Franklin Templeton Weighs New Crypto Fund Investing in Tokens Beyond Bitcoin, Ether: Report

-

The fund would target institutional investors, according to the report.

-

The asset manager already has a spot bitcoin ETF and has applied for a similar ether offering.

01:27

Falling Bitcoin-Ether Futures Spread Shows Rising Risk Appetite for Alts

01:25

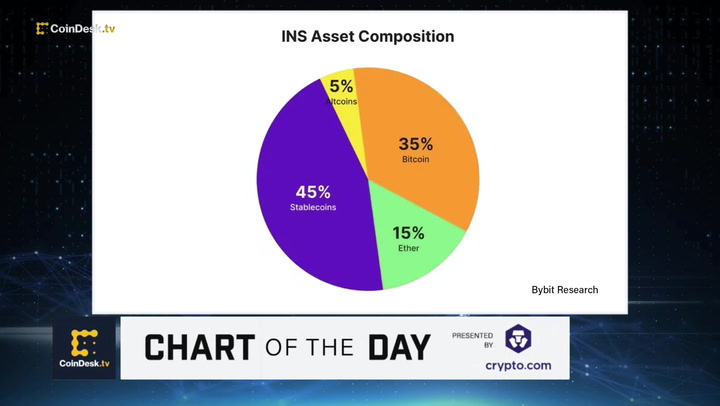

Institutional Traders are Bullish on Bitcoin: Bybit Research

01:16

Top Tokens by Liquidity Are BTC, ETH, XRP in Q3: Kaiko

02:06

SEC Reportedly Fires Back Against Recent Spot Bitcoin ETF Filings; Celsius Can Convert Altcoins to BTC, ETH

Franklin Templeton, the $1.6 trillion U.S. Silicon Valley asset manager, is considering a new crypto-focused investment fund, The Information reported Thursday citing people with direct knowledge of the effort.

The investment vehicle would be structured as a private fund targeting institutional investors and invest in cryptocurrencies beyond bitcoin (BTC) and ether (ETH). The asset manager is also thinking about passing staking rewards on to the fund’s investors, according to the report.

Franklin Templeton is one of several traditional finance heavyweights venturing into the digital asset industry to offer crypto and tokenized asset investments to clients.

It started a spot bitcoin exchange-traded fund (ETF) in the U.S. earlier this year and applied to list a similar offering for the second-largest crypto asset, ether. It also opened a tokenized U.S. government bond fund using the Stellar (XLM) network in 2021, years before BlackRock did.

Edited by Sheldon Reback.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/8b1395a8-12af-4705-9fe5-b862b248250d.png)