Framing Bitcoin For Progressives

Despite being consistently framed as right-wing, Bitcoin is all-inclusive and benefits all ideologies.

What Is Bitcoin?

At its core, Bitcoin is a digital store of value that enables everyone in the world to coalesce around a singular monetary system. For the first time, anyone in the world can send money to anyone else in the world, instantaneously, regardless of nationality, credit score or even access to a bank. No government owns it or sets its policies. This levels the playing field amid a global geopolitical environment prone to corruption, censorship and currency manipulation. No corporation owns it, either. Claws off, Zuckerburg (you too, Sandberg).

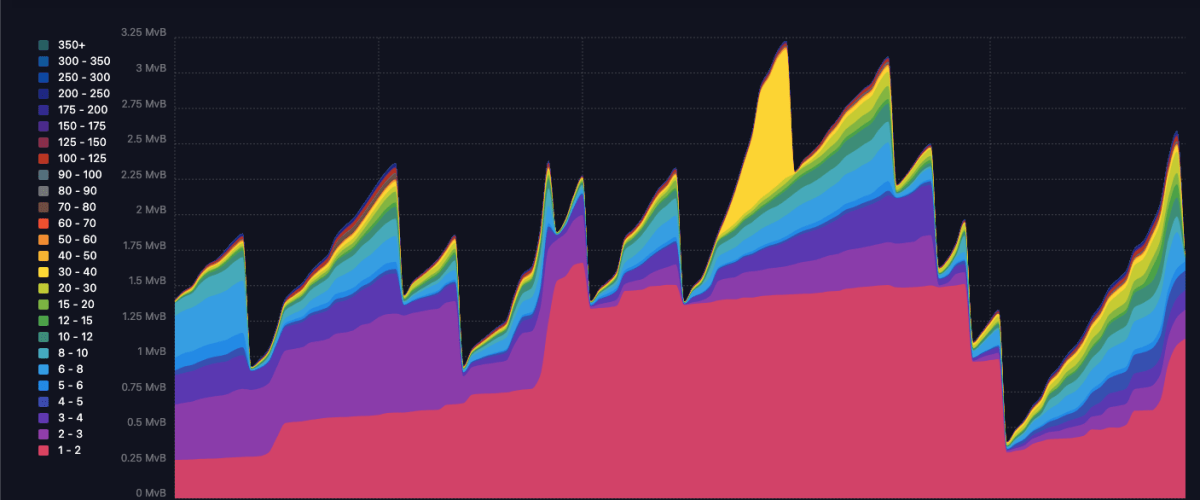

Bitcoin is governed by immutable code that is agnostic to human categorical markers and biases. Its network is secured by miners all over the world and verified by thousands to tens of thousands of nodes throughout the world. Nodes are servers that store all bitcoin transaction history and reinforce Bitcoin’s protocol. Nodes propagate new pending transactions throughout the network until they are received and processed by a miner.

Bitcoin mining is essentially the process of computers competing against other computers to solve complicated math problems to authenticate a time-based series of transactions called blocks. Known as Proof-of-work, miners earn bitcoin in exchange for their work securing the network. This process is what enables Bitcoin to function without central ownership, giving every person across the globe (with a smartphone) equal opportunity for financial inclusion.

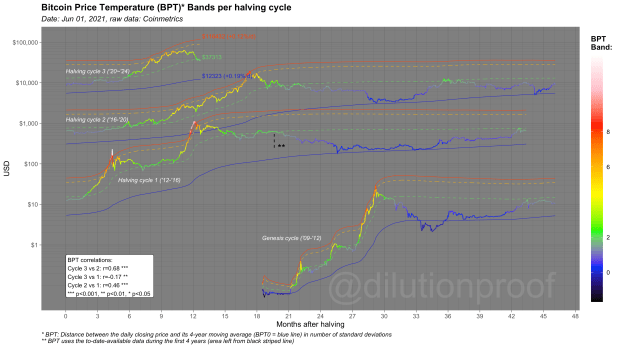

Think of bitcoin as digital scarcity. There will only ever be 21 million bitcoin, guaranteed by the protocol’s issuance algorithm. Bitcoin’s supply is coded to reduce in half every four years until a final halving reduces new supply to 0. Meanwhile, people, companies, institutional investors and governments are increasing their demand for bitcoin every day.

Scarcity drives value. This is true anywhere demand exceeds supply: oil, gold, toilet paper and single family homes on the West Coast. The internet of the 1990s enabled us to exchange information digitally. Bitcoin enables us to exchange value digitally. As society increasingly shifts online, how we measure value will increasingly move online, too. A digitally connected world will need a digital store of value that is sovereign, decentralized, censorship resistant, peer-to-peer, runs 24/7, secure and resistant to attack. Bitcoin is money for the digital world.

Central banks from China to the U.S. are adapting to the digital world by promoting central bank digital currencies (CBDCs). Unfortunately, merely transferring the current fiat system to the digital space replicates the same limitations we face now and exacerbates privacy concerns. For example, a limitation of the current system is that one nation, or a basket of nations, holds the world’s reserve currency. This positions one, or a few allied nations, to enforce monetary policy over the rest of the world, often leading to unsustainable debt and economic dependency. El Savador recently declared bitcoin legal tender in an attempt to circumvent this dynamic.

A new problem CBDCs would cause is the complete lack of privacy for all financial transactions. Particularly in places like Russia or Hong Kong, but increasingly in places like Texas, the risk of the government monitoring the purchasing activity of its citizens must be taken seriously. The Chinese government has already experimented with setting expiration dates for money it supplied. CBDCs also have the potential to restrict what purchases people are authorized to make. This is a form of financial coercion that could play out with catastrophic consequences throughout the world.

Bitcoin enables privacy. Individuals take full ownership of their bitcoin, known as self custody. Identified only through a public key (think of it as a digital ID) the name of a person transacting on the Bitcoin network is not known. However, every transaction on the Bitcoin network is auditable.

You’ve probably heard the term blockchain. A blockchain is a digital ledger that gets distributed to every node in the network. It’s extremely difficult to hack or change. This provides a verifiable record of every transaction ever made on the blockchain that requires no trusted third parties. While private, Bitcoin is transparent.

You’ve probably also heard a lot about bitcoin being used for illicit activity. Ironically, the rate of illicit activity on the Bitcoin network is far less than the U.S. dollar. Research puts the figure at less than 1% of all transactions.

Doesn’t Mining Harm The Environment?

A top area of concern for many progressives is bitcoin mining’s impact on the environment. Bad takes from the New York Times, The New Yorker, The Guardian and elsewhere have done a disservice to their audience and is what prompted this article. Contrary to popular opinion, the bitcoin mining industry is already ushering in an era of renewable energy.

Here’s the thing: Bitcoin uses energy. The mining rigs that secure the Bitcoin network — enabling its decentralized, sovereign nature — require electricity to run. In fact, electricity is the primary ongoing cost for miners. This incentivizes miners to find the cheapest source of electricity, which is often energy that would otherwise be wasted and subsequently flared into the atmosphere. Gas companies are increasingly converting their excess energy into bitcoin mining operations or selling it to mining companies that are happy to pay bottom dollar to repurpose it.

Innovation in the mining space has been profound. Hydro power is being leveraged like never before by entities large and small. Alex Gladstein documents how mining bitcoin with hydroelectric energy in the Congo is funding the preservation of a national park. His corresponding take on how Bitcoin transforms international development and humanitarian aide is worth reading in full.

Closer to home, the state of Texas is (among other more rage-inducing activities), leveraging its wind energy for bitcoin mining. Wyoming actively courts bitcoin miners, noting the state’s abundant natural resources and lower energy costs. Given its enormous potential for economic development, specifically for underserved communities located outside populated city centers, there’s ample incentive for all states to pursue bitcoin mining. It is short-sighted for states with abundant natural resources to restrict bitcoin mining in the name of environmental virtue signaling.

It’s true that bitcoin has historically had a heavier climate footprint. In the geopolitical gift of the century, China (after countless empty threats) cracked down on its bitcoin miners this year. The crackdown shut off about half of bitcoin’s mining operations, many of which have already, or are in the process of, relocating to North America. Coal-heavy Chinese mining operations are increasingly replaced with renewable alternatives as more mining infrastructure gets developed.

The Bitcoin Mining Counsel estimates about half of all bitcoin mining is powered by renewable energy. For comparison, the banking industry uses only about 25% renewable energy. Over time, mining is anticipated to become increasingly powered by renewables. If anything, the more pressing concern for progressive Bitcoiners is the corporatization of the mining industry. However, that corportization also scales the use of renewable energy beyond any other industry.

Additionally, it’s important to put Bitcoin’s energy usage in context. Pundits constantly note

that Bitcoin’s annual energy use exceeds the energy use of a small country. This is true. But so does the U.S.’s use of Christmas lights and they are only used a fraction of the year.

Importantly, Bitcoin’s Lightning Network, a layer 2 technology, enables exponentially more transactions without adding to the network’s energy usage. This was not taken into account in Dutch central banker Alex de Vries and MIT researcher Christian Stoll’s widely cited calculation of Bitcoin’s energy use. Clickbait headlines using pianos as a unit of measurement for Bitcoin’s waste must be disregarded accordingly (google it, if you must).

So, like a holiday tradition for some, Bitcoin does use energy. However, energy is being harvested in increasingly sustainable ways and on larger and larger scales. The innovation coming out of the bitcoin mining industry is astonishing. Current metrics on bitcoin’s energy usage are a lagging indicator.

What Social Problems Does Bitcoin Solve?

In the U.S., we are relatively fortunate to (officially) lose “only” a few percent of our purchasing power to inflation each year. The lowest wage earners among us are hurt the most from a financial system dependent on costs increasing every year. However, the more well-off are only marginally impacted or even benefit from rising asset values.

In other parts of the world where currency is less stable or collapses, people can lose most or nearly all of their purchasing power overnight. Venezuela has the worst inflation rate in the world, at nearly 10,000%. Bitcoin provides an alternative store of value, a lifeline for anyone facing hyperinflation.

It’s also particularly useful for people living under unstable regimes, or unstable regime changes. Alex Gladstein writes eloquently about Bitcoin’s efficacy in Cuba, Palestine and Afghanistan. Bitcoin’s utility as borderless, globally-recognized money cannot be understated.

Crucially, Bitcoin could also serve as an economic empowerment tool for victims and survivors of domestic violence. It’s widely cited that 98% of domestic violence victims experience economic abuse. Most cite financial dependence as a primary barrier to escaping. Bitcoin empowers survivors to buy, sell and store value without their abuser knowing or requiring permission. It’s not an exaggeration to say that access to money that cannot be monitored or confiscated may save some survivor’s lives.

Bitcoin also enables financial inclusion. It addresses an important access issue for the hundreds of millions of people who are unbanked, including 7 million in the U.S.. It’s also a much fairer system because it’s completely divorced from credit. Bradley Rettler explains how exclusionary policies like redlining contributed to poorer credit within African American communities. Bitcoin is uniquely beneficial for anyone who faces increased barriers to wealth and housing due to a low credit score. Since the credit system disproportionately harms people of color, Bitcoin’s pivot out of a credit based system may promote more racially-just outcomes.

Closing Thought

This is not an exhaustive list of what progressives should know about Bitcoin. A comprehensive understanding of Bitcoin admittedly requires a significant time commitment. For example, this article barely touched upon Bitcoin’s layer 2 technology, or why it’s likely to revolutize online gaming. There was virtually no technical content, leaving readers to dig into other sources to learn about block sizes or hashrates.

What was hopefully made clear is that Bitcoin is not a niche “shadowy super coder” cyber world, as Senator Elizabeth Warren hopefully no longer believes. Nor is it a prominent threat to our planet. Bitcoin is humanity’s first opportunity to unify under a singular, global, peer-to-peer form of money. It cannot be debased. It is never closed for holidays. And it’s going to change the world.

This is a guest post by Nicole Dobrow. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.