Former Fed Chair Says Negative Interest Rates Are Coming to the US: Bullish for Bitcoin?

According to a former chairman of the U.S. Federal Reserve, Alan Greenspan, it won’t be long before negative interest rates come to the U.S. He added that gold prices have been trending upward as investors look for a hedge. Can Bitcoin thrive in these tumultuous economic conditions?

Negative Interest Rates Headed to the US

Alan Greenspan was the Chair of the U.S. Federal Reserve from 1987 to 2006. Commenting on the current economic situation, he stated that it’s only a matter of time before negative interest rates come to the US.

“You’re seeing it pretty much throughout the world. It’s only a matter of time before it’s more in the United States,” Greenspan told CNBC’s “Squawk on the Street”.

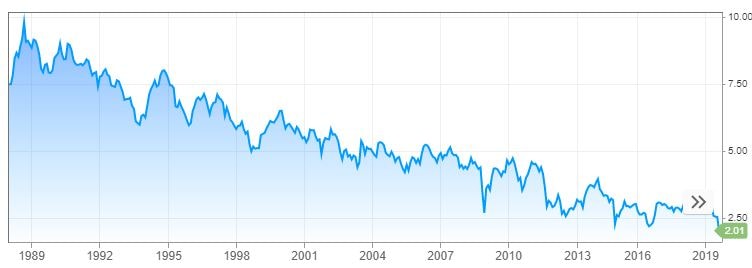

Indeed, the U.S. 30-year treasury rate was around 1.93% on Wednesday, an all-time low.

With negative interest rates, cash deposits placed at banks incur a storage charge rather than the opportunity to receive interest income.

Greenspan added:

We’re so used to the idea that we don’t have negative interest rates, but if you get a significant change in the attitude of the population, they look for a coupon. […] As a result of that, there’s a tendency to disregard the fact that that has an effect on the net interest rate that they receive.

Bullish for Bitcoin?

The veteran banker also noted that gold prices have been surging recently as investors are looking for hard assets such as gold, as their values tend to hold strong or increase in the long term.

Gold has been performing splendidly in 2019. Gold CFDs are up more than 25 percent year-to-date, and it appears that the international economic uncertainty is only fueling the growth.

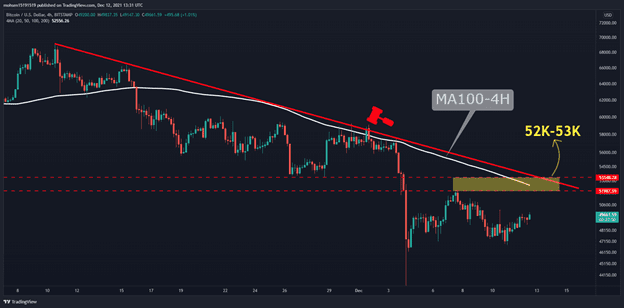

But in these market conditions, it’s also reasonable to look to Bitcoin. As CryptoPotato reported yesterday, Bitcoin has marked higher lows every single month since February.

The fact that it’s not correlated to traditional financial markets is something that makes it attractive to investors in times like these. At the beginning of August, when U.S. President Donald Trump slammed another 10 percent tariff on $300 billion worth of Chinese goods, traditional markets tumbled. Bitcoin, on the other hand, gained more than $700 in less than 24 hours, potentially signaling that investors considered it to be a store of value and a hedge in tumultuous economic conditions.

The post Former Fed Chair Says Negative Interest Rates Are Coming to the US: Bullish for Bitcoin? appeared first on CryptoPotato.