside the law, into the wild west of narcotics, credit card fraud and the oft-fabled assassination markets, or to participate legally, handing over one’s actual ID to brokers and thus linking oneself to transactions in a way that undermines the entire point of an anonymous, cryptographically secure system.

What is blockchain for?

Even if Bitcoin can’t emancipate everyone, it might at least do less harm than current systems. Yet in the last couple of years, bitcoin has made as many headlines for its environmental impact as for its political power.

The value of bitcoin supposedly comes from the computational work required to mine it, but it might more accurately be said that it derives from a more traditional type of mining: the vast consumption and combustion of cheap Chinese coal.

It’s become terrifyingly clear that the ‘mining’ of bitcoin is an inescapably wasteful process. Vast amounts of computational energy, consuming vast quantities of electricity, and outgassing vast quantities of heat and carbon dioxide, are devoted to solving complex equations in return for money. The total power consumption of the network exceeds that of a small country – 42TWh in 2016, equivalent to a million transatlantic flights – and continues to grow.

Bitcoin mining facility, from CoinDesk archives

As the value of bitcoin rises, mining becomes more and more profitable, and the incentive to consume ever more energy increases. This, too, is surely in opposition to any claim to belong to the future, even if one is to take into account the utter devastation imposed upon the earth by our current systems of government and finance.

These complaints, which are both uncomfortably true in the present and addressable in time by adjustments to the underlying system, mask the larger unsolved problem posed by the blockchain: what is it really for? Somewhere between the establishment of the Cypherpunk mailing list and the unveiling of the first bitcoin exchange, a strange shift, even a forgetting, occurred in the development of the technology.

What had started out as a wild experiment in autonomous self-government became an exercise in wealth creation for a small coterie of tech-savvy enthusiasts and those insightful early adopters willing to take a risk on an entirely untested new technology. While bitcoin is largely to blame for this, by putting all of the potential of a truly distributed, anonymous network in the service of the market, to focus purely on this aspect of its unfolding is to ignore the potential that remains latent in Satoshi’s invention and example. It is to ignore the opportunity, rare in our time, to transform something conceived as a weapon into its opposite.

The arguments over the use of wartime weapons in a time of relative peace, made explicit in the Crypto Wars, have a clear analogue: nuclear technology. While the Allies’ desire for global dominance through atomic power was scuppered by Soviet espionage before it began, and the world settled into a Cold War backed by the horrifying possibility of mutually assured destruction, the nuclear powers agreed on one thing: if ever these weapons were to fall into the hands of non-state actors, the results would destroy not merely the social order, but life itself.

Similar arguments were made, at the end of the 20th century, about certain algorithms: the wide availability of cryptography would render toothless the apparatuses of state security and lead to the collapse of ordered society. While it’s easy to scoff now at the idea that the availability of certain complex mathematical processes would bring down governments, we are nevertheless faced with a different, more insidious, threat in the present: that of the substitution of one form of oppressive government with another.

While Tim May, part of the original Cypherpunk triumvirate, attested in The Crypto Anarchist Manifesto that assassination and extortion markets were ‘abhorrent’, he had little time for those who weren’t part of the crypto utopia. In the sprawling Cyphernomicon, a wider exploration of crypto anarchy posted to the Cypherpunks mailing list, May was far clearer on the world he foresaw: ‘Crypto anarchy means prosperity for those who can grab it, those competent enough to have something of value to offer for sale; the clueless 95 percent will suffer, but that is only just.

With crypto anarchy, we can painlessly, without initiation of aggression, dispose of the nonproductive, the halt and the lame.

Lessons from the Atomic Age

Make no mistake: the possibility of cryptographically-enforced fascism is very real indeed.

A future where every transaction, financial or social, public or private, is irrevocably encoded in a public ledger which is utterly transparent to those in power is the very opposite of a democratic, egalitarian crypto utopia. Rather, it is the reinstatement of the divine right of kings, transposed to an elevated elite class where those with the money, whether they be state actors, central bankers, winner-takes-all libertarians or property-absolutist anarcho-capitalists, have total power over those who do not.

And yet, as in the nuclear age, there remains space for other imaginaries.

In the 1960s, in the name of the ‘friendly atom’, the United States instituted a series of test programs to ascertain whether the awesome power of the atomic bomb could be turned to peaceful ends. Their proposals, some of which were actually carried out, included the excavation of vast reservoirs for drinking water, the exploitation of shale gas (an extreme form of contemporary fracking) and the construction of new roadways. Another idea involved interstellar travel, using the intermittent displacement of atomic bombs in the trail of spacecraft to propel them to distant stars.

The former programme was given the name Project Plowshare, in reference to the Prophet Isaiah’s injunction to beat swords into plowshares. Long after the cancellation of the project in the face of keen public opposition, the name was taken up by the Plowshares movement, an anti-nuclear weapons and Christian pacifist organization that became well-known for direct action against nuclear facilities.

Meanwhile, ‘peaceful’ nuclear energy became a mainstay of everyday life, in the form of the greenest, if most deeply controversial, large-scale energy generation technology we possess. Its outputs, in the form of toxic, radioactive waste, became in turn a source of new contestations over the roles and responsibilities we have to one another, and to the environment.

There is no separation of our technology from the world. Bitcoin, in the decade since Satoshi Nakamoto first announced it, has succeeded technologically but failed politically, because we have failed to understand a central tenet, long established in political theory, that free markets do not create free people – only, and only occasionally, the other way round. A technology developed according to the founding principles of true anarchism – No Gods, No Masters – has already been suborned by capital, because of a lack of imagination and education, and a failure to organize ourselves in the service of true liberation, rather than personal enrichment. This is not a problem of technology, or technological understanding, but of politics.

Bitcoin’s touted environmental offenses are not a rogue emergent effect, nor the hubristic yet predictable outcome of techno-utopianism. Rather, they are a result of failing to grapple with the central problem of human relations, long diagnosed but rarely put to the test in such dramatic fashion: how to work together in the light of radical equality without falling back into the domination of the rich over the poor, the strong over the weak.

But the emergence of that particular offense at this particular time should chime with our position in history. The problem of taking effective global action in leaderless networks is not a problem confined to bitcoin; in the face of global climate change, it is the primary problem facing humanity today. Like language, the printed word, steam, nuclear power and the internet, another miraculous savior technology is revealed to be a timely question asked directly to our capacity for change.

At the time of writing, and despite the best, the worst, the most unconsidered and the most deliberate intentions of its progenitors, the blockchain is primarily being used to drive the creation of a new class of monopolists, to securitise existing asset structures, to produce carbon dioxide and to set in stone a regime of surveillance and control unprecedented in the dreams of autocrats.

And yet, and yet.

The problem created by blockchain, and dramatized by bitcoin, is fundamentally inseparable from the political situation it emerged from: the eternal battle between power structures and individual rights. The solution to this problem is not to be found in the technology alone, but in radically different political imaginaries. A word often heard in the corridors of the new blockchain industry seems to encapsulate the inherent contradictions of a cryptologically ordered future; that word is ‘trustless’. The concept of trustlessness is at the heart of a vision which seeks to escape from established systems of power by making each individual sovereign to themselves, cryptographically secured, anonymous, untraceable and thus ungovernable.

Yet lack of government is but one plank in the construction of freedom: commonality, community and mutual support are equally, if not more, important. This is demonstrated, ultimately, even in the market: as David Graeber has put it, ‘the value of a unit of currency is not the measure of the value of an object, but the measure of one’s trust in other human beings’.

Blockchain, whatever products it might engender in the short term, poses a necessary problem that we should seek to answer not through technological fixes and traditional political forms but through the participation of the widest and most diverse public possible, and the creation of new forms of political relationships between one another.

Bitcoin image via CoinDesk archives